Created

: 2025.10.02

![]() 2025.10.02 08:21

2025.10.02 08:21

GBP/USD eased into a fourth straight bullish session, briefly tapping the 1.3500 handle before settling back to a sedate 0.27% gain for the day's market sessions. Cable traders now head into an ueasy back half of the trading week, with a US government shutdown threatening the flow of high quality official labor and inflation data, as well as a notable lack of meaningful economic data releases on the UK side.

The US federal government is now in shutdown mode, with Congress unable to muscle a budget spending bill across the line before the regular start of the fiscal year on October 1, which occurs every single year and should come as no surprise to policymakers in Washington. Democrats have introduced two separate budget reconciliation bills this week, but House Republicans responded by skipping all budget meetings and remaining absent during two separate bill readings that would have provided a stopgap funding solution while a larger budget bill is considered.

Federal shutdowns have almost become the norm rather than the exception during Trump's presidency: This will be the fourth federal shutdown over budget disagreements that Trump has presided over across his two terms. The last federal shutdown, which occurred in 2018, lasted for 35 consecutive days and remains the longest government closure in US history. Donald Trump has a long-standing history of stating that any government shutdown is the fault of the president, as he declared in 2013 and 2011 by saying, "problems start from the top, and they have to get solved from the top and the president's the leader... he's got to get everybody in the room and he's got to lead."

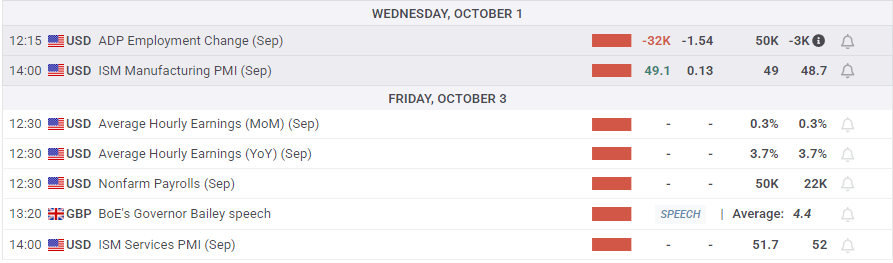

ADP Employment Change figures came in much lower than the street expected, showing a contraction of -32K in September versus the expected 50K. August's initial print of 54K was also revised sharply lower to -3K. ADP jobs figures suffer from constant revisions, but the figure has generally missed expectations for all but three of the monthly figures published since the start of 2025.

The Bureau of Labor Statistics (BLS) is poised to delay or suspend the release of September's Nonfarm Payrolls (NFP) jobs report that was slated for this week. Initially due on Friday, the closure of the US federal government has made it difficult, if not impossible, for official data services to conduct regular operations. The NFP suspension comes at a time when markets are closely watching official labor data to suss out the Federal Reserve's (Fed) expected pace of rate cuts through the remainder of the year.

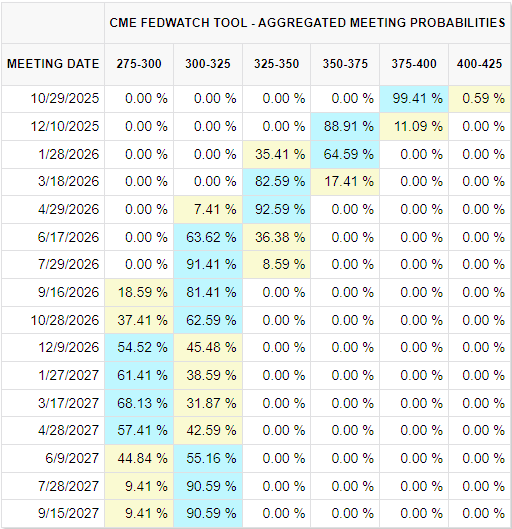

With the NFP print in jeopardy, investors are leaning further on private data such as ADP. According to the CME's FedWatch Tool, rate trader bets of another quarter-point interest rate cut on October 29 surged to 99% post-ADP on Wednesday. Rate markets are also pricing in nearly 90% odds of a third-straight rate trim on December 10, and a further 93% that the Fed will deliver a fourth interest rate cut by next April at the absolute latest.

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as 'Cable', which accounts for 11% of FX, GBP/JPY, or the 'Dragon' as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of "price stability" - a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

![]()

Created

: 2025.10.02

![]()

Last updated

: 2025.10.02

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy