Created

: 2025.11.03

![]() 2025.11.03 17:53

2025.11.03 17:53

EUR/USD steadies at the early European session on Monday, trading at 1.1530 at the time of writing, just above a fresh three-month low near 1.1520 hit earlier in the day. The pair remains vulnerable, following a nearly 1% sell-off over the last three trading days, with the US Dollar (USD) buoyed by the US-China trade deal and the Federal Reserve's (Fed) hawkish stance.

FX majors have remained relatively unchanged during the Asian session as the bank holiday in Japan has kept volatility subdued. In Europe, President of the Deutsche Bundesbank and European Central Bank's Monetary Committee member Joachim Nagel affirmed on Monday that economic data is not diverging from the central bank's projections, but that all options remain open for the next meeting.

Investors' mood remains cautious, with all eyes on the final release of the Eurozone Manufacturing Purchasing Managers Index (PMI) for October, due at 09:00 GMT on Monday, and the US ISM Manufacturing PMI, due later in the day. Beyond that, ECB board member Phillip Lane is expected to meet the press during the European session, while, in the American trading session, Fed officials Mary Daly and Lisa Cook might provide further insight into the bank's monetary policy plans.

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.01% | 0.04% | 0.11% | 0.02% | -0.14% | -0.15% | -0.00% | |

| EUR | 0.01% | 0.07% | 0.09% | 0.03% | -0.13% | -0.13% | 0.03% | |

| GBP | -0.04% | -0.07% | 0.04% | -0.04% | -0.18% | -0.20% | -0.02% | |

| JPY | -0.11% | -0.09% | -0.04% | -0.09% | -0.23% | -0.11% | -0.07% | |

| CAD | -0.02% | -0.03% | 0.04% | 0.09% | -0.19% | -0.16% | 0.00% | |

| AUD | 0.14% | 0.13% | 0.18% | 0.23% | 0.19% | 0.00% | 0.19% | |

| NZD | 0.15% | 0.13% | 0.20% | 0.11% | 0.16% | -0.00% | 0.17% | |

| CHF | 0.00% | -0.03% | 0.02% | 0.07% | -0.01% | -0.19% | -0.17% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

.

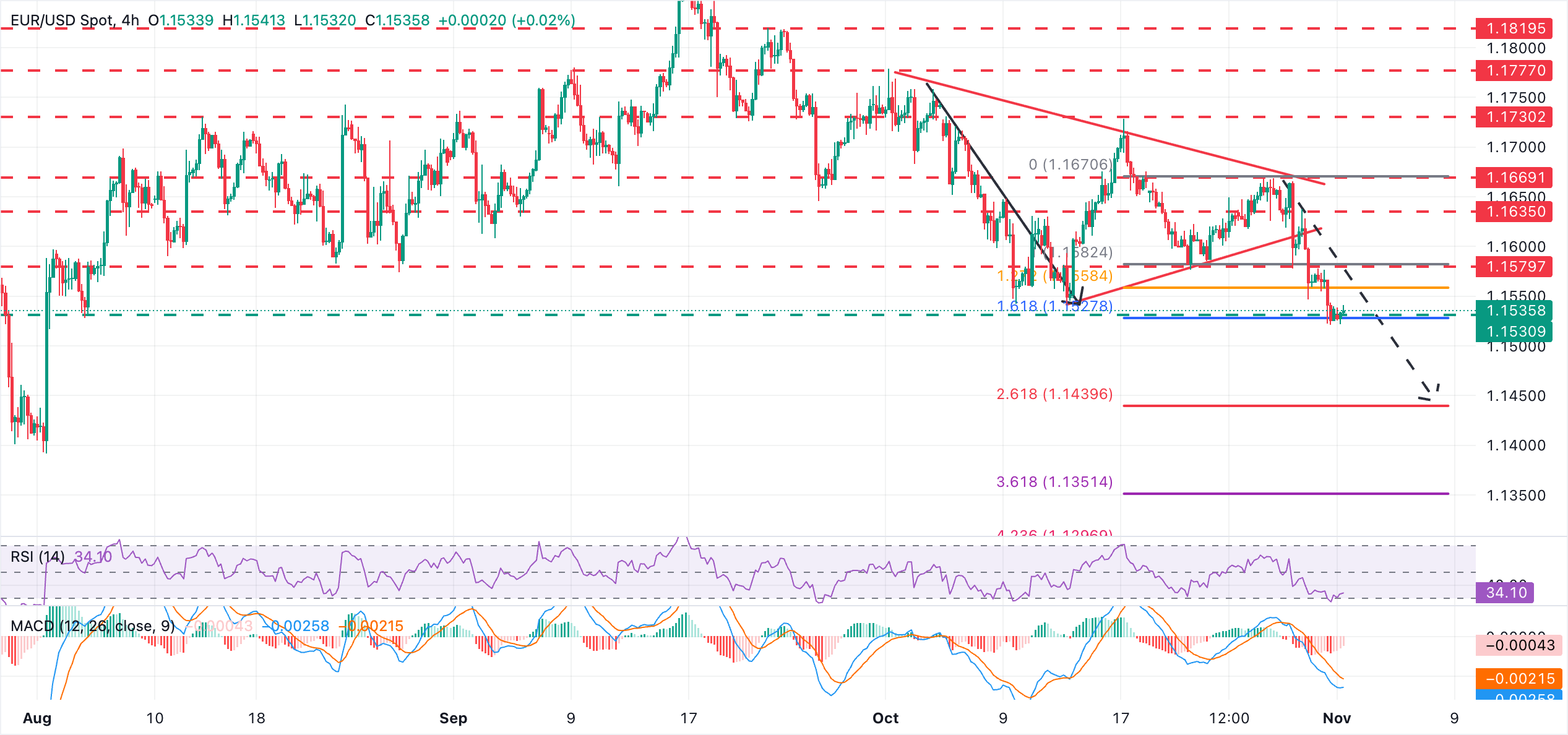

The EUR/USD broke the bottom of the monthly triangle pattern last week, giving fresh hopes for bears, which are now testing support at the 1.1530 area, where the August 5 low meets the 161,8% retracement of the late October rebound. The bias remains strongly negative, with the 4-hour Relative Strength Index (RSI) still above oversold levels, and the Moving Average Convergence Divergence (MACD) histogram keeps printing red bars.

Upside attempts are likely to be seen as good entry options for bears. A previous support at 1.1550 (October 30 low) keeps holding bears for now, ahead of the October 22 and 23 lows at 1.1580. An unlikely confirmation above this level would shift the focus towards the October 30 low, near 1.1635.

On the downside, below the mentioned 1.1530, the measured target of the triangle pattern lies near the 261.8% retracement of the October 23-28 bullish run, near 1.1440. Further down, the August 1 low lies at 1.1390.

The Manufacturing Purchasing Managers Index (PMI), released on a monthly basis by S&P Global and Hamburg Commercial Bank (HCOB), is a leading indicator gauging business activity in the Eurozone manufacturing sector. The data is derived from surveys of senior executives at private-sector companies from the manufacturing sector. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. The index varies between 0 and 100, with levels of 50.0 signaling no change over the previous month. A reading above 50 indicates that the manufacturing economy is generally expanding, a bullish sign for the Euro (EUR). Meanwhile, a reading below 50 signals that activity among goods producers is generally declining, which is seen as bearish for EUR.

Read more.Next release: Mon Nov 03, 2025 09:00

Frequency: Monthly

Consensus: 50

Previous: 50

Source: S&P Global

![]()

Created

: 2025.11.03

![]()

Last updated

: 2025.11.03

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy