Created

: 2025.10.20

![]() 2025.10.20 20:14

2025.10.20 20:14

USD/JPY recovered to 150.75 after dropping briefly under 149.50 on Friday, BBH FX analysts report.

'Japan's Liberal Democratic Party (LDP) and the center-right Innovation Party (Ishin) have agreed to form a coalition government. Combined, the LDP and Ishin hold 231 seats in the lower house of parliament - still two seats shy of a majority. The new coalition will have enough votes to elect Sanae Takaichi as Japan's prime minister tomorrow but will face constraints implementing Takaichi's expansive fiscal agenda.'

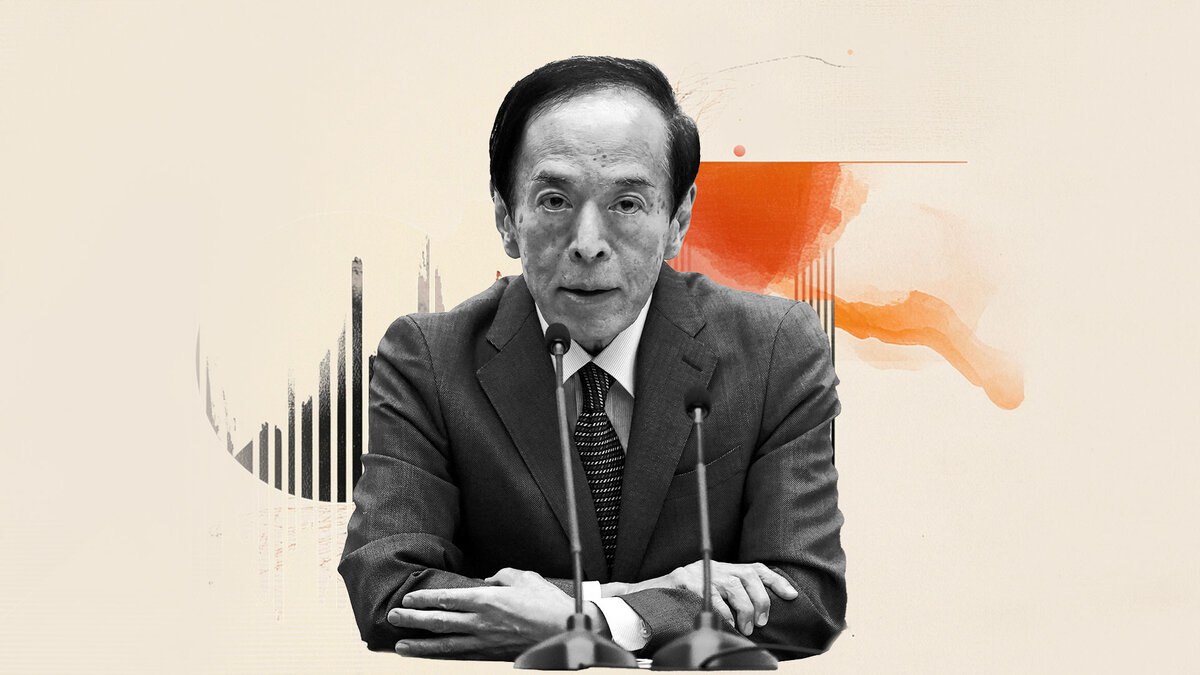

"Bank of Japan (BOJ) board member Takata Hajime reiterated his hawkish stance. Takata noted that 'now is a prime opportunity to raise the policy interest rate.' Recall, at the September BOJ meeting, two of the nine board members (Takata Hajime and Tamura Naoki) favored a 25bps hike to 0.75%. The rest voted to keep the policy rate at 0.50%."

"We agree with Takata and anticipate the BOJ to resume raising rates at the upcoming October 30 meeting (26% priced-in). Japan's Tankan business survey points to an ongoing recovery in real GDP growth and underlying inflation is making good progress towards the BOJ's 2% target. Bottom line: USD/JPY has room to edge lower given that it's already trading well-above the level implied by US-Japan bond yield spreads."

![]()

Created

: 2025.10.20

![]()

Last updated

: 2025.10.20

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy