Created

: 2025.10.15

![]() 2025.10.15 08:30

2025.10.15 08:30

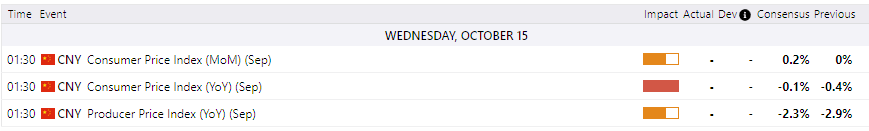

China releases its latest Consumer Price Index (CPI) and Producer Price Index (PPI) inflation metrics early Wednesday at 01:30 GMT, and will be providing markets with a much-needed update on potential trade war fallout between China and the US as trade tensions between the two giants ramps up once again.

While tariff impacts and economic inflation from China don't impact the Australian Dollar (AUD) directly, Australia's economic zone is tied tightly to demand growth in domestic Chinese markets, and rapid shifts in Chinese inflation figures will have knock-on consequences for Australian growth prospects.

Chinese CPI inflation is expected to show a 0.2% bump MoM in September, compared to the previous month's sluggish 0.0%. On an annualized basis, Chinese CPI inflation is still expected to hold on the low side, forecast at a 0.1% contraction, but still an improvement over the previous YoY period of -0.4%.

Chinese PPI tells a vastly different story, expected to clock in at -2.3% YoY in September, but even this represents an improvement from August's -2.9% YoY print.

With Australia's close economic ties to China, what's good (or bad) for the gander is frequently the same for the goose. As China takes steps to throw off downside economic fallout from the US's steady ramp-up of trade war rhetoric through 2025, signs of continued domestic growth will help bolster expectations of continued economic expansion in Australia. On the other hand, a steepening economic slump in China could spell doom for Australia, which is already teetering on a wobbly economy.

Healthy inflationary pressures in China would typically provide low-pressure yet sustained bullish pressure for the Australian Dollar (AUD), while a further steepening into a deflationary hole will erode the Aussie's market position over time.

The Consumer Price Index (CPI), released by the National Bureau of Statistics of China on a monthly basis, measures changes in the price level of consumer goods and services purchased by residents. The CPI is a key indicator to measure inflation and changes in purchasing trends. The YoY reading compares prices in the reference month to the same month a year earlier. Generally, a high reading is seen as bullish for the Renminbi (CNY), while a low reading is seen as bearish.

Read more.Next release: Wed Oct 15, 2025 01:30

Frequency: Monthly

Consensus: -0.1%

Previous: -0.4%

![]()

Created

: 2025.10.15

![]()

Last updated

: 2025.10.15

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy