Created

: 2025.09.25

![]() 2025.09.25 02:52

2025.09.25 02:52

The Dow Jones Industrial Average (DJIA) followed the broader market lower on Wednesday, shedding 270 points at its lowest. Investors are taking profits and trimming their exposure to the AI-fueled tech rally ahead of the latest US employment figures and inflation data.

The Dow Jones has eased lower for the second day in a row after punching in fresh all-time highs this week, punching a small hole through the 46,700 level before slipping back into recent technical territory around 46,150. The Dow is still trading deep into bull country, a full 6.5% above its 200-day Exponential Moving Average (EMA) near 43,350.

AI tech rally darling Nvidia (NVDA) fell another 1% on Wednesday, extending its recent decline as investors grow increasingly concerned about the insular investment scaffold that the AI industry has built itself around. Mega partnerships between tech giants, such as Nvidia's recent $100 billion stake in OpenAI and recent investment announcement with Intel (INTC) show that plenty of investment capital is sloshing around the AI tank, but real bottom-line revenues for the AI industry remain elusive after several years of ever-climbing valuations.

Wednesday was a meager affair on the economic data docket. US New Home Sales Change rebounded to its strongest level since late 2022, clocking in at 20.5 versus its previous contraction of 1.8, but the mid-tier figure is still within its long-term range. The latest 5-year Treasury auction saw yields slip back to 3.7% from 3.724%, but the figure still remains elevated from recent lows near 3.75% as investors remain uneasy about the US government barreling into another budget crisis. The Trump administration is struggling to avert a government funding shutdown with President Donald Trump canceling key budget meetings with US elected officials.

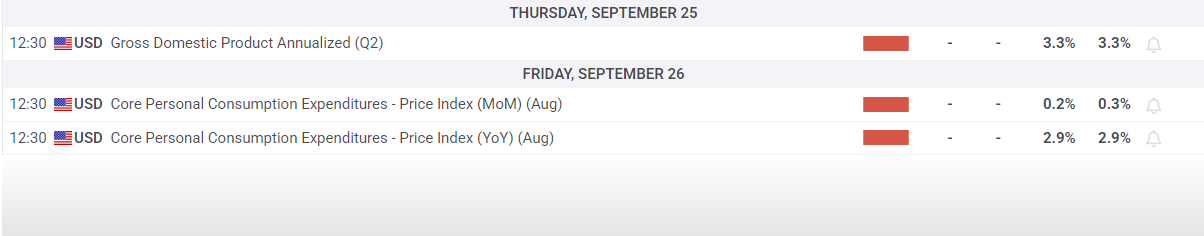

The US is releasing its latest Personal Consumption Expenditures Price Index (PCE) inflation report this Friday. Investors will be paying close attention to find out if enough businesses are absorbing some of the costs to prevent rapidly passing too much of the tariff expenses directly onto consumers.

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow's theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

![]()

Created

: 2025.09.25

![]()

Last updated

: 2025.09.25

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy