Created

: 2025.09.23

![]() 2025.09.23 20:12

2025.09.23 20:12

Gold continues to march higher on Tuesday, reaching fresh all-time highs and nearing $3,800 after appreciating more than $140 over the last three trading days. The US Dollar's pullback ahead of the US PMI and Fed Powell's speech has provided further support to the precious metals.

Investors' expectations of further Fed rate cuts, on one side, and growing geopolitical concerns, namely the frictions between Russia and its NATO neighbours, have boosted demand for the safe-haven gold this week.

On Tuesday, a range of Fed speakers offered diverse opinions about the bank's rate path, but futures markets continued to price in a 90% chance of a 25-basis-point cut in November and a 70% chance of another one in December. Against this backdrop, the US Dollar's upside attempts are likely to remain subdued.

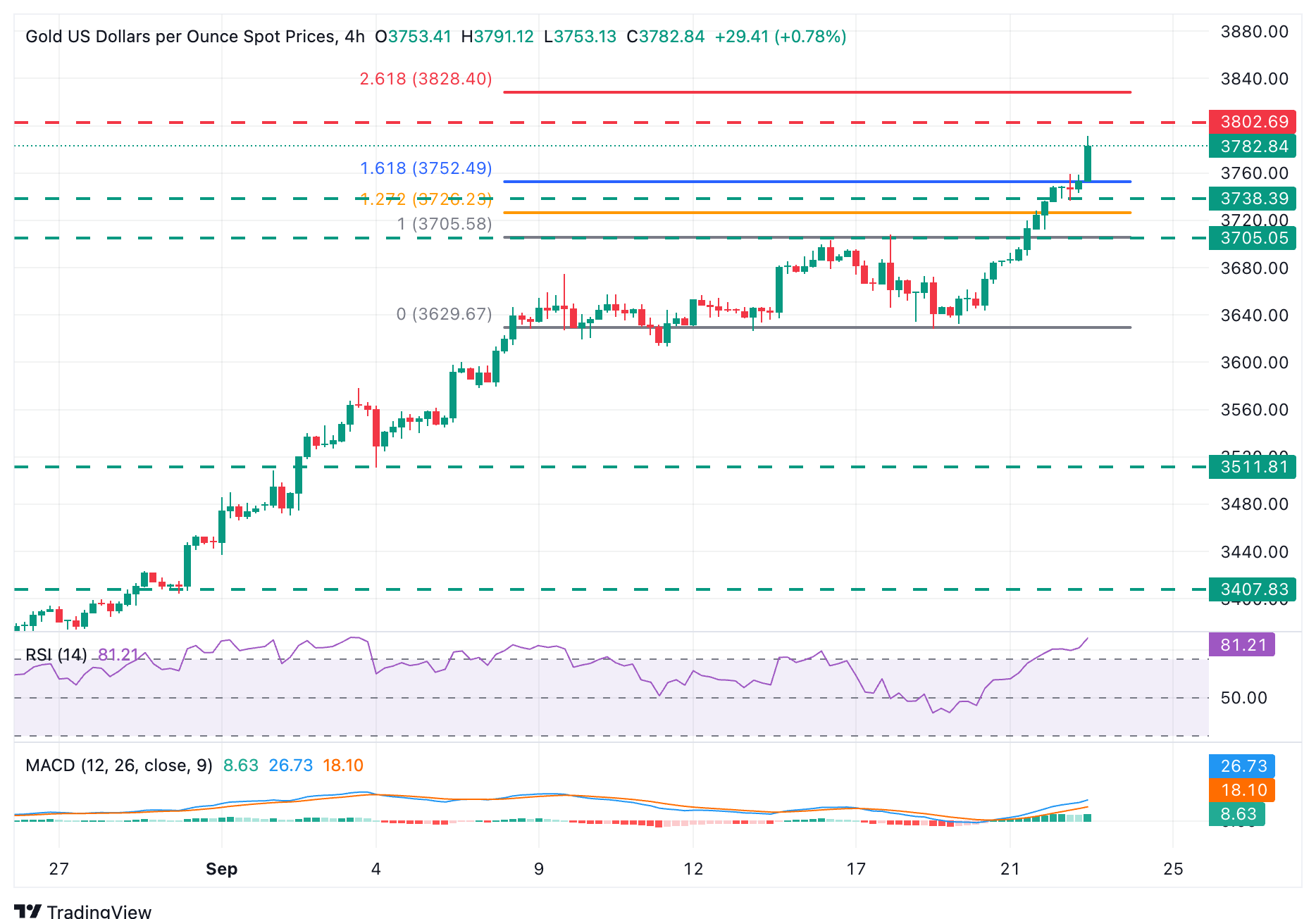

The technical picture shows an overextended rally from mid-August lows. Bullion has appreciated nearly 15% ever since, and these performances, sooner than later, lead to corrections. The RSI is overbought at most timeframes, supporting that view.

On the upside, the psychological level at $3,800 might be a plausible target ahead of a healthy correction. Further up, the 261.8% Fibonacci retracement of the mid-September pullback, at $3,828, emerges as a potential target.

To the downside, immediate support is at the intraday low of $3,738 ahead of the previous record high, in the area of $3,700. Further down, the September 15 and 19 lows, around $36,30 would come into focus.

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.04% | -0.13% | -0.03% | 0.09% | -0.19% | -0.04% | -0.14% | |

| EUR | -0.04% | -0.04% | -0.05% | 0.09% | -0.17% | -0.04% | -0.12% | |

| GBP | 0.13% | 0.04% | 0.04% | 0.14% | -0.13% | 0.00% | -0.09% | |

| JPY | 0.03% | 0.05% | -0.04% | 0.10% | -0.12% | -0.02% | -0.02% | |

| CAD | -0.09% | -0.09% | -0.14% | -0.10% | -0.27% | -0.13% | -0.22% | |

| AUD | 0.19% | 0.17% | 0.13% | 0.12% | 0.27% | 0.14% | 0.12% | |

| NZD | 0.04% | 0.04% | -0.00% | 0.02% | 0.13% | -0.14% | -0.09% | |

| CHF | 0.14% | 0.12% | 0.09% | 0.02% | 0.22% | -0.12% | 0.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

![]()

Created

: 2025.09.23

![]()

Last updated

: 2025.09.23

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy