Created

: 2025.07.12

![]() 2025.07.12 02:49

2025.07.12 02:49

West Texas Intermediate (WTI) Crude Oil prices are holding firm above $67.00 on Friday as traders digest a shift in the fundamental landscape.

A combination of revised US production forecasts, robust domestic fuel demand, and persistent geopolitical threats is providing support despite ongoing concerns around trade tariffs introduced by the Trump administration.

At the time of writing, WTI is trading around $67.27, stabilizing after a volatile week driven by headlines ranging from fresh tariff announcements to updated drilling projections.

One of the more significant developments this week occurred on Tuesday, when the Energy Information Administration (EIA) revised its forecast for US crude production for the year.

The agency now expects 13.37 million barrels per day, down from the prior estimate of 13.42 million. This marks the second consecutive month of downward revision and reflects the slowdown in rig activity seen across shale basins since late Q2.

Lower production expectations are being interpreted as a sign that supply may remain tight heading into the winter months, particularly if demand remains elevated and global disruptions emerge.

While inventory data from earlier in the week showed a surprise build in Crude stockpiles, with the EIA reporting a 7.07 million barrel increase on Wednesday, markets quickly shifted their focus to gasoline demand.

Ahead of the Independence Day holiday, gasoline consumption in the US jumped to multi-month highs, reinforcing the narrative that fuel demand remains resilient despite elevated pump prices and lingering inflation.

This seasonal strength has played a key role in limiting downside moves in WTI, particularly as refinery margins remain healthy and utilization rates stay high.

President Donald Trump's announcement of a 35% tariff on Canadian oil imports, followed by broader threats of 15-20% tariffs on other trading partners, initially raised concerns about retaliatory measures or supply disruption.

However, the muted market response suggests traders are largely viewing the announcements as politically motivated, rather than indicative of real logistical risk in the short term.

While tariffs could distort flows later in the year, the current view is that physical supply chains, particularly pipelines between the US and Canada, will remain operational.

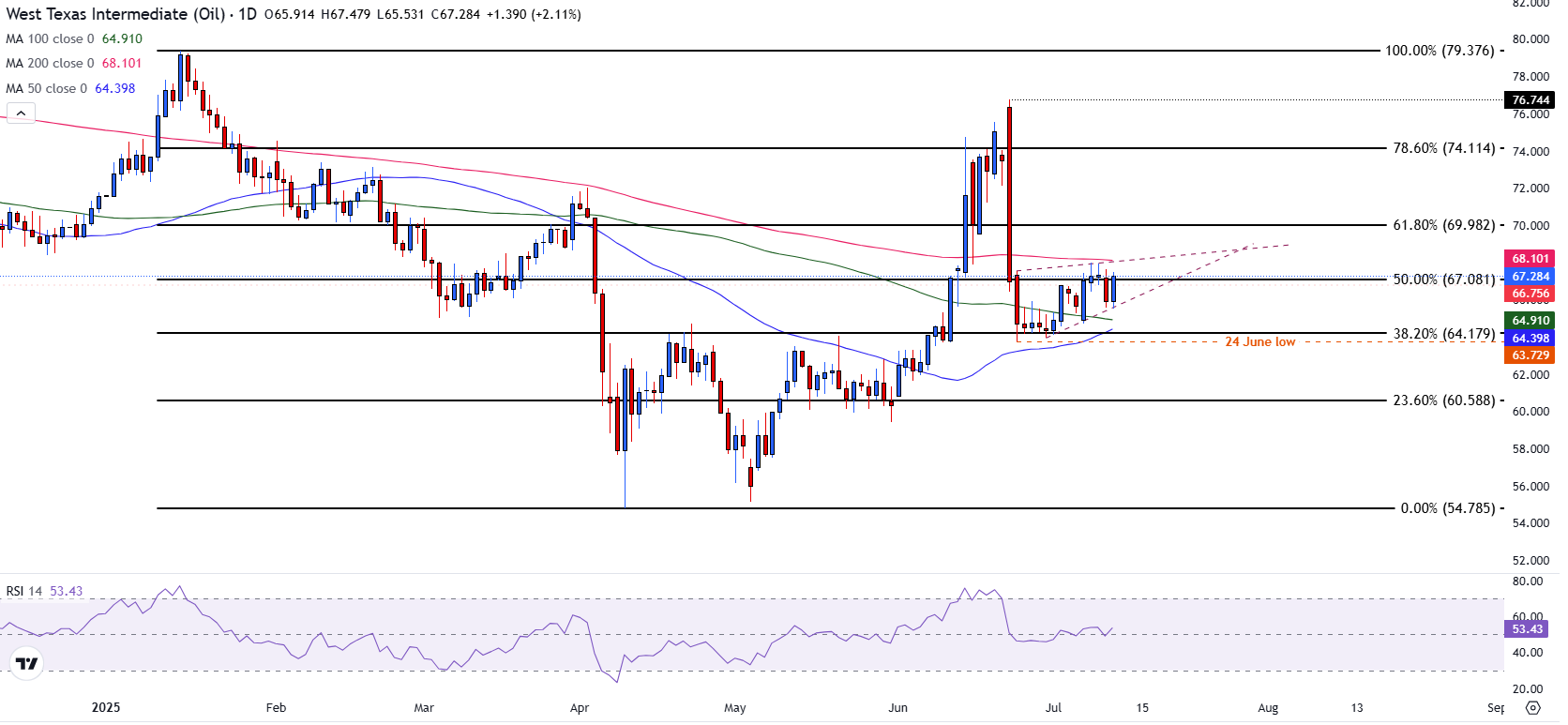

West Texas Intermediate (WTI) is currently trading near $67.27, stabilizing within a tightening range as price action consolidates just above the 50.0% Fibonacci retracement of the January-April decline at $67.08.

This level now acts as immediate support, while additional downside levels include the 100-day Simple Moving Average (SMA) at $64.91, the 50-day SMA at $64.40, and the June 24 low at $63.72.

On the upside, the 200-day SMA at $68.10 remains the primary resistance to watch.

A confirmed breakout above this level could expose the 61.8% Fibonacci retracement at $69.98. Structurally, WTI is forming a short-term ascending triangle, characterized by higher lows since late June, which suggests underlying bullish pressure.

The Relative Strength Index (RSI) is currently near 53, indicating a modest bullish bias.

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as "light" and "sweet" because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered "The Pipeline Crossroads of the World". It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API's report is published every Tuesday and EIA's the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

![]()

Created

: 2025.07.12

![]()

Last updated

: 2025.07.12

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy