Created

: 2025.06.23

![]() 2025.06.23 23:40

2025.06.23 23:40

The Australian Dollar (AUD) reverses earlier losses and edges higher against the US Dollar (USD) on Monday, as traders reassess safe-haven flows after the United States (US) launched attacks on Israel over the weekend. The initial rush into the Greenback pushed the Aussie to a one-month low before a mixed batch of US Purchasing Managers Index (PMI) data helped temper US Dollar demand.

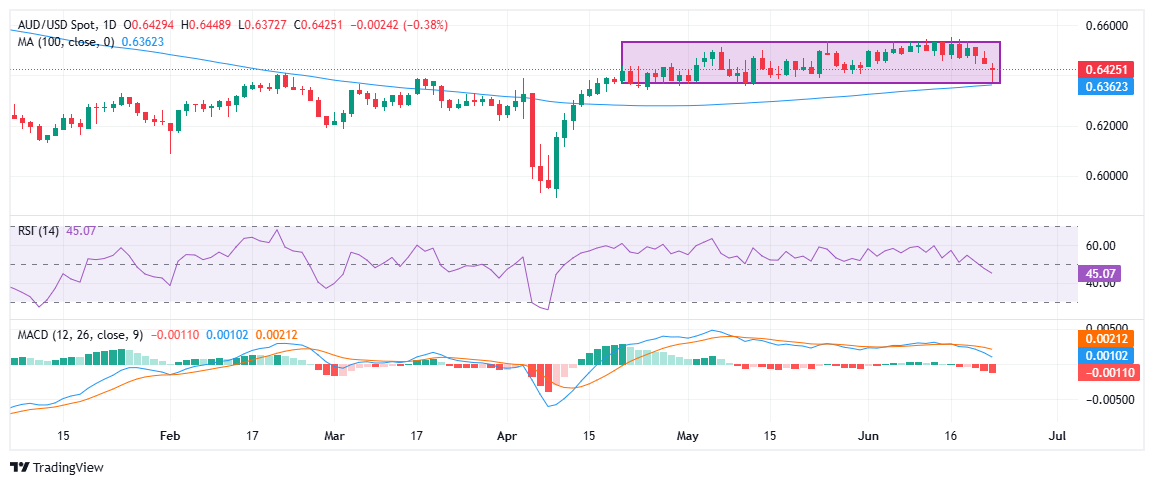

AUD/USD is currently trading around 0.6452 at the time of writing, during the American session, having erased most of its intraday losses and now down approximately 0.38% on the day. The pair rebounded strongly from a session low of 0.6372, finding a tailwind as the latest US PMIs failed to deliver a decisive boost to the US Dollar.

US data painted a slightly softer tone, the S&P Global Composite x PMI slipped to 52.8 in June from 53 in May, hinting at a mild loss of momentum while still marking over two years of expansion. The Manufacturing PMI held steady at 52, in line with May's 15-month high and beating forecasts, while the Services PMI dipped to 53.1 from 53.7 but remained above market expectations. Overall, the mixed readings cooled fresh buying interest in the US Dollar, giving AUD/USD room to bounce.

Meanwhile, earlier in the day, S&P Global figures showed Australia's private sector growing at its second-fastest pace in ten months, with services activity hitting a three-month high and manufacturing holding steady. The encouraging PMI print offered a measure of relief for the Aussie, providing some reassurance after recent soft economic releases had revived talk of possible rate cuts.

Technically, the pair's strong recovery from the lower edge of its tight range suggests buyers are defending key support near 0.6400, reinforced by the 100-day Moving Average around 0.6362. The RSI has turned higher toward the midline, and the MACD shows early signs of stabilization. A daily close above 0.6450 could open the door for a push back toward the 0.6500-0.6550 area, keeping the range-trading strategies alive. A failure to hold above 0.6400, however, would re-expose the downside toward 0.6300.

The Composite Purchasing Managers Index (PMI), released on a monthly basis by S&P Global, is a leading indicator gauging private-business activity in Australia for both the manufacturing and services sectors. The data is derived from surveys to senior executives. Each response is weighted according to the size of the company and its contribution to total manufacturing or services output accounted for by the sub-sector to which that company belongs. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. The index varies between 0 and 100, with levels of 50.0 signaling no change over the previous month. A reading above 50 indicates that the Australian private economy is generally expanding, a bullish sign for the Australian Dollar (AUD). Meanwhile, a reading below 50 signals that activity is generally declining, which is seen as bearish for AUD.

Read more.Last release: Sun Jun 22, 2025 23:00 (Prel)

Frequency: Monthly

Actual: 51.2

Consensus: -

Previous: 50.5

Source: S&P Global

![]()

Created

: 2025.06.23

![]()

Last updated

: 2025.06.23

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy