Created

: 2025.06.27

![]() 2025.06.27 21:20

2025.06.27 21:20

Gold (XAU/USD) is suffering another setback after reports telling that China and the United States have reached a trade deal.

As risk appetite continues to improve, the precious metal has been under pressure this week. With safe-haven flows shifting toward riskier assets, Gold is trading below $3,300 at the time of writing on Friday.

Friday's US economic agenda, includings the release of the core Personal Consumption Expenditure (PCE), will be closely monitored. This important dataset measures the pace at which prices of goods and services are rising and is released on a monthly basis. It is the Federal Reserve's preferred measure of inflation, which plays a significant role in setting expectations for interest rates.

Although the May print is expected to show a slight increase on an annual basis, major deviations from expectations and the repricing of information can have a direct impact on the Gold price.

Moreover, President Trump is putting immense pressure on the Fed to cut rates to stimulate the economy.

A major concern for the Fed has been the impact of tariffs on inflation. A trade deal with China, which has resulted in a pause of higher reciprocal tariffs on Chinese imports until August 12, could alleviate some of the pressure that potential higher tariffs may have on the US economy. According to the CME FedWatch Tool, the probability of a 25-basis point (bps) rate cut in September has increased to 72%, with markets anticipating rates to fall by at least 50 bps by year-end.

While lower rates bode well for Gold, the increase in demand for equities and riskier assets may continue to weigh on bullion in the short term.

Gold remains under pressure, with prices trading below the key psychological level of $3,300, which now provides near-term resistance for the yellow metal.

Above that is the 50-day Simple Moving Average at $3,324 and the 20-day SMA near $3,356.

The Relative Strength Index (RSI) at 43 signals fading bullish momentum without yet entering oversold territory.

In the bearish scenario, a sustained break below the mid-point of the April low-high move, represented by the 50% Fibonacci retracement level, provides support at $3,228. A break of which could open the door toward the $3,200 psychological handle. The 100-day SMA at $3,164 acts as a deeper support level.

On the other hand, the bullish scenario would require a decisive recovery above the 20-day SMA, potentially reigniting upside momentum toward the $3,400 and $3,452 resistance levels. Until such a move materializes, Gold may remain vulnerable to deeper retracements within its broader consolidation pattern.

The Core Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve's (Fed) preferred gauge of inflation. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The core reading excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures." Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Next release: Fri Jun 27, 2025 12:30

Frequency: Monthly

Consensus: 2.6%

Previous: 2.5%

Source: US Bureau of Economic Analysis

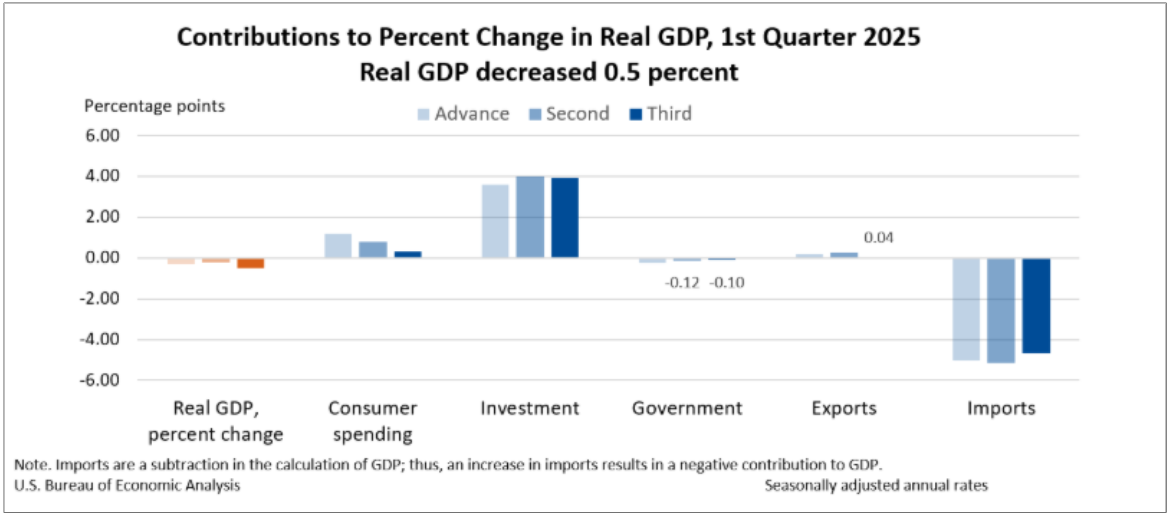

After publishing the GDP report, the US Bureau of Economic Analysis releases the Personal Consumption Expenditures (PCE) Price Index data alongside the monthly changes in Personal Spending and Personal Income. FOMC policymakers use the annual Core PCE Price Index, which excludes volatile food and energy prices, as their primary gauge of inflation. A stronger-than-expected reading could help the USD outperform its rivals as it would hint at a possible hawkish shift in the Fed's forward guidance and vice versa.

![]()

Created

: 2025.06.27

![]()

Last updated

: 2025.06.27

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy