Created

: 2025.05.28

![]() 2025.05.28 04:23

2025.05.28 04:23

The EUR/USD pair retreats below 1.1400 for the second consecutive day, driven by a recovery in the US Dollar (USD) following an upbeat Consumer Confidence report. Additionally, soft inflation data in France undermined the shared currency, which trades on Tuesday at 1.1335, down over 0.40%.

Risk appetite has improved as market participants digested news that US President Donald Trump stated trade talks between the United States (US) and the European Union (EU) picked up some steam following his 50% tariff threats last Friday. Although he backpedaled, giving some room for negotiations, it remains to be seen if both parties reach an agreement before July 9.

Upbeat US Consumer Confidence data in May, as revealed by the Conference Board (CB), provided a leg down on the EUR/USD pair. The US Dollar Index (DXY), which tracks the value of the American currency against the other six, rises by over 0.62% to 99.54.

Other data in the US showed that Durable Goods Orders plunged in April, hitting their lowest level since October 2020.

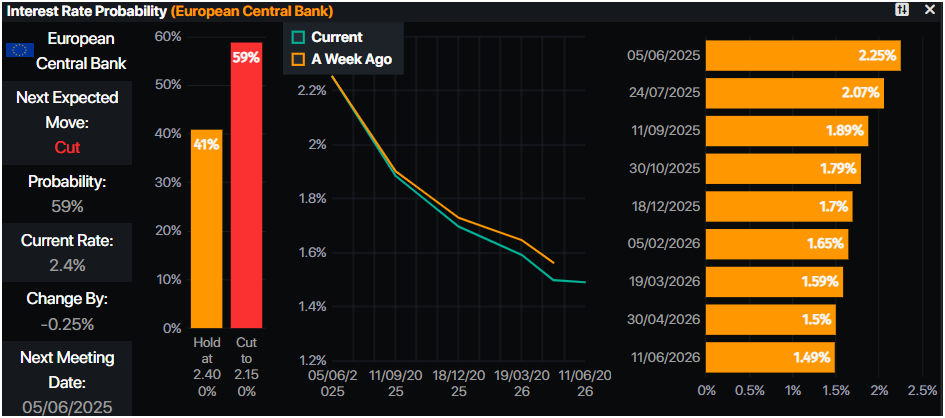

Across the pond, France's inflation figures continued to show an improvement in the deflationary process, opening the door for further easing by the European Central Bank (ECB).

ECB's Gediminas Simkus revealed that he sees scope for an "interest rate reduction in June." Nevertheless, some voices at the ECB had turned slightly hawkish, with Robert Holzmann, an Austrian Central Bank member and an ECB member, stating in an interview with the Financial Times (FT) that he doesn't see any reason to lower rates at the policy meetings in June and July.

Data from the entire bloc revealed that the EU Economic Sentiment Indicator improved for the first time in three months in May, in line with the German GfK Consumer Sentiment for June.

Source: Prime Market Terminal

EUR/USD is upwardly biased, although it faced stiff resistance at 1.1400. Monday's price action formed an 'inverted hammer', a candlestick pattern that indicates sellers may be gaining control. However, further confirmation was needed at the time. As of writing, the pair has fallen below Monday's low of 1.1358, opening the door for lower prices.

A daily close below the latter could send EUR/USD diving towards the 1.1300 figure. Further downside is seen at the 20-day Simple Moving Average (SMA) at 1.1267, followed by the 1.1200 mark.

On the upside, if EUR/USD stays above 1.1375, the next resistance would be the May 26 high of 1.1418, followed by 1.1450 and 1.1500.

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB's primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates - or the expectation of higher rates - will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB's 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone's economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

![]()

Created

: 2025.05.28

![]()

Last updated

: 2025.05.28

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy