Created

: 2025.10.10

![]() 2025.10.10 04:59

2025.10.10 04:59

The Canadian Dollar (CAD) shed weight at an accelerating pace on Thursday, falling over one-half of one percent against the US Dollar (USD) amid a broad-market uptick in Greenback demand. FX markets are seeing an across-the-board pivot into picking up the US Dollar, leaving the already-struggling Loonie in the dust.

The US government's funding-based shutdown is stretching into its ninth straight day. Investors initially brushed off the closure of US federal services last week. Now, a clear lack of forward progress by US lawmakers to re-fund the government is weighing on broad-market sentiment, sparking a sharp uptick in risk-off safe-haven flows and buoying the Greenback.

USD/CAD extended its recent rally, with the pair now trading near 1.4025 after breaking through the key 1.4000 level. The move marks a decisive shift in daily structure, as price has pushed above both the 50-day and 200-day Exponential Moving Averages (EMA), now clustered around 1.3850 and 1.3870, respectively. That area has flipped from resistance to potential support, signaling a meaningful shift in market sentiment toward the U.S. dollar.

From a price action standpoint, the trend remains constructive, with a clear pattern of higher highs and higher lows since August. The breakout above 1.4000 likely cleared resting liquidity, opening the door for a push toward the March swing high near 1.4450. However, the Relative Strength Index (RSI) reading at 70 suggests momentum is running hot, which could lead to some short-term profit taking or consolidation before another leg higher. If the pair can hold above the 1.3900-1.3950 zone, the broader bias stays bullish, while a close back below that area would hint at a deeper pullback toward 1.3800.

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada's largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada's exports versus its imports. Other factors include market sentiment - whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) - with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada's biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada's case is the Canadian Dollar.

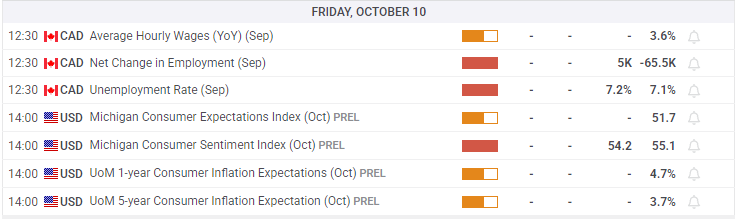

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

![]()

Created

: 2025.10.10

![]()

Last updated

: 2025.10.10

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy