Created

: 2025.10.02

![]() 2025.10.02 05:48

2025.10.02 05:48

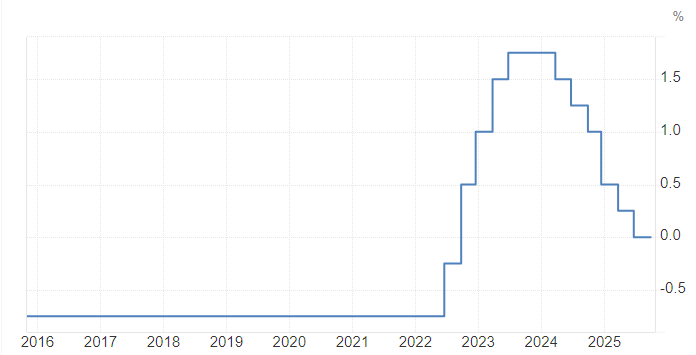

USD/CHF continues to trudge its way through familiar technical territory, with price action holding stubbornly just south of the 0.8000 major handle. The Swiss National Bank (SNB) continues to fight back against market expectations of a return to negative interest rates, with Swiss inflation already riding too close to zero to allow the SNB to make sharp policy moves.

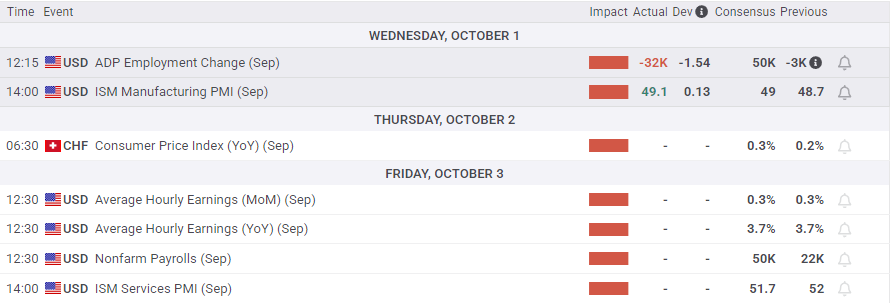

The US federal government has hit a slight policy snag after Congress failed to pass an interim budget spending bill that would finance government operations at the start of the federal government's fiscal year, which begins on October 1 every year. This marks the fourth government shutdown across Donald Trump's two terms as president. Investors are largely brushing off the operational blackout, as US government shutterings tend to have a limited impact on economic factors.

Swiss Consumer Price Index (CPI) inflation is due on Thursday, and is expected to show headline Swiss inflation ticking up to 0.3% YoY from 0.2%. However, the increase in inflation is still far too low to open the door for an easy policy transition back into negative territory as a growing number of market participants expect from the SNB.

Swiss National Bank Interest Rate, via tradingeconomics.com

This week's hotly anticipated US Nonfarm Payrolls (NFP) jobs report is at risk of being delayed or suspended. According to the US Bureau of Labor Statistics (BLS), a government shutdown will result in official dataset releases being suspended until federal operations resume.

ADP Employment Change figures came in much lower than the street expected, showing a contraction of -32K in September versus the expected 50K. August's initial print of 54K was also revised sharply lower to -3K. ADP jobs figures suffer from constant revisions, but the figure has generally missed expectations for all but three of the monthly figures published since the start of 2025.

With the NFP print in jeopardy, investors are leaning further on private data such as ADP. According to the CME's FedWatch Tool, rate trader bets of another quarter-point interest rate cut on October 29 surged to 99% post-ADP on Wednesday. Rate markets are also pricing in nearly 90% odds of a third-straight rate trim on December 10, and a further 93% that the Fed will deliver a fourth interest rate cut by next April at the absolute latest.

The Swiss Franc (CHF) is Switzerland's official currency. It is among the top ten most traded currencies globally, reaching volumes that well exceed the size of the Swiss economy. Its value is determined by the broad market sentiment, the country's economic health or action taken by the Swiss National Bank (SNB), among other factors. Between 2011 and 2015, the Swiss Franc was pegged to the Euro (EUR). The peg was abruptly removed, resulting in a more than 20% increase in the Franc's value, causing a turmoil in markets. Even though the peg isn't in force anymore, CHF fortunes tend to be highly correlated with the Euro ones due to the high dependency of the Swiss economy on the neighboring Eurozone.

The Swiss Franc (CHF) is considered a safe-haven asset, or a currency that investors tend to buy in times of market stress. This is due to the perceived status of Switzerland in the world: a stable economy, a strong export sector, big central bank reserves or a longstanding political stance towards neutrality in global conflicts make the country's currency a good choice for investors fleeing from risks. Turbulent times are likely to strengthen CHF value against other currencies that are seen as more risky to invest in.

The Swiss National Bank (SNB) meets four times a year - once every quarter, less than other major central banks - to decide on monetary policy. The bank aims for an annual inflation rate of less than 2%. When inflation is above target or forecasted to be above target in the foreseeable future, the bank will attempt to tame price growth by raising its policy rate. Higher interest rates are generally positive for the Swiss Franc (CHF) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken CHF.

Macroeconomic data releases in Switzerland are key to assessing the state of the economy and can impact the Swiss Franc's (CHF) valuation. The Swiss economy is broadly stable, but any sudden change in economic growth, inflation, current account or the central bank's currency reserves have the potential to trigger moves in CHF. Generally, high economic growth, low unemployment and high confidence are good for CHF. Conversely, if economic data points to weakening momentum, CHF is likely to depreciate.

As a small and open economy, Switzerland is heavily dependent on the health of the neighboring Eurozone economies. The broader European Union is Switzerland's main economic partner and a key political ally, so macroeconomic and monetary policy stability in the Eurozone is essential for Switzerland and, thus, for the Swiss Franc (CHF). With such dependency, some models suggest that the correlation between the fortunes of the Euro (EUR) and the CHF is more than 90%, or close to perfect.

![]()

Created

: 2025.10.02

![]()

Last updated

: 2025.10.02

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy