Created

: 2025.09.27

![]() 2025.09.27 02:28

2025.09.27 02:28

The Dow Jones Industrial Average (DJIA) rebounded on Friday, paring away the midweek's losses and recovering footing as investors self-soothe over odds of a follow-up interest rate cut in October. US Personal Consumption Expenditures Price Index (PCE) inflation came in about where median market forecasts predicted, keeping market hopes for an October rate trim on the high side.

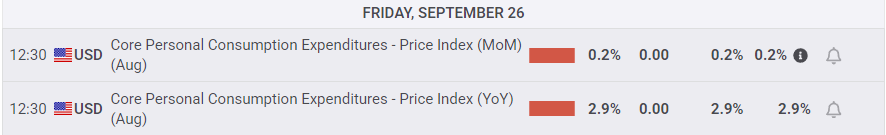

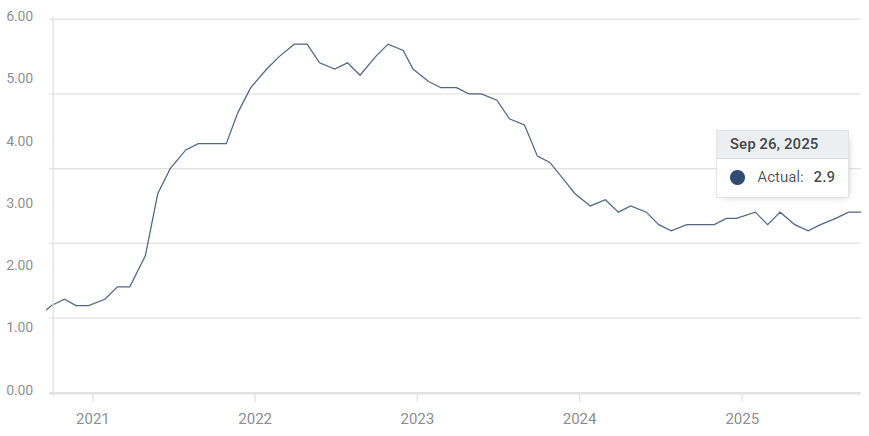

Core PCE inflation held steady at 2.9% on an annual basis, meeting market forecasts. The monthly figure also held flat at 0.2% MoM, while headline PCE inflation accelerated to 0.3% MoM and 2.7% YoY. The US economy is now eight months into its "one-time inflation passthrough" from the Trump administration's tariffs, and core annual PCE inflation metrics are at the same level they were nearly 18 months ago in March of 2024.

Despite the lack of meaningful progress on inflation, markets are still leaning into the bullish side as Friday's PCE inflation print was not high enough to spark any concerns about the Fed falling back into hawkish territory. Amid a slumping labor market, the Fed is still on track to deliver a second straight quarter-point interest rate cut on October 25th. According to the CME's FedWatch Tool, rate traders are pricing in nearly 90% odds that the Fed will deliver a 25 bps rate trim to match the opening rate cut from September's rate meeting.

Core PCE inflation, YoY

Personal Income and Personal Spending both rose in August, climbing to 0.4% and 0.6%, respectively. While rising income and consumption metrics are positive signs for the US economy, accelerating wage pressures could bolster inflation metrics in the future, complicating the Fed's path to a fresh rate-cutting cycle.

September's University of Michigan (UoM) Consumer Expectations and Sentiment Indexes both declined slightly from the previous month, but again, the data was mostly in line with market expectations. UoM 5-year and 5-year Consumer Inflation Expectations also ticked lower in September, but the topline figures are still riding high at 4.7% and 3.7%, respectively.

Consumers have a strong tendency to overshoot realistic outcomes, but such consistently high figures over time could be a warning of overly price-sensitive consumers' inflation expectations becoming entrenched in a self-fulfilling prophecy. As long as consumers continue to expect above-pace inflation, businesses will be more inclined to meet those expectations.

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow's theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

![]()

Created

: 2025.09.27

![]()

Last updated

: 2025.09.27

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy