Created

: 2025.08.26

![]() 2025.08.26 20:00

2025.08.26 20:00

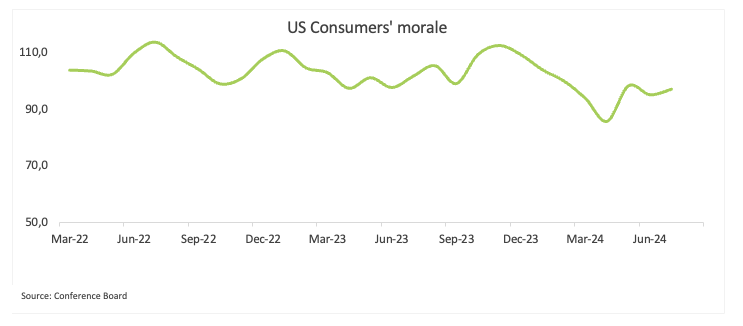

The United States (US) will see the release of the August Conference Board's Consumer Confidence Index on Tuesday. The report is a monthly survey conducted by the Conference Board that gathers information on consumer behaviour, expectations, purchasing intentions, and vacation plans.

The report contains several sub-readings: The Present Situation Index, which measures consumers' perceptions of current business and labour market conditions, and the Expectations Index, which measures the short-term outlook for income, business, and employment.

On the whole, Consumer Confidence is expected to register a mild decline to 96.4 in August after rising to 97.2 in July. In June, the Consumer Confidence Index fell to 95.2.

In July, the Present Index Situation dropped to 131.5, while the Expectations Index increased to 74.4.

The US Dollar Index (DXY) sold off on Friday exclusively in response to Federal Reserve (Fed) Chair Powell's dovish remarks at the Jackson Hole Symposium.

Pablo Piovano, Senior Analyst at FXStreet, notes, "If the DXY slips below its multi-year low of 96.37 (July 1), the next major support lines up at 95.13 (February 4) and 94.62 (January 14)."

"On the flip side, the first obstacle is the August high at 100.25 (August 1); a decisive break there could clear the way to 100.54 (May 29) and then the May peak at 101.97 (May 12)," Piovano adds.

"Momentum indicators are also softening, as the Relative Strength Index (RSI) has eased to nearly 46, suggesting waning bullish momentum, while the Average Directional Index (ADX) is holding near 13, signalling a lack of strong directional trend", he concludes.

The Consumer Confidence index, released on a monthly basis by the Conference Board, is a survey gauging sentiment among consumers in the United States, reflecting prevailing business conditions and likely developments for the months ahead. The report details consumer attitudes, buying intentions, vacation plans and consumer expectations for inflation, labor market, stock prices and interest rates. The data shows a picture of whether or not consumers are willing to spend money, a key factor as consumer spending is a major driver of the US economy. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish. Note: Because of restrictions from the Conference Board, FXStreet Economic Calendar does not provide this indicator's figures.

Read more.Last release: Tue Jul 29, 2025 14:00

Frequency: Monthly

Actual: -

Consensus: -

Previous: -

Source: Conference Board

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

![]()

Created

: 2025.08.26

![]()

Last updated

: 2025.08.26

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy