Created

: 2025.08.15

![]() 2025.08.15 20:00

2025.08.15 20:00

On Friday, the US gets the first look at August's University of Michigan Consumer Sentiment Index. This monthly survey gauges households' perceptions of the economy's trajectory. A final reading follows two weeks later.

The release breaks down into several measures. There's the Current Conditions Index and the Consumer Expectations Index -- plus the parts markets really watch: one-year and five-year inflation expectations.

In July, sentiment improved to a five-month high at 61.7 from May's 52.2, which also was the lowest level since the summer of 2022. Still, on the bright side, the Current Conditions component ticked higher to 68.0, although Expectations eased to 57.7.

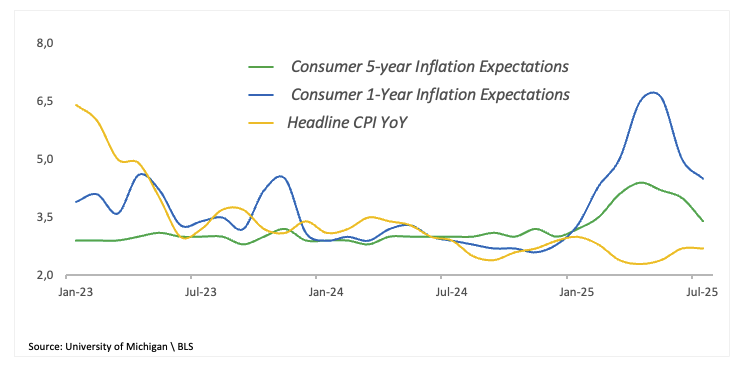

Looking closer, the one-year inflation outlook extended its downward trend in July, down to 4.5% following June's 5.0% increase and May's 6.6% gain, the highest level so far this year. In the longer run, the five-year gauge eased to 3.4% in July, clinching its third consecutive monthly decline.

Still, consumers seem unconvinced of a lasting pass-through of inflation-related tariffs into their daily expenses, in a context where the White House's trade policy does not appear to be navigating in the clear either.

The U-Mich survey will land just after July's US Inflation Rate, which showed the headline Consumer Price Index (CPI) holding steady at 2.7% from a year earlier, while the core CPI increased to 3.1% compared to the same month in 2024, reinforcing the persistence of domestic inflationary pressure and the cautious approach taken by the Federal Reserve (Fed).

The Greenback maintains a downward trend so far in August, prompting the US Dollar Index (DXY) to slip back to the sub-98.00 region following multi-week highs north of the psychological 100.00 barrier recorded on August 1.

The US Dollar's decline in the past few weeks has accelerated due to prospects for a couple of interest rate cuts by the Fed, likely in September and December, along with President Trump's efforts to transform the Fed into a more dovish institution. Looking at the wider picture, the idea of a weaker currency to incentivise the country's competitiveness has been weighing on the Greenback since "Inauguration Day".

Senior Analyst at FX Street, Pablo Piovano, argues that if DXY clears its multi-year trough at 96.37 (July 1), the index might then challenge the February 2022 base at 95.13 (February 4), ahead of the 2022 valley at 94.62 (January 14).

In the opposite direction, the immediate barrier sits at the August ceiling of 100.25 (August 1), while a surpass of this region could pave the way for a potential visit to the weekly top at 100.54 (May 29), prior to the May peak at 101.97 (May 12).

Momentum indicators also give mixed signals: the Relative Strength Index (RSI) has dropped to around 44, suggesting the likelihood of extra losses in the near term, while the Average Directional Index (ADX) is nearing 13 and points to a weak trend.

The Michigan Consumer Sentiment Index, released on a monthly basis by the University of Michigan, is a survey gauging sentiment among consumers in the United States. The questions cover three broad areas: personal finances, business conditions and buying conditions. The data shows a picture of whether or not consumers are willing to spend money, a key factor as consumer spending is a major driver of the US economy. The University of Michigan survey has proven to be an accurate indicator of the future course of the US economy. The survey publishes a preliminary, mid-month reading and a final print at the end of the month. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Last release: Fri Aug 01, 2025 14:00

Frequency: Monthly

Actual: 61.7

Consensus: 62

Previous: 61.8

Source: University of Michigan

Consumer exuberance can translate into greater spending and faster economic growth, implying a stronger labor market and a potential pick-up in inflation, helping turn the Fed hawkish. This survey's popularity among analysts (mentioned more frequently than CB Consumer Confidence) is justified because the data here includes interviews conducted up to a day or two before the official release, making it a timely measure of consumer mood, but foremost because it gauges consumer attitudes on financial and income situations. Actual figures beating consensus tend to be USD bullish.

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

![]()

Created

: 2025.08.15

![]()

Last updated

: 2025.08.15

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy