Created

: 2025.07.17

![]() 2025.07.17 03:37

2025.07.17 03:37

The British Pound (GBP) is retreating against the Japanese Yen (JPY) on Wednesday after another failed attempt from bulls to push prices above the 200.00 psychological level.

Despite the release of a hotter-than-expected UK inflation print and upbeat UK Retail Sales data, GBP/JPY is trading near 198.00, reflecting a 0.60% decline at the time of writing.

The UK Consumer Price Index (CPI) data released on Wednesday showed that headline CPI increased at an annual rate of 3.6% in June, up from 3.4%, while Core CPI, which excludes food and energy, climbed to 3.7%. Both figures exceeded forecasts and reinforce the view that inflation remains elevated.

Additionally, the Retail Price Index ticked up to 4.4%, signaling resilience in consumer spending.

These upside surprises in inflation increase the likelihood that the Bank of England (BoE) will delay any rate cuts, which has been the narrative that has continued to support the bullish momentum reflected in recent GBP/JPY price action.

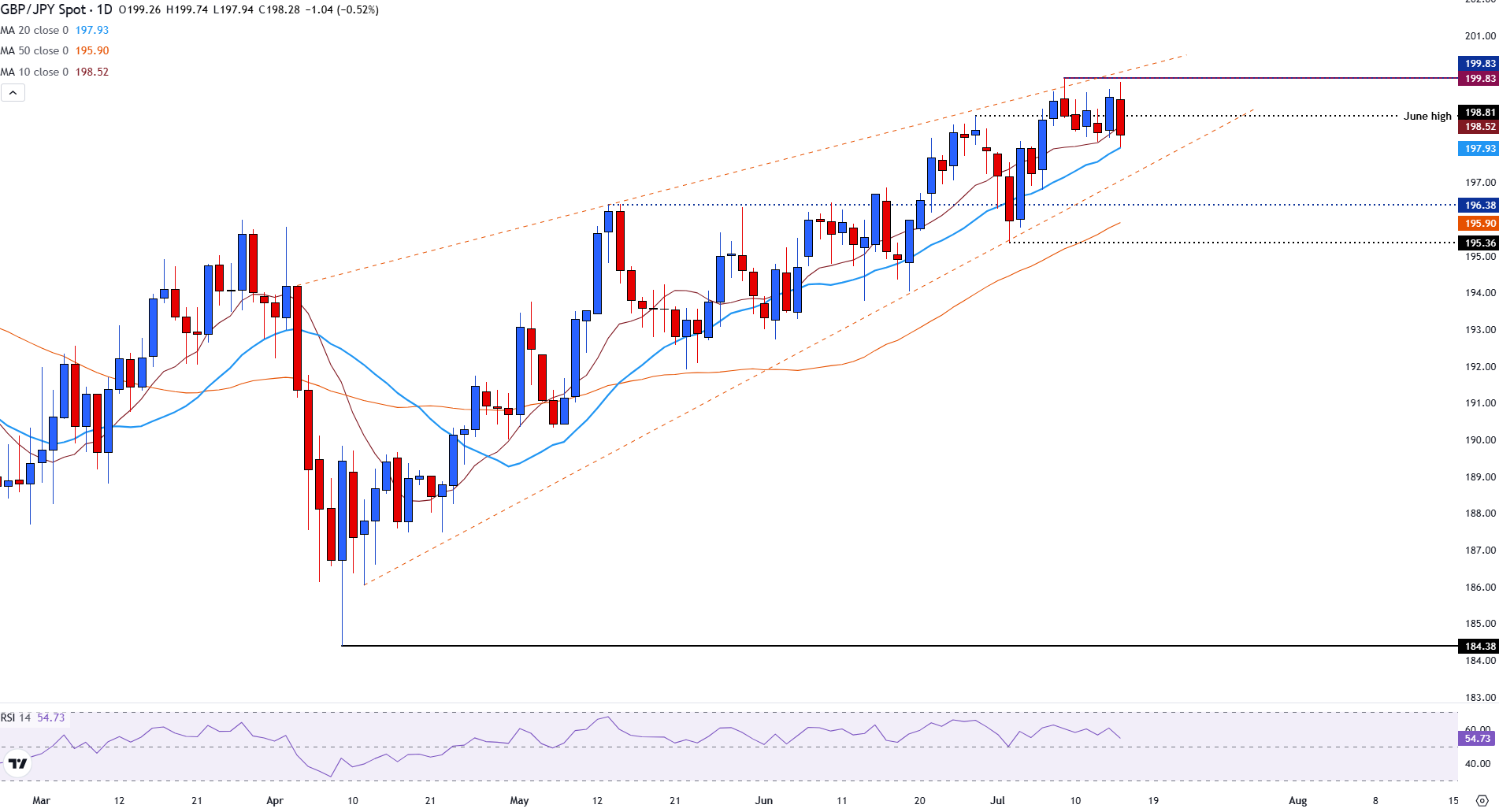

GBP/JPY continues to trade within a well-defined ascending channel and remains above all major moving averages, reinforcing its bullish technical structure.

The pair is currently testing key resistance at 199.83, a double-tested high, with the psychological 200.00 level marking the top of the channel.

Recent price action has shown repeated rejections near this upper boundary, indicating the possibility of a short-term consolidation or pullback.

On the downside, initial support lies at the June high of 198.11, followed by the 20-day Simple Moving Average (SMA) at 197.94.

A break below this area exposes the May high of 196.38, which also aligns with a prior channel resistance level.

Further downside could test the stronger support zone around the 50-day SMA at 195.90, with the channel's lower boundary at 195.36 acting as a key level to watch.

GBP/JPY daily chart

The Relative Strength Index (RSI) currently sits near 56, reflecting neutral-to-mild bullish momentum with room for further upside.

As long as GBP/JPY holds above the 197.90-198.00 support zone, the broader uptrend remains intact. However, a confirmed breakout above 199.83-200.00 is needed to resume the bullish advance, while a close below 197.90 would increase the risk of a deeper pullback toward 195.90.

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve 'price stability', or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England's target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects - a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets - usually government or AAA-rated corporate bonds - from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

![]()

Created

: 2025.07.17

![]()

Last updated

: 2025.07.17

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy