Created

: 2025.07.09

![]() 2025.07.09 01:50

2025.07.09 01:50

The British Pound (GBP) reached a new YTD high against the Japanese Yen (JPY) on Tuesday as United States (US) tariff threats on Japan weighed on the JPY.

At the time of writing, GBP/JPY is trading above 199.00 after reaching a high of 199.48 in the European session.

The Trump Administration sent Japan a formal letter on Monday informing them that Japanese imports to the US will face a 25% tariff charge from August 1.

At a conference in Tokyo on Tuesday, Japan's Prime Minister Shigeru Ishiba emphasized Japan's intent to continue talks to prevent escalation and protect bilateral trade ties.

Meanwhile, Japan's top trade negotiator, Ryosei Akazawa, reiterated that "There's no point striking a deal with the US without an agreement on automobile tariffs."

The US tariff threats against Japan are making the Yen less attractive, helping the GBP/JPY pair move higher.

Although the three-week tariff extension offers Japan a limited window to finalize a trade agreement with the United States, existing tariffs are already weighing on the Japanese Yen.

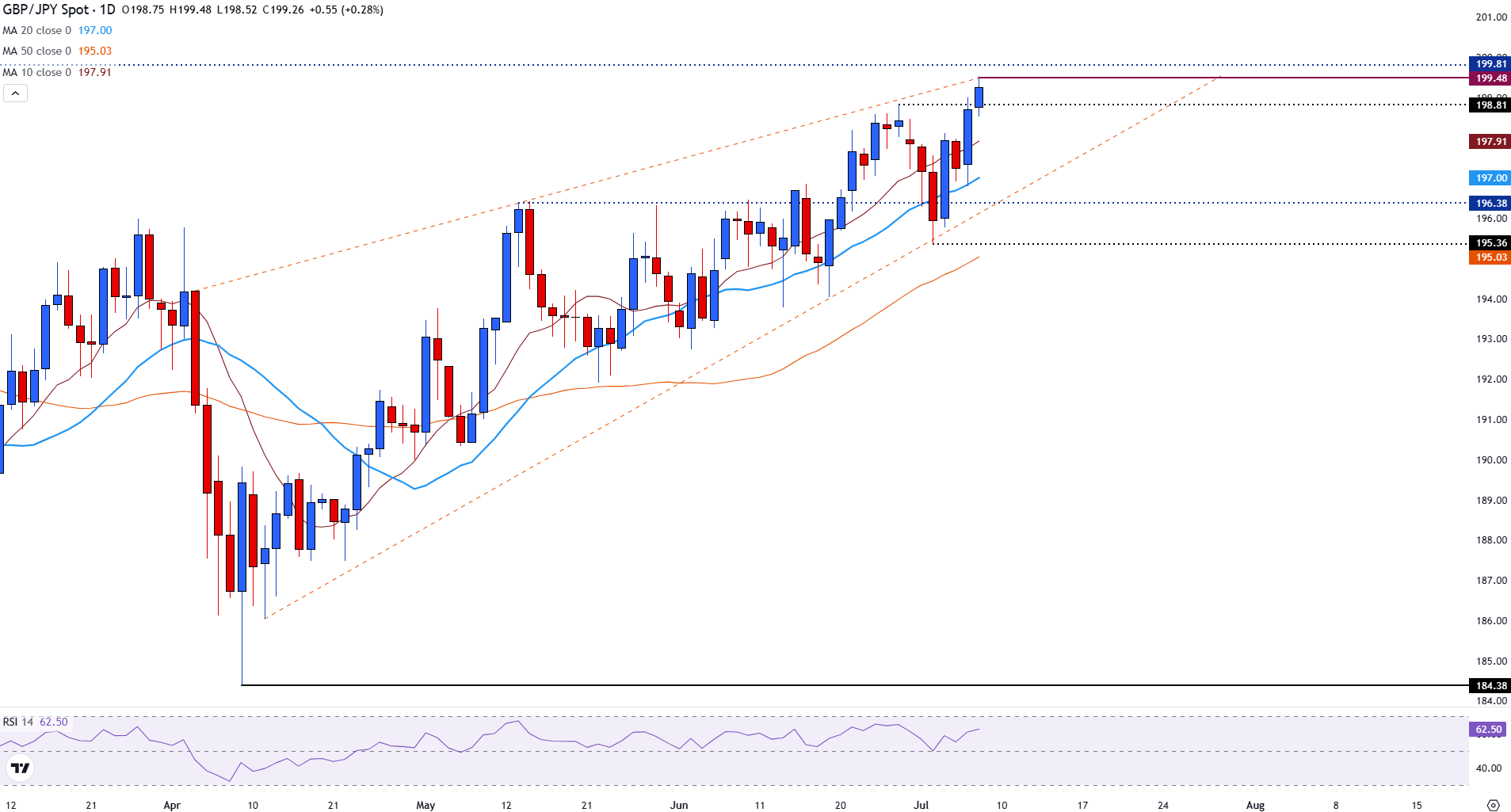

GBP/JPY is trading near 199.20 on Tuesday, maintaining its bullish trajectory within a well-defined ascending wedge pattern.

The pair has benefited from sustained Japanese Yen weakness amid renewed trade tensions with the United States, which have eroded demand for the Yen as a safe haven.

Price action is firming above the 199.00 psychological level, providing imminent support for the pair.

With the Relative Strength Index (RSI) hovering around 62, the market is approaching overbought territory, suggesting the potential for short-term consolidation or a pullback.

GBP/JPY daily chart

With the Relative Strength Index (RSI) hovering around 62, the market is approaching overbought territory, suggesting the potential for short-term consolidation or a pullback. Immediate support is seen at 198.81, followed by the 10-day and 20-day Simple Moving Averages at 197.91 and 197.00, respectively.

A break below these levels would weaken the bullish structure and expose GBP/JPY to a deeper retracement toward the 50-day SMA at 195.03.

Meanwhile, the intraday high of 199.48 remains as resistance, marking the upper boundary of the rising wedge. Above that is the October high of 199.81 and the next psychological level of 200.00.

The Japanese Yen (JPY) is one of the world's most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan's policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan's mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ's stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen's value against other currencies seen as more risky to invest in.

![]()

Created

: 2025.07.09

![]()

Last updated

: 2025.07.09

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy