Created

: 2025.07.08

![]() 2025.07.08 00:51

2025.07.08 00:51

The Pound Sterling is virtually unchanged during the North American session, yet it remains above a key technical level, following a solid US jobs report in the United States (US). This, along with the likelihood of further tax hikes by the UK government, is exerting pressure on Cable. At the time of writing, the GBP/USD exchange rate is 1.3638.

Last week, the US revealed that the Nonfarm Payroll figures exceeded estimates of 110K, coming in at 147K, while the Unemployment Rate ticked lower. Additionally, wages remain steady, and the number of Americans filing for unemployment benefits has dipped.

Risk appetite shifted slightly sour, as traders' attention returned to US trade policy, particularly tariffs. US President Donald Trump announced that over ten to twelve letters would be sent later during the day to some trade partners, setting tariffs on those countries, adding to investors' angst and fears that the trade war would continue.

In the UK, the Finance Minister Rachel Reeves warned ministers that taxes would need to increase after the government's U-turn on welfare reform. In the meantime, traders are focusing on the BRC Retail Sales report, the Bank of England's Breeden speech, and the release of Gross Domestic Product (GDP) figures, as well as Industrial and Manufacturing Production data.

Across the pond, traders will be watching the release of the Federal Open Market Committee (FOMC) meeting minutes, Initial Jobless Claims data, and speeches by the Federal Reserve.

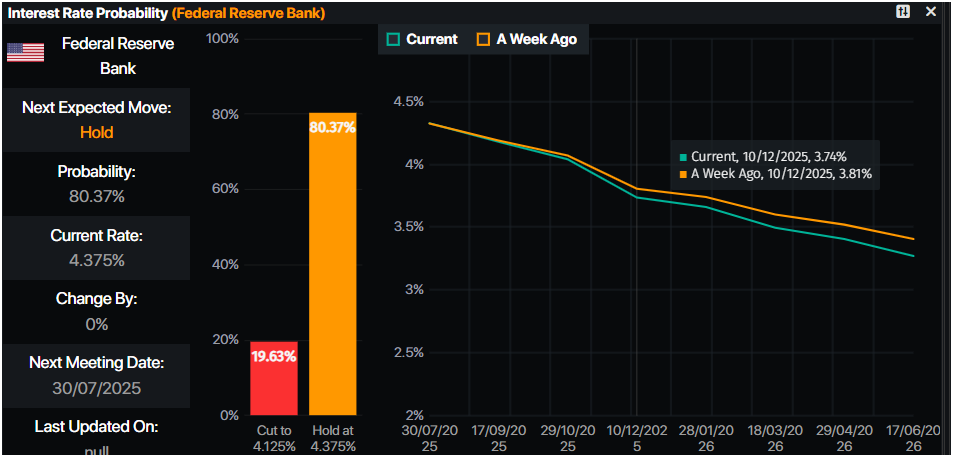

The Federal Reserve is expected to hold rates unchanged at the July 30 meeting, with odds at 80.37%. Money market futures had projected 50 basis points of easing by December 2025.

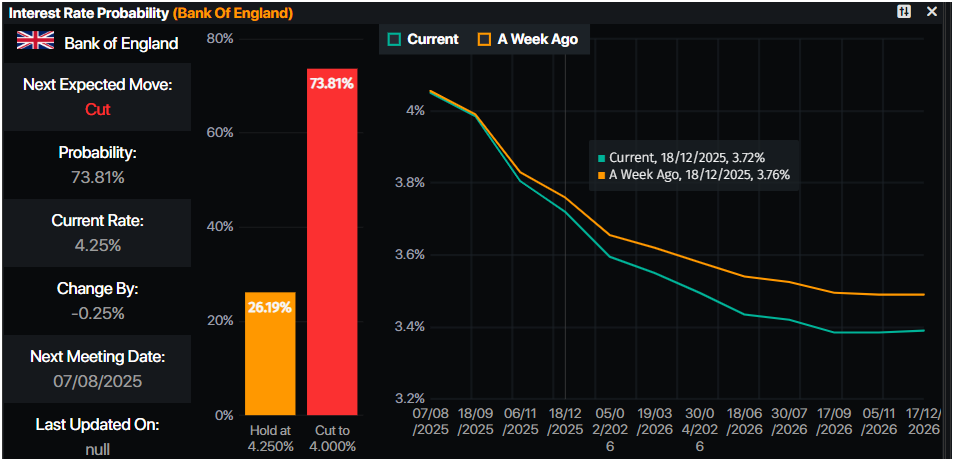

The Bank of England's chances of a 25-basis-point cut at the August 7 meeting are at 73.81%, which would bring the Bank Rate to 4.25%. Traders had priced in over 53 basis points of easing toward the end of the year.

Fed Interest Rate Probabilities - Prime Market Terminal

BoE Interest Rate Probabilities - Prime Market Terminal

Therefore, further central bank divergence might exert pressure on the GBP/USD and boost the Greenback's prospects as the interest rate differential might benefit the US.

The GBP/USD uptrend remains intact, but momentum seems to be faltering. The Relative Strength Index (RSI) is dipping towards its neutral line. Hence, a pullback toward the 1.3600 figure, and below is on the cards.

In that outcome, key support levels would be the July 2 daily low at 1.3561, followed by 1.3500 and the 50-day SMA at 1.3473. On the upside, if GBP/USD climbs past the July 4 daily high, it would be up next at 1.3681, which would put 1.3700 in play. A breach of the latter will expose the YTD peak at 1.3788.

The table below shows the percentage change of British Pound (GBP) against listed major currencies this month. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.49% | 0.71% | 1.34% | 0.32% | 1.02% | 1.35% | 0.49% | |

| EUR | -0.49% | 0.23% | 0.68% | -0.14% | 0.60% | 0.83% | 0.00% | |

| GBP | -0.71% | -0.23% | 0.60% | -0.37% | 0.38% | 0.61% | -0.22% | |

| JPY | -1.34% | -0.68% | -0.60% | -0.89% | -0.26% | 0.06% | -0.76% | |

| CAD | -0.32% | 0.14% | 0.37% | 0.89% | 0.67% | 0.98% | 0.15% | |

| AUD | -1.02% | -0.60% | -0.38% | 0.26% | -0.67% | 0.23% | -0.61% | |

| NZD | -1.35% | -0.83% | -0.61% | -0.06% | -0.98% | -0.23% | -0.83% | |

| CHF | -0.49% | -0.00% | 0.22% | 0.76% | -0.15% | 0.61% | 0.83% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

![]()

Created

: 2025.07.08

![]()

Last updated

: 2025.07.08

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy