Created

: 2025.06.24

![]() 2025.06.24 23:23

2025.06.24 23:23

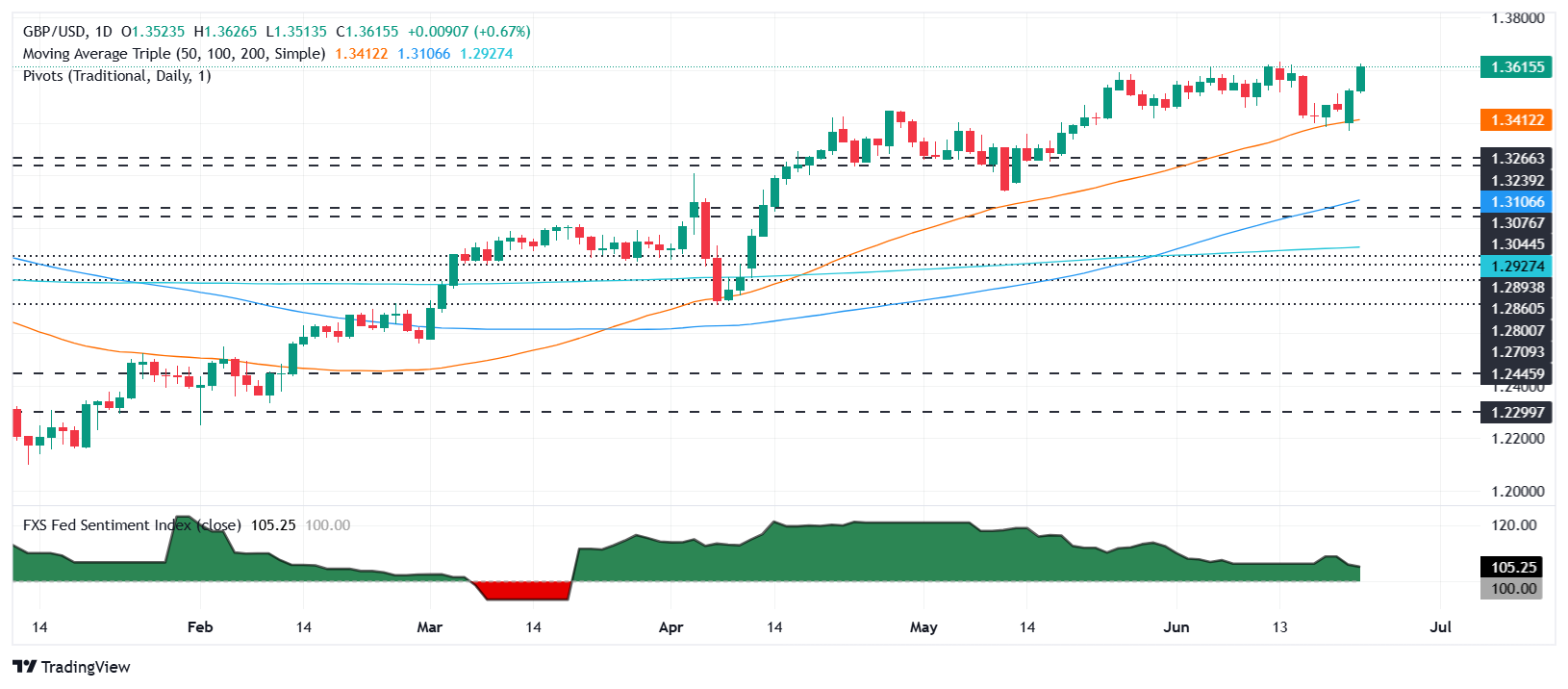

The Pound Sterling extended its gains versus the US Dollar on Tuesday, as the proposed ceasefire between Israel and Iran was violated by both parties, despite US President Donald Trump's warning. Nevertheless, the risk appetite remains strong, despite the ongoing developments in the Middle East. The GBP/USD trades above 1.3600, gaining over 0.65%, after printing a weekly high of 1.3626.

Aside from geopolitical risks, the Fed Chair Jerome Powell said in prepared remarks for his testimony at the US Congress, that rate cuts can wait, as the central bank studies the impact of tariffs on the economy. He stated that "tariffs this year are likely to push up prices and weigh on economic activity," adding that the impact could be short-lived or persistent.

He pushed back against a previously dovish posture by Fed Governors Christopher Waller and Michelle Bowman. Last year, they were two of the most hawkish members, who, so far, had backed a rate cut in the July meeting.

Recently, Cleveland Fed Beth Hammack, a hawk, revealed that rate cuts could be "on hold for quite some time." She echoed previous words of Atlanta Fed President Raphael Bostic, who said that there's no need to cut rates now and acknowledged that he sees just a 25 basis points (bps) of easing this year.

US housing data showed that home prices rose 2.7% from the previous year in April. Across the pond, the UK economic docket was light, with the release of the CBI Industrial Trends Survey revealing that manufacturing output volumes fell in the quarter to June, from -25 to -23. The poll showed "Manufacturers expect output volumes to decline at a slower pace in the three months to June."

Bank of England Governor Dave Ramsden said that "cumulative evidence of material loosening in the labour market" influenced his decision at the latest BoE meeting. He said that the weakness in the labor market is getting his attention.

Ahead, traders will eye Fed Chair Jerome Powell's testimony at the US House of Representatives.

On Wednesday, the UK docket will feature speeches by members of the Bank of England's Monetary Policy Committee (MPC). In the US, Fed Chair Powell will appear at the US Senate.

The GBP/USD remains upwardly biased, after briefly diving towards the 50-day SMA at 1.3407. Since then, the pair has climbed and appears poised to break decisively above the 1.3600 figure.

Momentum remains bullish as depicted by the Relative Strength Index (RSI). However, traders should be aware that geopolitical risks loom. Hence, an escalation of the Middle East conflict could pave the way for a pullback.

If GBP/USD weakens, the first support is seen at 1.3550, followed

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -1.22% | -1.53% | -1.32% | -0.36% | -1.09% | -1.24% | -1.31% | |

| EUR | 1.22% | -0.33% | -0.07% | 0.88% | 0.10% | 0.00% | -0.13% | |

| GBP | 1.53% | 0.33% | 0.32% | 1.21% | 0.44% | 0.32% | 0.20% | |

| JPY | 1.32% | 0.07% | -0.32% | 0.95% | 0.20% | 0.13% | -0.08% | |

| CAD | 0.36% | -0.88% | -1.21% | -0.95% | -0.69% | -0.89% | -1.00% | |

| AUD | 1.09% | -0.10% | -0.44% | -0.20% | 0.69% | -0.13% | -0.24% | |

| NZD | 1.24% | -0.00% | -0.32% | -0.13% | 0.89% | 0.13% | -0.11% | |

| CHF | 1.31% | 0.13% | -0.20% | 0.08% | 1.00% | 0.24% | 0.11% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

![]()

Created

: 2025.06.24

![]()

Last updated

: 2025.06.24

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy