Created

: 2025.06.19

![]() 2025.06.19 03:19

2025.06.19 03:19

The US Dollar Index (DXY) whipsawed on Wednesday after the Federal Reserve's (Fed) Federal Open Market Committee (FOMC) kept interest rates unchanged, as investors had broadly expected. The Greenback continues to churn in a long-tailed midrange near the 98.60 region as traders await Fed Chair Jerome Powell's upcoming press conference and follow-up Q&A session.

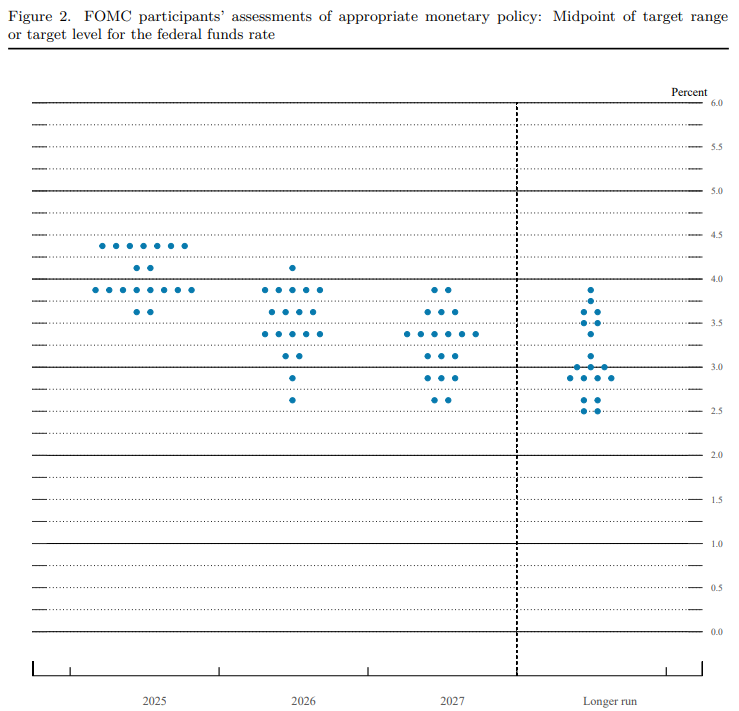

The Fed still sees an average of 50 basis points in interest rate cuts by the end of the year, following closely with what is priced in according to the CME's FedWatch Tool; however, ongoing trade policy uncertainty has pushed the spread of policymaker rate expectations wider, with some Fed personnel seeing higher year-end rates compared to the previous Summary of Economic Projections (SEP).

more to come...

The US Dollar Index is slightly lower following the FOMC's rate call and dot plot update. US Dollar positioning overall is largely unchanged on the day as investors await Fed Chair Powell's press conference and the following Q&A session.

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed's 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials - the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed's weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

![]()

Created

: 2025.06.19

![]()

Last updated

: 2025.06.19

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy