Created

: 2025.06.17

![]() 2025.06.17 17:57

2025.06.17 17:57

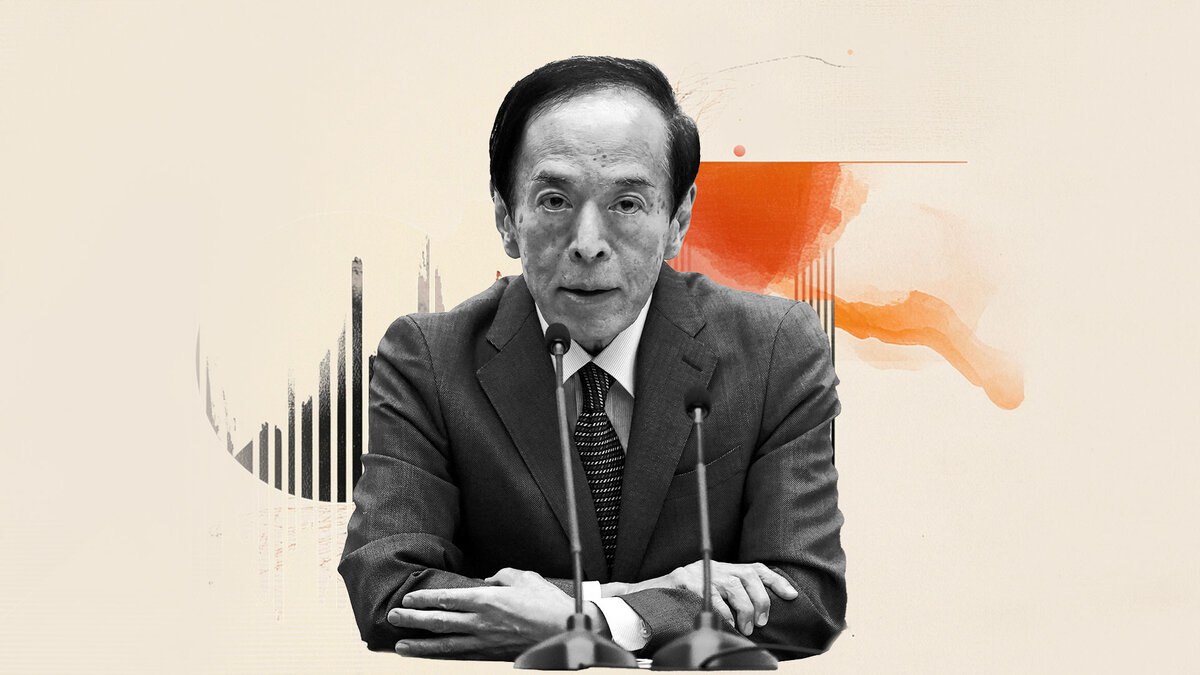

The Japanese Yen (JPY) move is fairly muted, rising against the dollar to 144.46 (vs 145 previously) then staying range-bound, and JGB futures dropped around 0.1% after the Bank of Japan's decision to keep its policy rate at 0.5% and to slow the JGB tapering from April 2026, ING's FX analyst Francesco Pesole notes.

"Both decisions are in line with the market consensus. The BoJ will reduce JGB purchases by 200bn per quarter starting from April 2026. But there was one dissenting voter, and there will be a meeting between the MoF and PDs later this week, which may create more volatility. So, this might have given some cautiousness to the JGB market."

"The BoJ's JGB hold on the short end is relatively smaller than the long end, thus quantitative tightening has a much bigger impact on market rates. Slowing QT doesn't necessarily signal a slowdown of rate hikes by the BoJ. To sum up, the BoJ's decision was in line with the market consensus, and the market's initial reaction seems a bit limited."

![]()

Created

: 2025.06.17

![]()

Last updated

: 2025.06.17

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy