Created

: 2025.05.24

![]() 2025.05.24 01:56

2025.05.24 01:56

Federal Reserve (Fed) Board of Governors member Dr. Lisa Cook noted on Friday during a hosted event at New York University that while US economic factors were strong during the first quarter, Fed policymakers are beginning to see signs of stress in key industries, namely housing and commercial real estate.

Dr. Cook also highlighted that Treasury markets were orderly and functional during April's trade-related volatility, but stopped short of saying that bond market functionality may begin to suffer at the hands of inconsistent policy management from the White House.

According to Dr. Cook, a "sufficiently large income shock could push up defaults, lead to losses for lenders." Fed BoG member Dr. Cook avoided outright stating what a large income shock might look like, but lately, Fedspeak has been notably tilted toward inflationary and downside employment pressures from lopsided trade policies from the Trump administration.

Dr. Cook admitted that she is "watching commercial real estate closely," and acknowledged that she is also beginning to see signs of balance sheet stress among low-to-moderate income households.

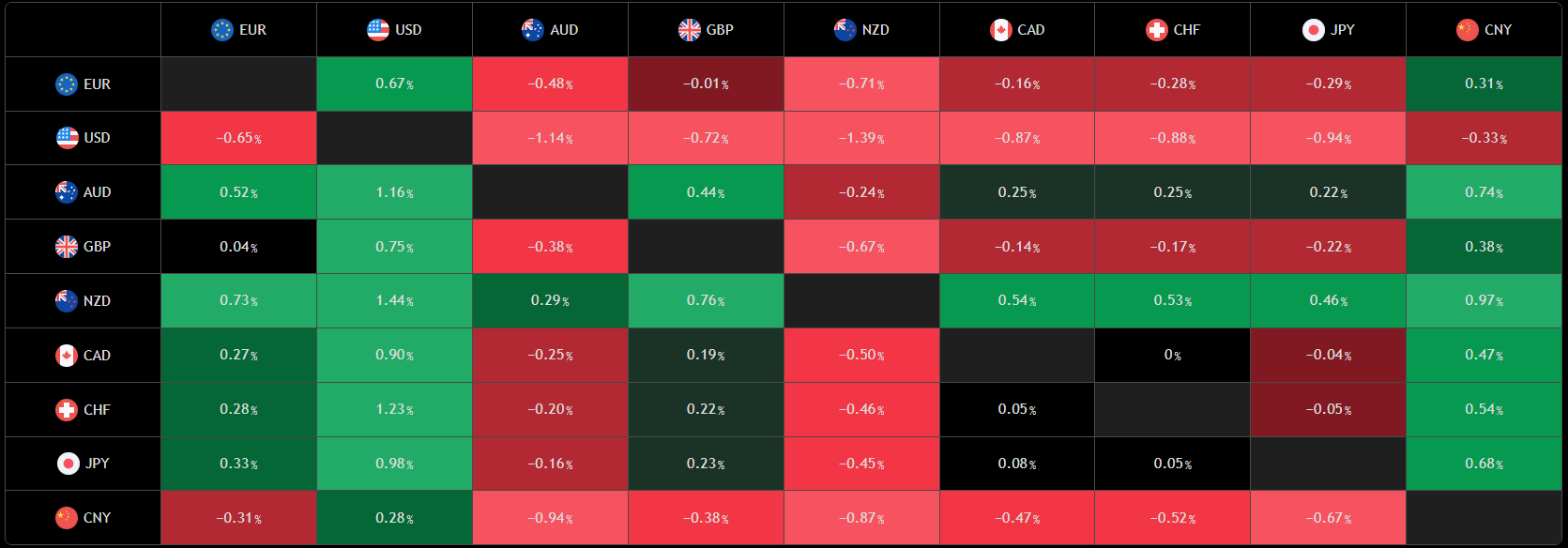

The Fed's Dr. Cook didn't reveal much that wasn't already known to investors, and market-wide positioning remains largely unchanged on the day as US investors gear up for a long weekend. The US Dollar Index (DXY) is sharply lower on Friday, down near 99.20 as of writing. The Greenback is down across the board heading into the weekend, floundering against the Euro (EUR), the Pound Sterling (GBP), and the Canadian Dollar(CAD), with steep losses stacked up in the Antipodeans, the Australian Dollar (AUD) and the New Zealand Kiwi (NZD).

(TradingView like forex heatmap, 1D timeframe)

![]()

Created

: 2025.05.24

![]()

Last updated

: 2025.05.24

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy