Created

: 2025.05.23

![]() 2025.05.23 03:22

2025.05.23 03:22

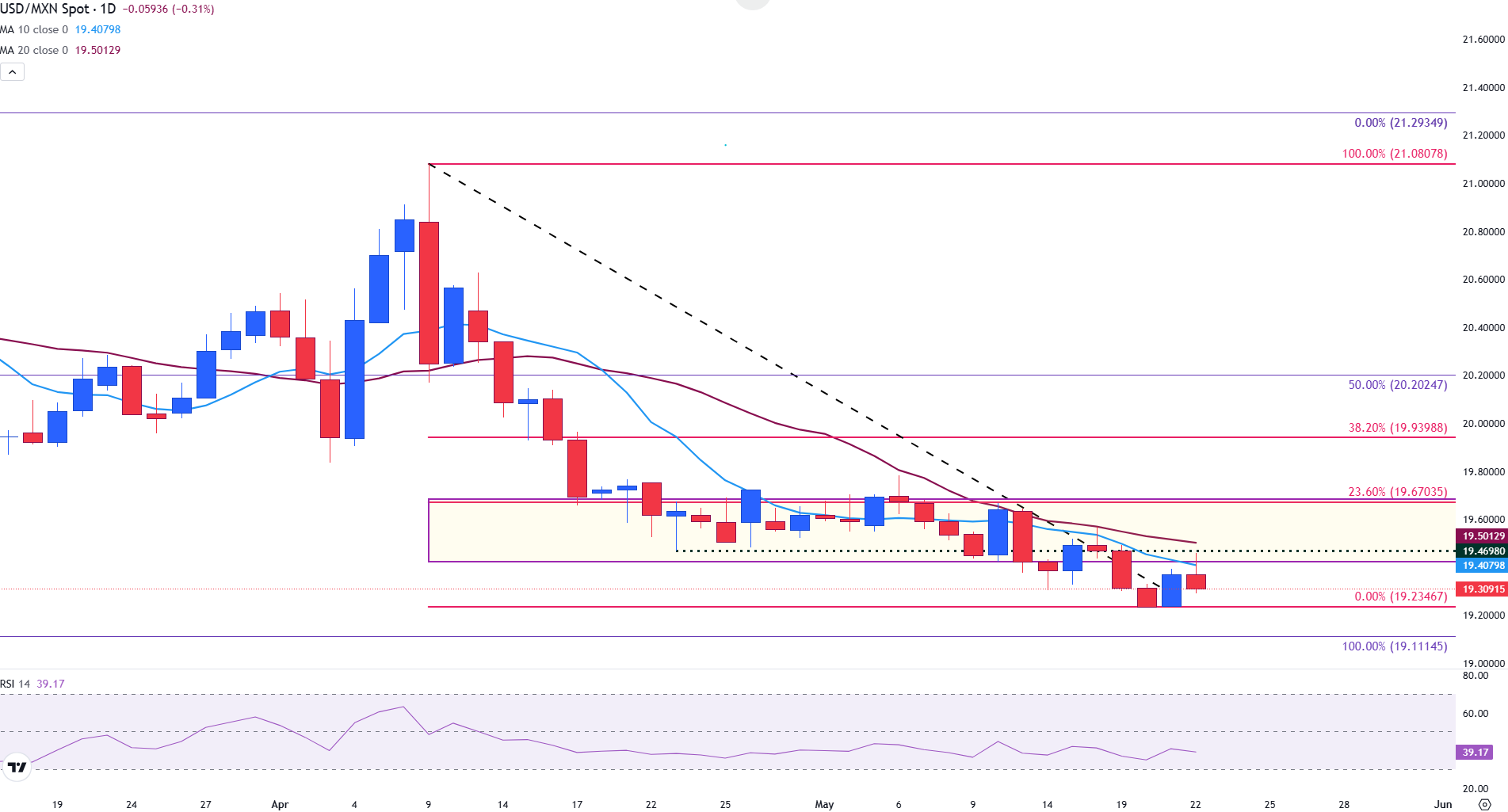

The Mexican Peso (MXN) is gaining traction against the US Dollar (USD) on Thursday, supported by a hotter-than-expected mid-May inflation reading. The data has prompted investors to reconsider the timeline for further interest rate cuts by Banxico, leading to increased demand for the Peso and pushing USD/MXN below its 20-day Simple Moving Average (SMA) to trade near 19.3096 at the time of writing.

At the same time, developments in the United States continue to exert significant influence over the pair's short-term trajectory. Despite inflation gradually aligning with the Federal Reserve's 2% target, a weaker US Dollar has emerged due to broader concerns, namely, a credit rating downgrade, deteriorating sentiment, and the passage of President Donald Trump's "One Big Beautiful Bill."

Together, these developments are weighing on the US Dollar and reinforcing MXN strength, particularly as Mexican monetary policy appears more data-dependent than dovish for now.

USD/MXN has extended its downside move after failing to hold above the 10-day Simple Moving Average (SMA), now acting as near-term resistance around 19.4080.

The pair is trading around 19.3096, with bearish momentum building. A decisive close below 19.30 could expose deeper support at the early May low of 19.11, followed by the October 2024 swing low at 19.00.

The Relative Strength Index (RSI) has crossed into neutral-bearish territory, indicating potential for further losses unless bulls reclaim control above the 10-day and 20-day SMA at 19.46.

Short-term bias favors further downside below that level.

However, if bears gain traction below 19.300, the May low near 19.235 and a continuation of USD weakness may allow sellers to push prices toward the October low of 19.111.

Meanwhile, the Relative Strength Index (RSI) indicator remains below the neutral zone of 50.

Since the 30 mark is considered a potential oversold territory, the bearish trend currently remains intact.

If prices fall below 19.20, it could open the door to the October low of around 19.11, paving the way towards the 19.00 mark.

On the other hand, if USD strength resurges and prices rise above the descending trendline, USD/XN could see a retest of the April low near 19.47, bringing the 20-day SMA into play at 19.53.

USD/MXN daily chart

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country's currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

![]()

Created

: 2025.05.23

![]()

Last updated

: 2025.05.23

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy