Created

: 2025.04.30

![]() 2025.04.30 15:00

2025.04.30 15:00

The United States (US) Bureau of Economic Analysis (BEA) is set to publish its preliminary estimate of first-quarter Gross Domestic Product (GDP) on Wednesday, with analysts expecting the data to show annualized growth of just 0.4%, a sharp slowdown from the 2.4% pace recorded in the final quarter of 2024.

Markets are on edge ahead of Wednesday's release of the US preliminary GDP figures for the first quarter--widely considered the most market-moving estimate of the three issued each quarter. Beyond headline growth, the report also includes fresh Personal Consumption Expenditures (PCE) data, the Federal Reserve's (Fed) preferred inflation gauge.

This quarter's numbers carry particular weight, as investors look for early signs of the economic fallout from President Donald Trump's newly imposed tariffs. With both output and domestic prices in focus, the data could offer crucial clues about the broader macroeconomic impact of the administration's trade policies.

The release follows the Fed's March 18-19 meeting, where policymakers delivered a mixed outlook in their latest Summary of Economic Projections (SEP), commonly referred to as the "dot plot." Officials marked down growth expectations for 2025, even as they penciled in slightly stronger PCE inflation. The revisions reflect growing uncertainty within the central bank over the balance of risks to the US economy.

Also included in the report is the GDP Price Index - commonly called the GDP deflator - which measures inflation across all domestically produced goods and services, including exports but excluding imports. It's expected to rise to 3.1% for the first quarter, up from 2.3% in the final months of 2024, offering further insight into how inflation is weighing on real output.

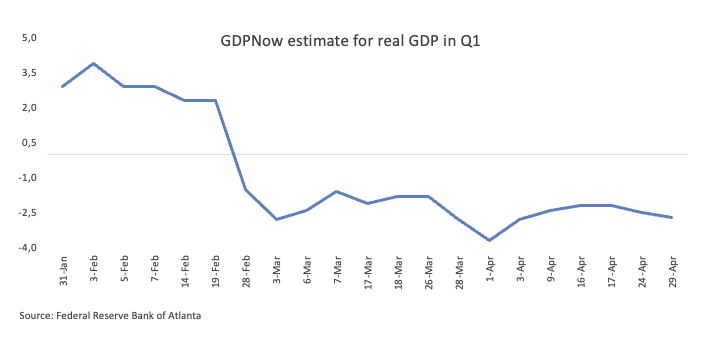

Adding to the caution, the Atlanta Fed's GDPNow model - closely watched for its real-time tracking of economic activity - forecasted a sharp 2.7% contraction in Q1 GDP as of its April 27 update.

The US GDP report, due at 12:30 GMT on Wednesday, could prove pivotal for the US Dollar as investors weigh the strength of the economy against persistent inflation pressures and the spectre of tariffs. Alongside the headline growth figure, markets will scrutinize updates to the GDP Price Index and the Q1 Personal Consumption Expenditures (PCE) Price Index, key data points that could shift expectations for Federal Reserve policy and the Dollar's direction.

A stronger-than-expected GDP print may temporarily ease fears of a stagflationary environment, potentially offering a brief reprieve for the struggling Greenback.

However, the broader technical outlook for the US Dollar Index (DXY) remains decisively bearish. The index continues to trade beneath its 200-day and 200-week simple moving averages (SMAs), now positioned at 104.48 and 102.70, respectively.

Downside levels remain in focus, with support eyed at 97.92 - the 2025 low marked on April 21 - and 97.68, a key pivot from March 2022. Any upside correction could first target the psychologically significant 100.00 handle, followed by the interim 55-day SMA at 103.64 and the March 26 swing high of 104.68.

Momentum indicators underscore the bearish trend. The Relative Strength Index (RSI) on the daily chart has slipped to around 36, while the Average Directional Index (ADX) has climbed above 55, suggesting growing strength behind the recent downward move.

The US Dollar (USD) is the official currency of the United States of America, and the 'de facto' currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world's reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed's 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed's weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

The real Gross Domestic Product (GDP) Annualized, released quarterly by the US Bureau of Economic Analysis, measures the value of the final goods and services produced in the United States in a given period of time. Changes in GDP are the most popular indicator of the nation's overall economic health. The data is expressed at an annualized rate, which means that the rate has been adjusted to reflect the amount GDP would have changed over a year's time, had it continued to grow at that specific rate. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Thu Mar 27, 2025 12:30

Frequency: Quarterly

Actual: 2.4%

Consensus: 2.3%

Previous: 2.3%

Source: US Bureau of Economic Analysis

The US Bureau of Economic Analysis (BEA) releases the Gross Domestic Product (GDP) growth on an annualized basis for each quarter. After publishing the first estimate, the BEA revises the data two more times, with the third release representing the final reading. Usually, the first estimate is the main market mover and a positive surprise is seen as a USD-positive development while a disappointing print is likely to weigh on the greenback. Market participants usually dismiss the second and third releases as they are generally not significant enough to meaningfully alter the growth picture.

![]()

Created

: 2025.04.30

![]()

Last updated

: 2025.04.30

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy