Created

: 2024.04.16

![]() 2024.04.16 21:49

2024.04.16 21:49

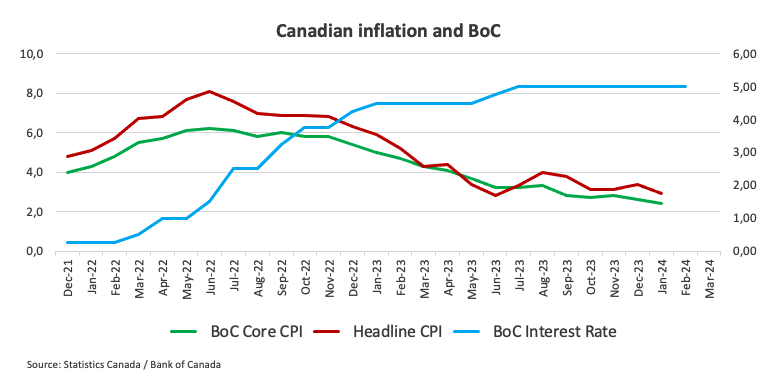

Inflation in Canada, as measured by the change in the Consumer Price Index (CPI), rose by 2.9% on a yearly basis in March from 2.8% in February, Statistics Canada reported on Tuesday. This reading came in above market expectations. On a monthly basis, the CPI went up by 0.6%.

The annual Core CPI, which excludes volatile food and energy prices, was up by 2.0% in the same period, down from 2.1% in the previous month.

According to Statistics Canada "Shelter prices continued to apply upward pressure in March, with the mortgage interest cost and rent indexes contributing the most to the year-over-year gain in the all-items CPI."

In addition, "Prices for services (+4.5%) continued to rise in March compared with February (+4.2%), driven by air transportation and rent, outpacing price growth for goods (+1.1%) which slowed compared with February (+1.2%) on a yearly basis."

This section below was published as a preview of the Canadian inflation data at 08:00 GMT.

Canada is slated to unveil the always-relevant inflation-related figures on Tuesday. Statistics Canada will release the Consumer Price Index (CPI) for the month of February, with expectations pointing towards a year-on-year rise of 3.1% in the headline print, slightly surpassing January's 2.9% increase. Monthly projections anticipate a 0.6% increase in the index compared to the previous month's flat reading.

Alongside the CPI data, the Bank of Canada (BoC) will release its Core Consumer Price Index gauge, which excludes volatile elements like food and energy costs. In January, the BoC Core CPI indicated a monthly uptick of 0.1% and a year-on-year rise of 2.4%.

These statistics will be closely monitored as they could influence the trajectory of the Canadian Dollar (CAD) and shape outlooks regarding the Bank of Canada's monetary policy. Speaking about the Canadian Dollar (CAD), it has shown weakness against the US Dollar (USD) in past sessions and presently hovers around multi-session lows well past the 1.3500 yardstick.

Analysts expect a pick-up of price pressures throughout Canada during last month. In fact, inflation measured by annual changes in the Consumer Price Index, is forecast to resume its upward trajectory in February, mirroring trends observed in many of Canada's G10 counterparts, notably its neighbour, the US. After reaching 4% in August, the CPI has shown a downward trend, with the exception of the bounce recorded in the last month of the year. All in all, inflation indicators still remain well above the Bank of Canada's 2% target.

Should the forthcoming data confirm the anticipated increase in inflationary pressures, investors might consider the possibility of the central bank keeping the current restrictive stance in place for a longer duration than originally predicted. Still, any additional tightening of monetary conditions seems unlikely, as per comments from the bank's officials.

The latter situation would necessitate a sudden and sustained resurgence of price pressures and a rapid increase in consumer demand, both of which seem improbable in the foreseeable future.

During his remarks at the latest BoC meeting, Governor Tiff Macklem expressed optimism about the ongoing battle against inflation, noting current progress and anticipating further advancements. He highlighted the significance of core inflation measures, suggesting that if they remain unchanged, the forecasts for overall inflation reduction may not come to fruition. He assessed the risks to the inflation outlook as reasonably balanced and noted that well-anchored inflation expectations are aiding efforts to bring inflation back under control.

On Tuesday at 12:30 GMT, Canada is set to release the Consumer Price Index for February. The Canadian Dollar's potential response is tied to changes in monetary policy expectations by the Bank of Canada. However, barring any real surprise in either direction, the BoC is unlikely to change its current cautious monetary policy stance, in line with other central banks such as the Federal Reserve (Fed).

The USD/CAD has started the new trading year in quite a bullish fashion, although the uptrend appears to have met a decent barrier around the 1.3600 zone.

Pablo Piovano, Senior Analyst at FXStreet, says: "There is a strong likelihood of USD/CAD maintaining the constructive bias as long as it remains above the significant 200-day Simple Moving Average (SMA) at 1.3479. The bullish sentiment is expected to strengthen even more if there is a sustained break above the so-far yearly tops around 1.3600. On the flip side, the breach of the 200-day SMA could open the door to extra losses and a potential move to the January low of 1.3358 (January 31). South from here, there are no support levels of note prior to the December 2023 bottom of 1.3177, which occurred on December 27".

Pablo adds: "Significant increases in volatility around CAD would require unexpected inflation figures. If the numbers fall below expectations, it could strengthen the argument for potential interest rate cuts by the BoC in the next few months, further appreciating USD/CAD. However, a rebound in the CPI, similar to trends observed in the US, might provide some support to the Canadian Dollar, although to a limited extent. A higher-than-anticipated inflation reading would intensify pressure on the Bank of Canada to maintain elevated rates for an extended period, potentially resulting in prolonged challenges for many Canadians dealing with higher interest rates, as highlighted by Bank of Canada Governor Macklem."

The Consumer Price Index (CPI), released by Statistics Canada on a monthly basis, represents changes in prices for Canadian consumers by comparing the cost of a fixed basket of goods and services. The YoY reading compares prices in the reference month to the same month a year earlier. Generally, a high reading is seen as bullish for the Canadian Dollar (CAD), while a low reading is seen as bearish.

Read more.Next release: 03/19/2024 12:30:00 GMT

Frequency: Monthly

Source: Statistics Canada

The Bank of Canada (BoC), based in Ottawa, is the institution that sets interest rates and manages monetary policy for Canada. It does so at eight scheduled meetings a year and ad hoc emergency meetings that are held as required. The BoC primary mandate is to maintain price stability, which means keeping inflation at between 1-3%. Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Canadian Dollar (CAD) and vice versa. Other tools used include quantitative easing and tightening.

In extreme situations, the Bank of Canada can enact a policy tool called Quantitative Easing. QE is the process by which the BoC prints Canadian Dollars for the purpose of buying assets - usually government or corporate bonds - from financial institutions. QE usually results in a weaker CAD. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The Bank of Canada used the measure during the Great Financial Crisis of 2009-11 when credit froze after banks lost faith in each other's ability to repay debts.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Bank of Canada purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the BoC stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Canadian Dollar.

![]()

Created

: 2024.04.16

![]()

Last updated

: 2024.04.16

FXStreet is a forex information website, delivering market analysis and news articles 24/7.

It features a number of articles contributed by well-known analysts, in addition to the ones by its editorial team.

Founded in 2000 by Francesc Riverola, a Spanish economist, it has grown to become a world-renowned information website.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy