Created

: 2022.08.19

On MetaTrader4 (MT4) / MetaTrader5 (MT5), you can place If-Done-OCO orders. If-Done-OCO order stands for "If Done, One Cancels the Other" and sometimes it is called the "IFDOCO" order.

If-Done-OCO order is a type of order where you place a new limit/stop/stop-limit order while setting the take-profit and stop-loss levels. Once the profit or the loss cut has been confirmed, the other order will be automatically canceled.(*1)

Here we will look at how to place an If-Done-OCO order on MT4/MT5.

Switch between MT4/MT5 tabs to check the steps for each.

(*1)Stop-limit order is only available on MT5.

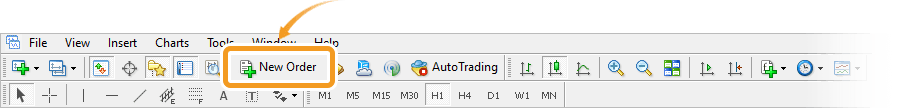

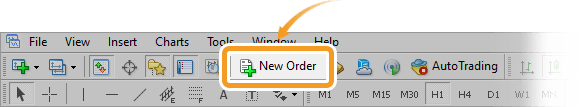

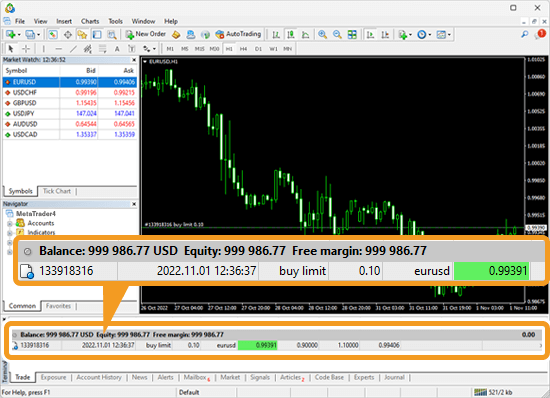

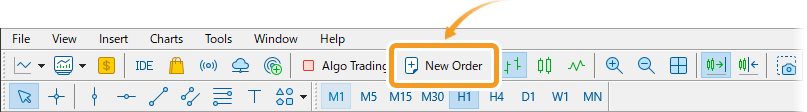

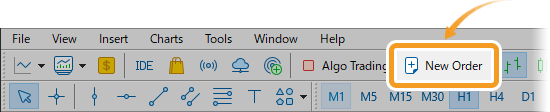

Click "New Order" in the toolbar.

Related article: Open the new order window

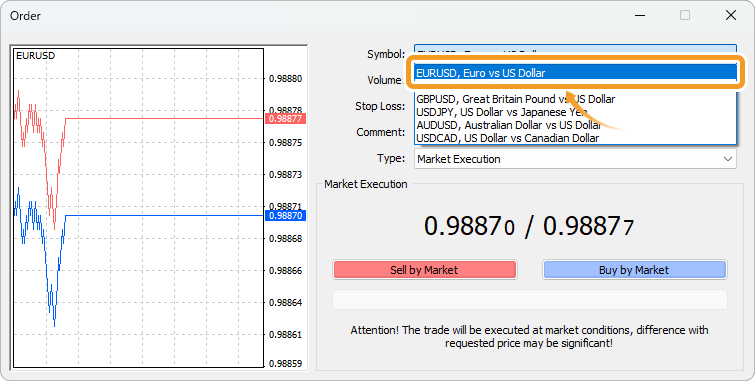

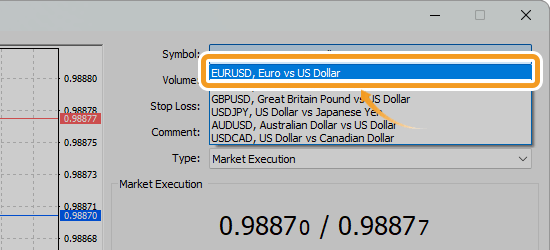

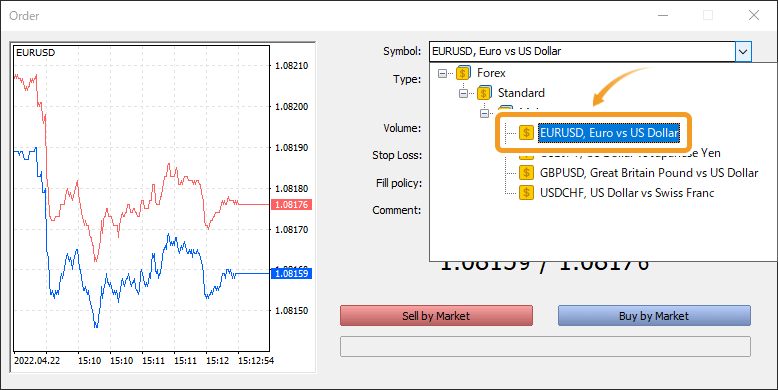

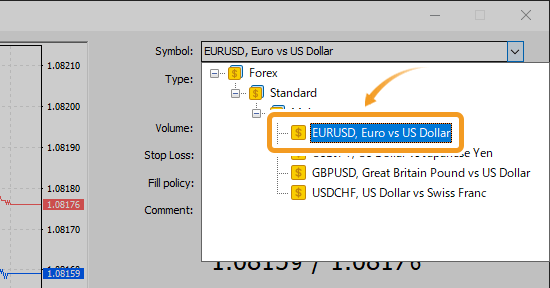

Click the "Symbol" field to choose the symbol to place an order for.

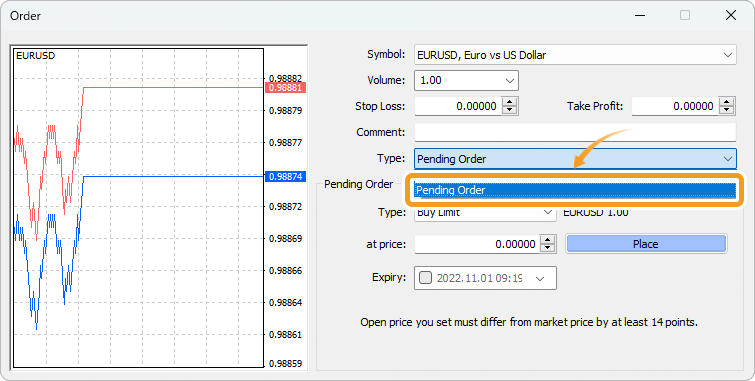

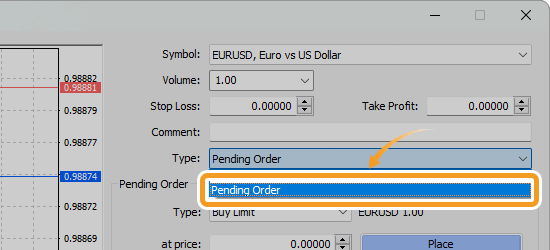

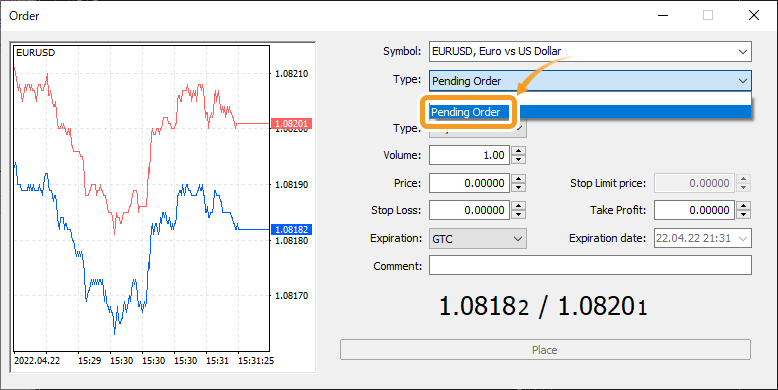

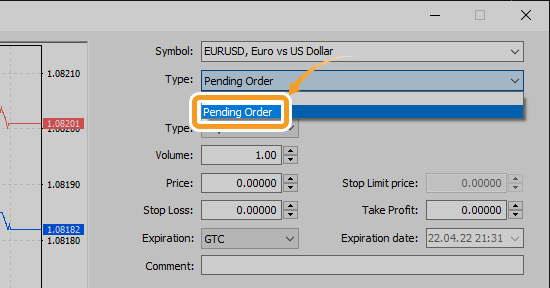

Click the "Type" field and select "Pending Order".

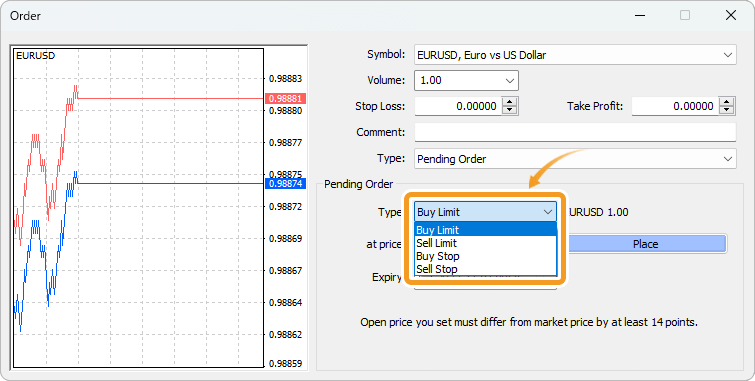

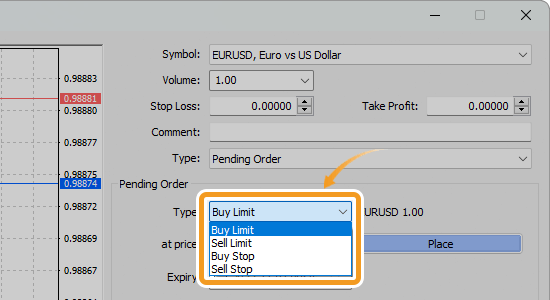

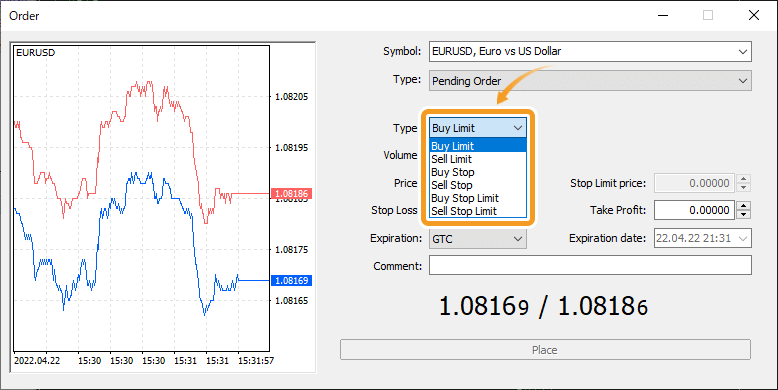

Click the "Type" field and select a type of limit/stop order.

Buy Limit

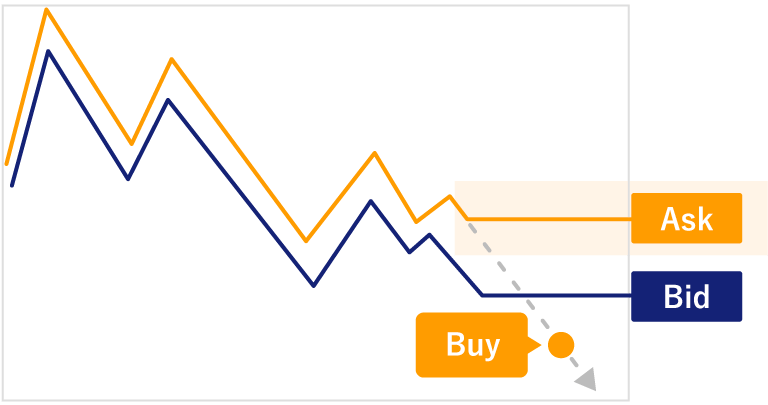

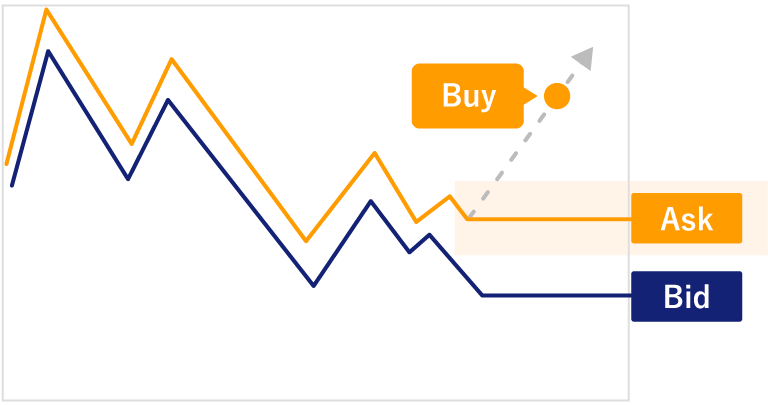

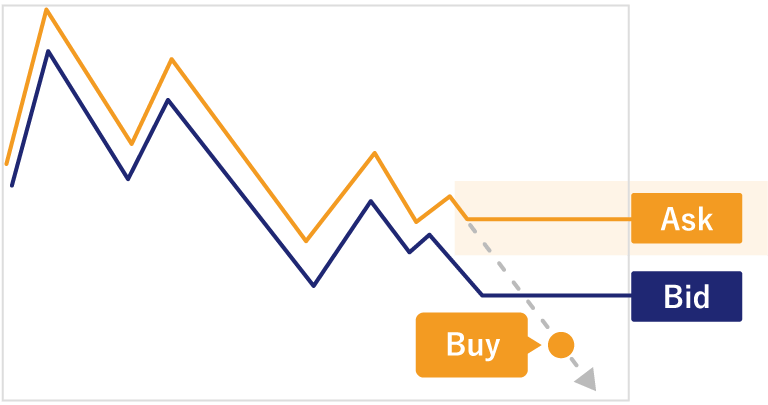

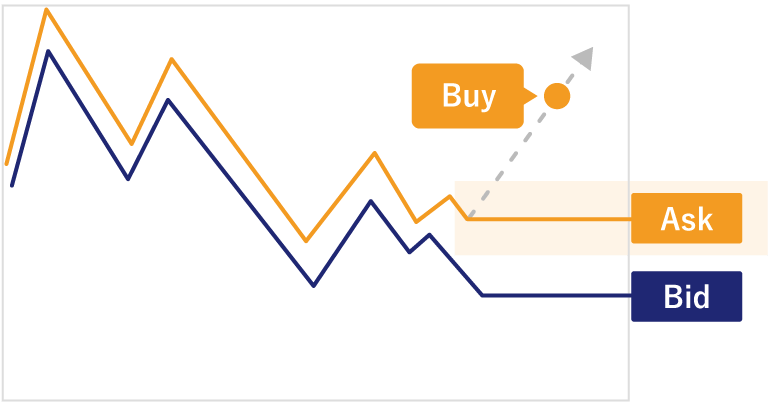

If you place a buy order by specifying a lower price than the current, select Buy Limit. Enter a price that is lower than the current Ask price.

Buy Stop

If you place a buy order by specifying a higher price than the current, select Buy Stop. Enter a price that is higher than the current Ask price.

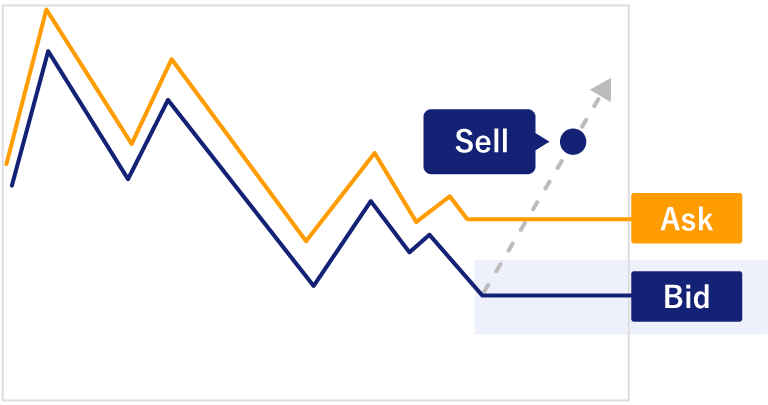

Sell Limit

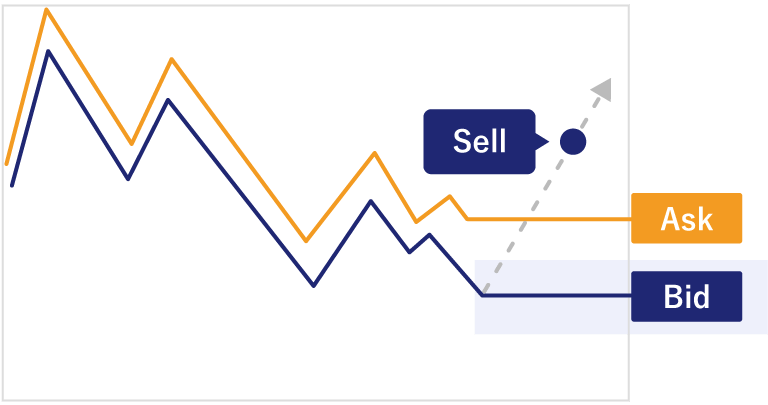

If you place a sell order by specifying a higher price than the current, select Sell Limit. Enter a price that's higher than the current Bid price.

Sell Stop

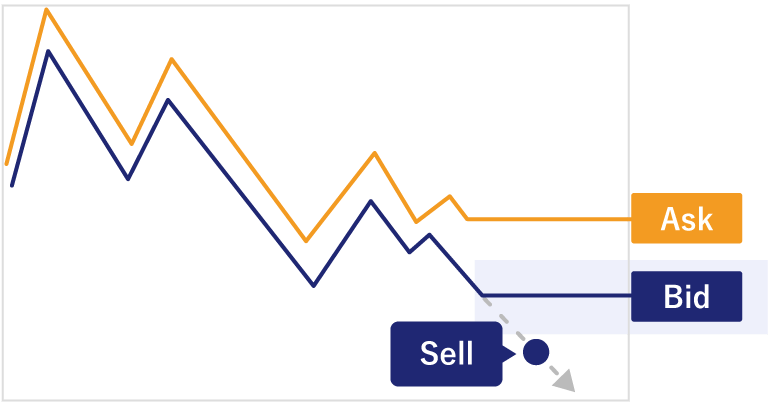

If you place a sell order by specifying a lower price than the current, select Sell Stop. Enter a price that's lower than the current Bid price.

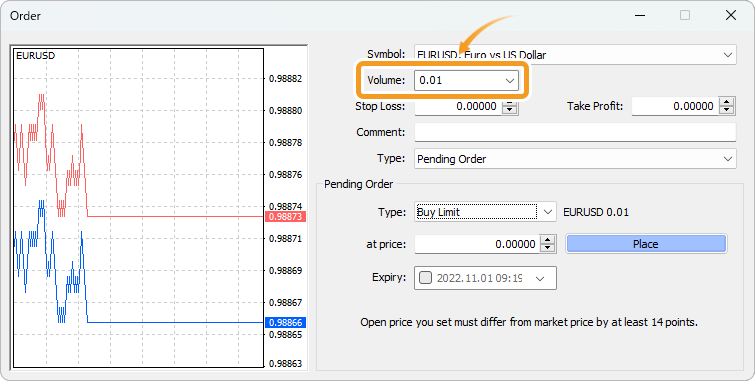

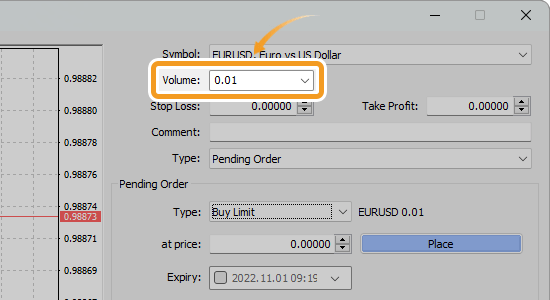

Set the trade volume in lots in the "Volume" field. Type the volume or select from the pull-down menu.

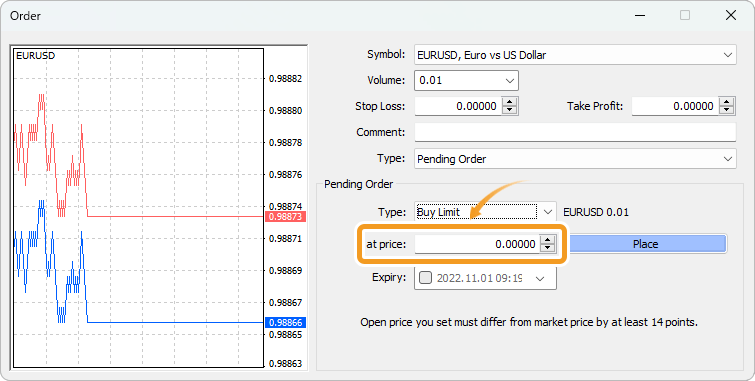

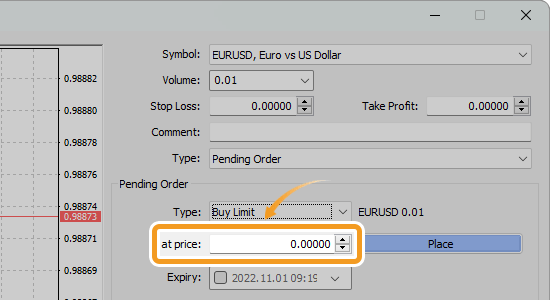

Set the limit/stop level in the "at price" field. Type the price or use the ▼▲ marks on the right side.

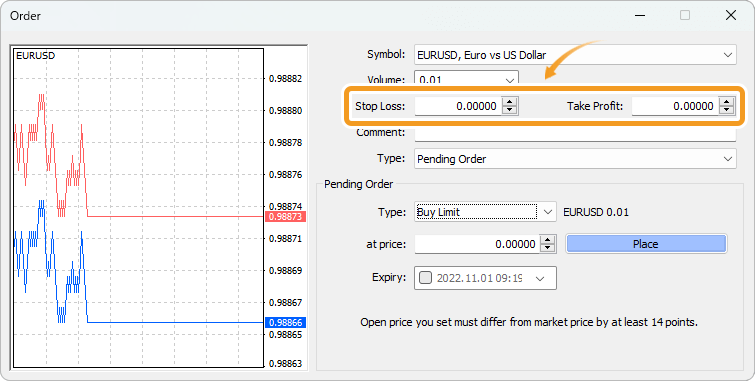

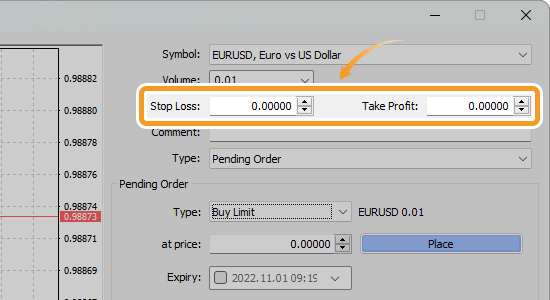

Set the stop-loss (S/L) value in the "Stop Loss" field, and the take-profit value in the "Take Profit" field. Type the value or use the ▼▲ marks on the right side.

Related article: Set or change T/P and S/L values

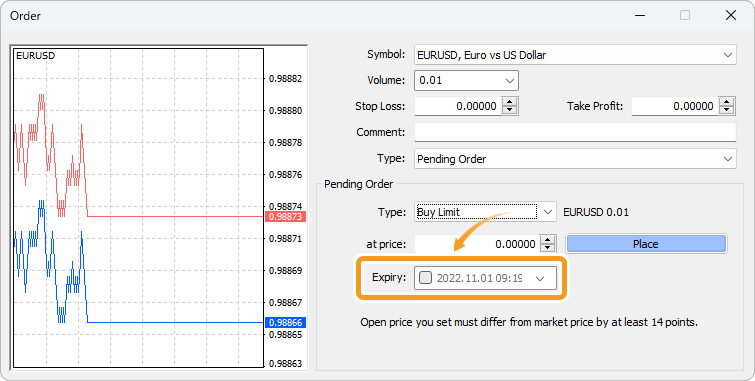

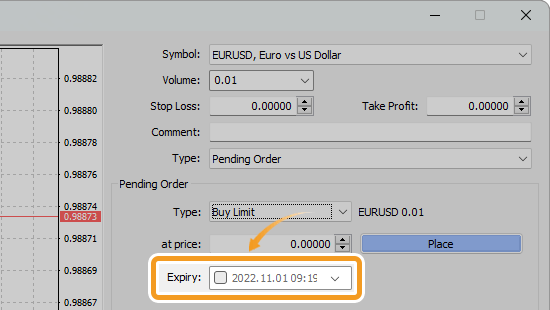

Set the expiration time for the limit/stop order in the "Expiry" field. To specify the date and time, open the calendar from the pull-down on the right side to select the date and time. Time is based on the server time.

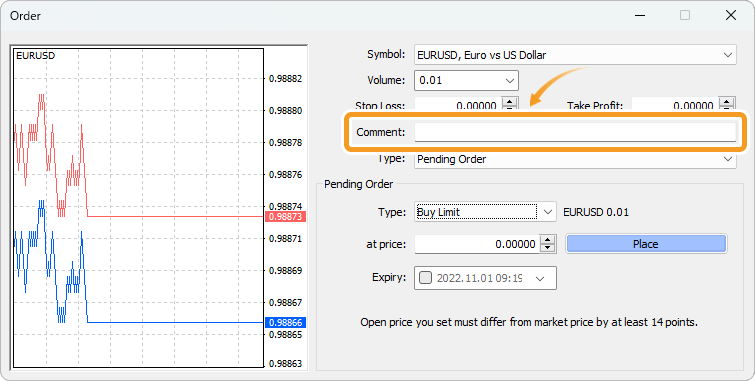

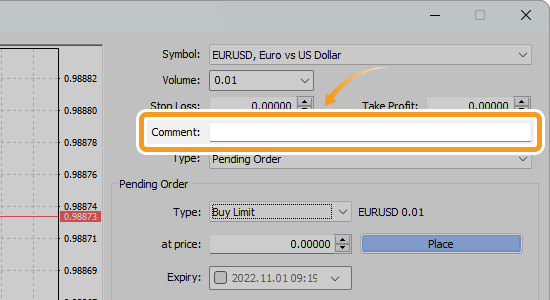

In the "Comment" field, you can add comments to an order. Use them as notes for later reference.

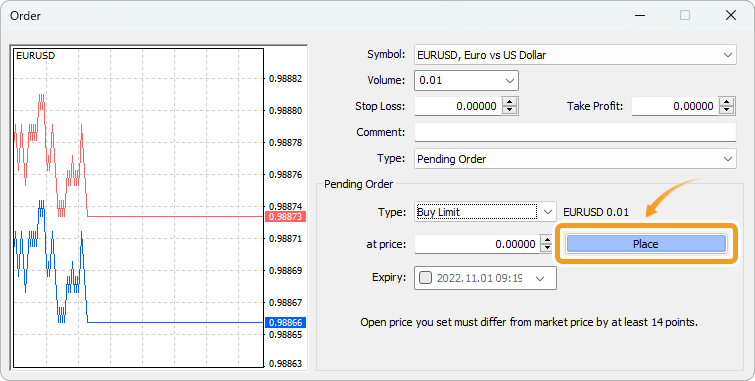

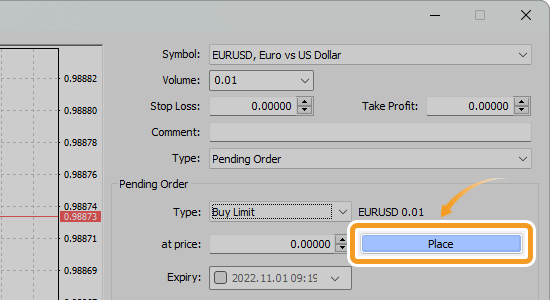

Click "Place".

When placing limit/stop orders, you have to specify a price that's certain points away from the current price. The difference between the two is called the stop level and it varies by the broker, account type, and symbol. If you can't click the "Place" button, adjust the price according to the stop level.

Related article: Check trading conditions

In the new order window, you can check the tick chart. A tick is the smallest unit of data that represents price. Tick charts detect smaller price changes than any other chart, which will help you execute well-timed orders. From the new order window's tick chart, you can check the Bid, Ask, take-profit (T/P), and stop-loss (S/L) values.

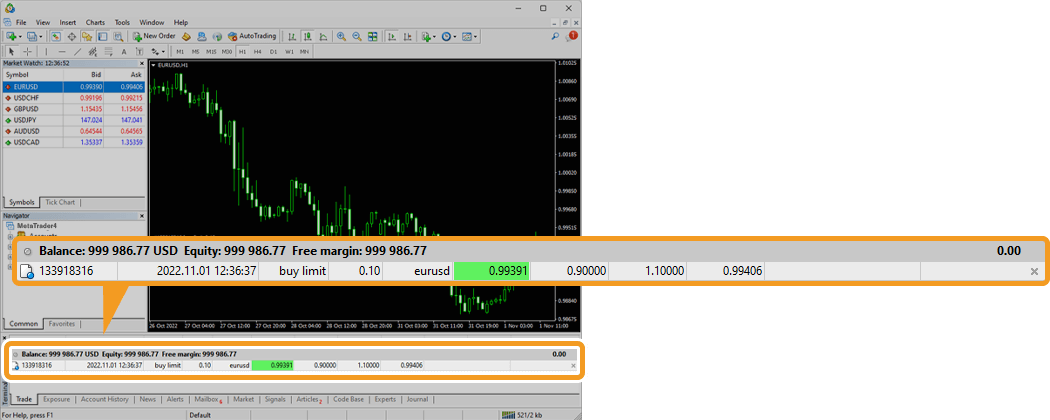

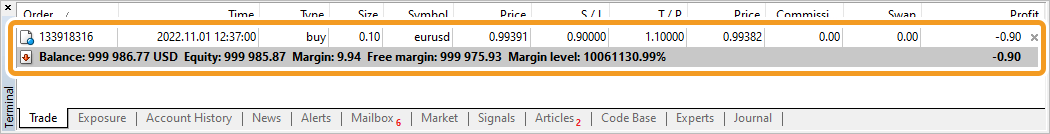

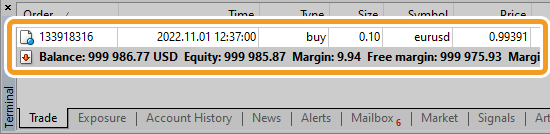

The order details will be added below the balance line in the "Trade" tab of the Terminal as a pending order.

The order will be executed once the specified price is reached. The order details will be updated as an open position and moved above the balance line.

Click "New Order" in the toolbar.

Related article: Open the new order window

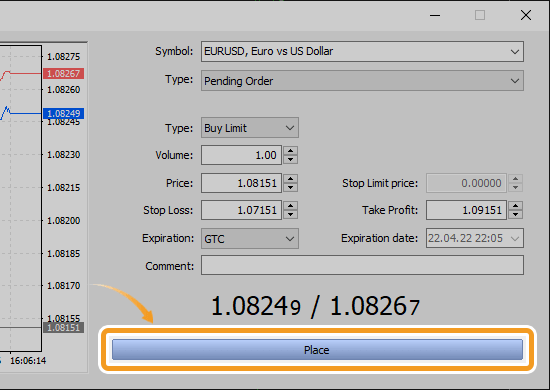

Click the "Symbol" field to choose the symbol to place an order for.

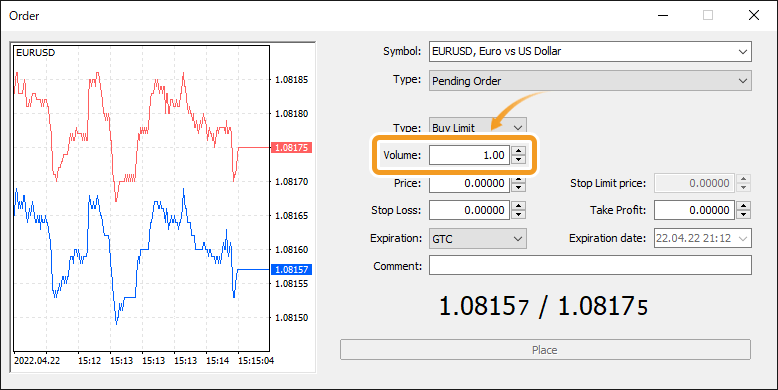

Click the "Type" field and select "Pending Order".

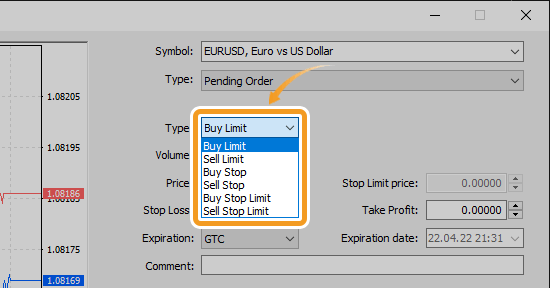

Click the "Type" field and select a type of limit/stop/stop-limit order.

Buy Limit

If you place a buy order by specifying a lower price than the current, select Buy Limit. Enter a price that is lower than the current Ask price.

Buy Stop

If you place a buy order by specifying a higher price than the current, select Buy Stop. Enter a price that is higher than the current Ask price.

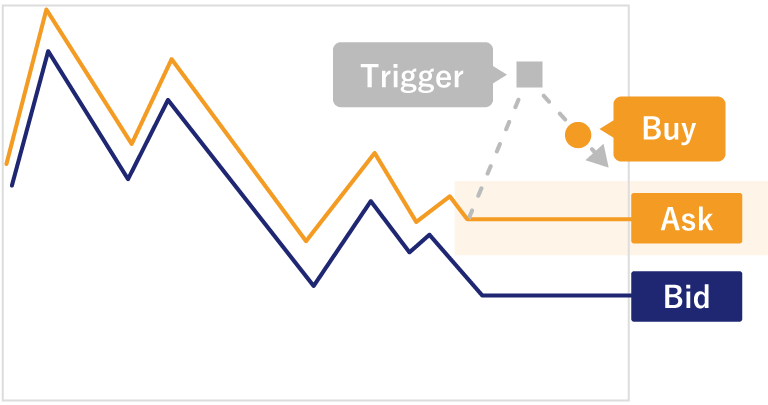

Buy Stop Limit

Select Buy Stop Limit and specify a trigger price higher than the current. Once the trigger price is achieved, a buy limit order will be placed.

Sell Limit

If you place a sell order by specifying a higher price than the current, select Sell Limit. Enter a price that's higher than the current Bid price.

Sell Stop

If you place a sell order by specifying a lower price than the current, select Sell Stop. Enter a price that's lower than the current Bid price.

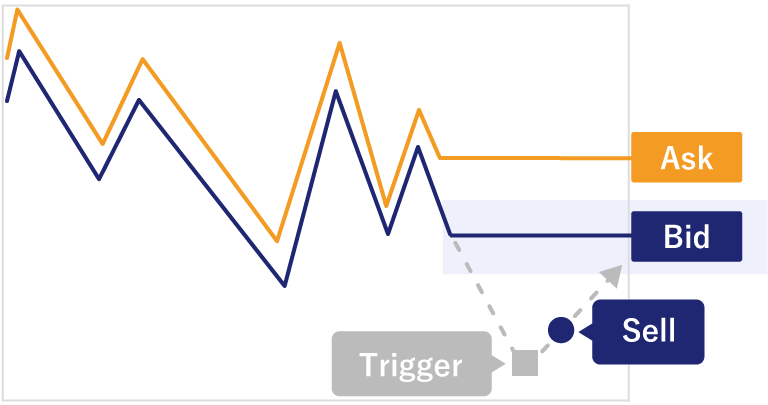

Sell Stop Limit

Select Sell Stop Limit and specify a trigger price lower than the current. Once the trigger price is achieved, a sell limit order will be placed.

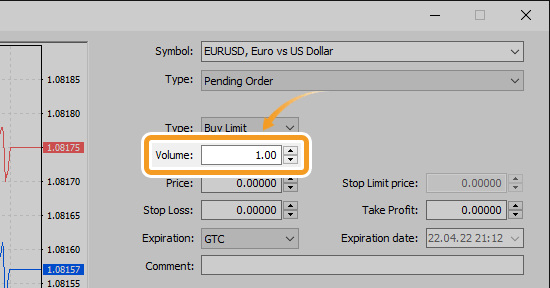

Set the trade volume in lots in the "Volume" field. Type the volume or use the ▼▲ marks on the right side.

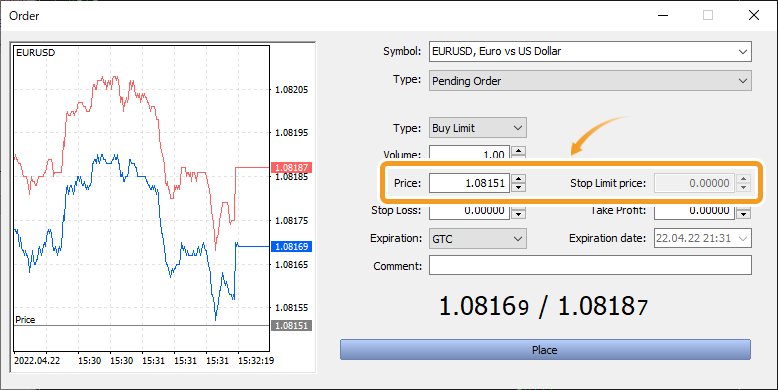

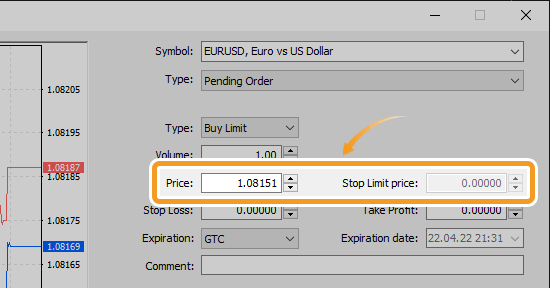

Set the limit/stop/stop-limit price (trigger price to activate stop-limit order) in the "Price" field. To place a stop-limit order, set the limit price in the "Stop Limit Price" field. Type the price or use the ▼▲ marks on the right side.

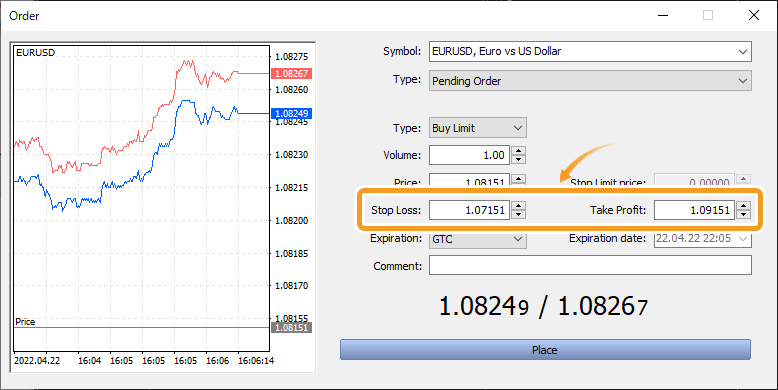

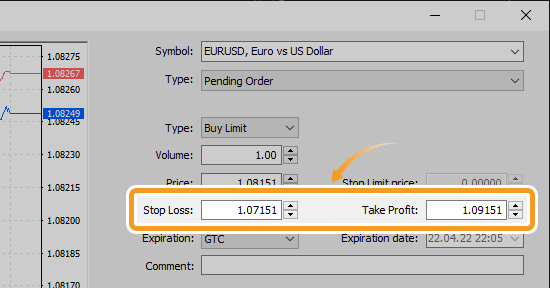

Set the stop-loss (S/L) value in the "Stop Loss" field, and the take-profit value in the "Take Profit" field. Type the value or use the ▼▲ marks on the right side.

Related article: Set or change T/P and S/L values

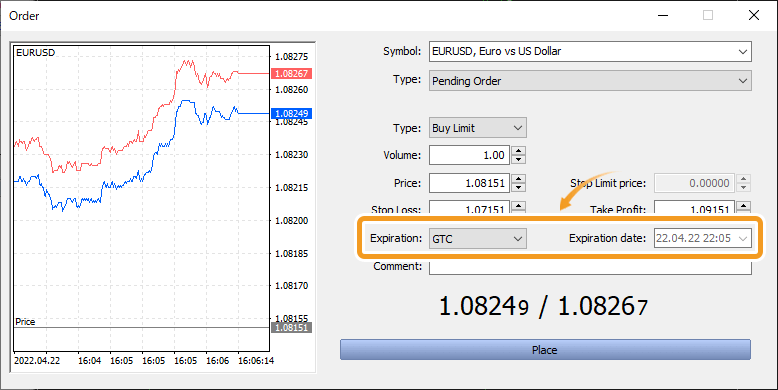

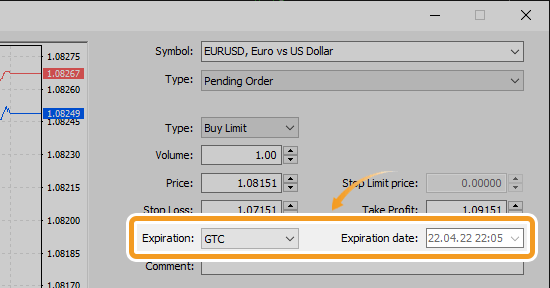

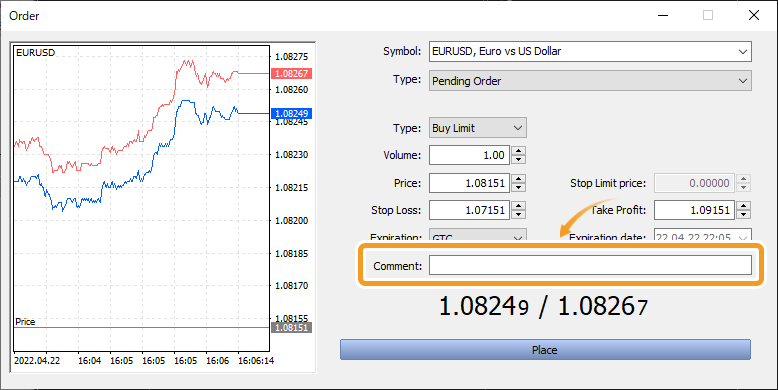

Set the expiration type for the limit/stop order. To specify the date, select "Specified" or "Specified day" in the "Expiration" field and specify the date and time in the "Expiration date" field. Time is based on the server time.

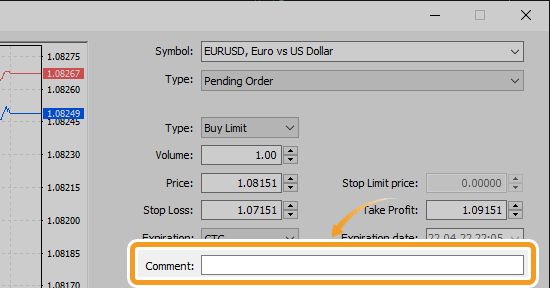

In the "Comment" field, you can add comments to an order. Use them as notes for later reference.

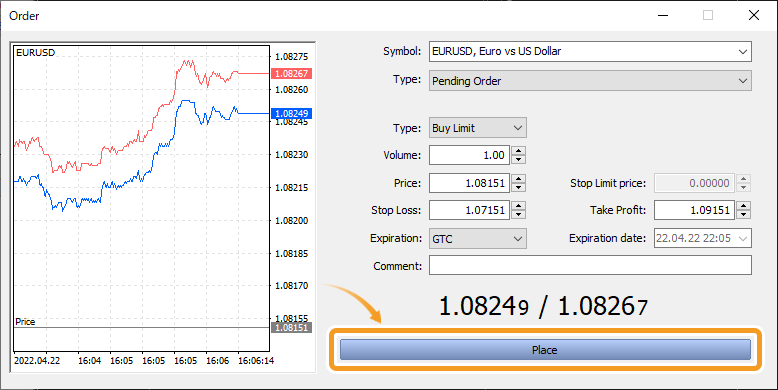

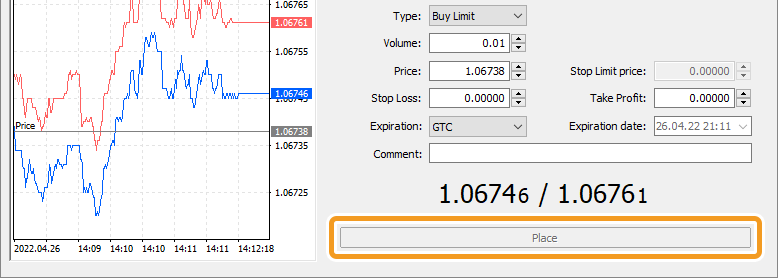

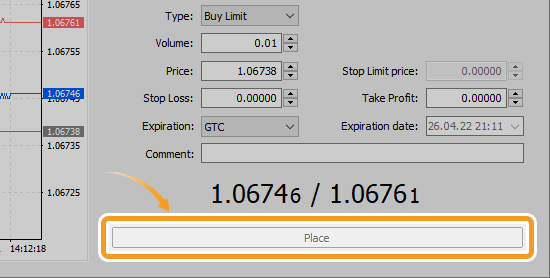

Click "Place".

When placing limit/stop orders, you have to specify a price that's certain points away from the current price. The difference between the two is called the stop level and it varies by the broker, account type, and symbol. If the "Place" button is blue or not red, check your price and make sure the deviation isn't smaller than the stop level.

Related article: Check trading conditions

In MT5's new order window, you can check the tick chart. A tick is the smallest unit of data that represents price. Tick charts detect price movement faster than any other chart, which will help you execute well-timed orders. From the new order window's tick chart, you can check the Ask, Bid, take-profit (T/P), and stop-loss (S/L) values.

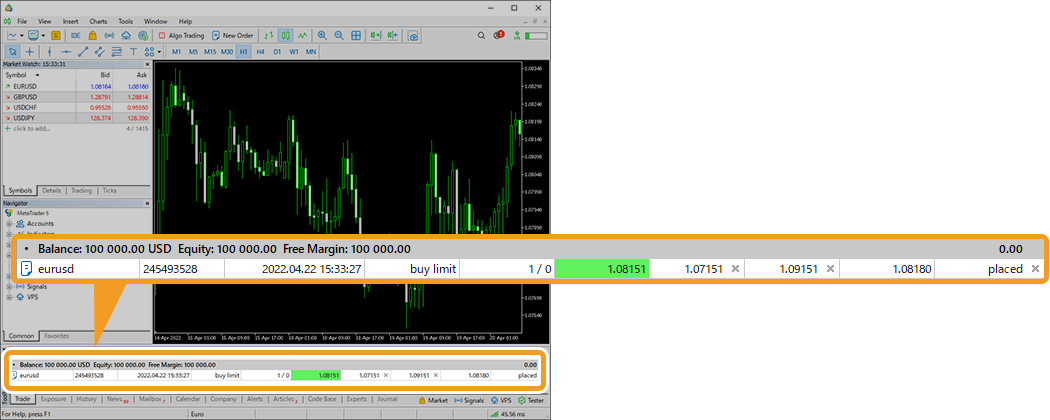

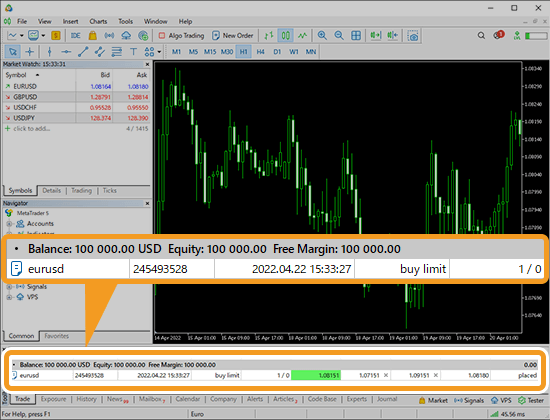

Once the order is placed, the order details will be added below the balance line in the "Trade" tab of the Toolbox as a pending order.

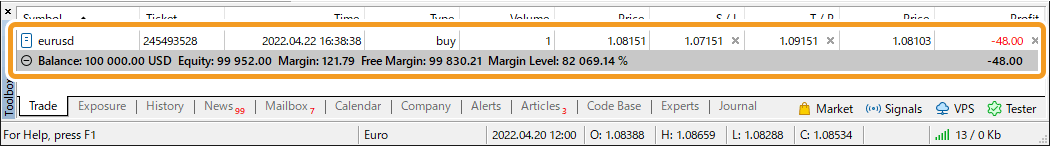

The order will be executed once the specified price is reached. The order details will be updated as an open position and moved above the balance line.

![]()

Created

: 2022.08.19

![]()

Last updated

: 2025.10.12

Nakamaru is a manual production consultant at FINTECS, a company that specializes in creating manuals for their clients.

With a wide range of experience from fintech to entertainment, he presents what user-friendly manuals should be like.

He works with numerous large corporations as an external manual production project manager.

【Business information】

http://www.fintecs.co.jp/profile/

Akira Takagi

Systems engineer, MetaTrader administrator

After graduating from Computer Science at the Uninove, Brazil, in 2014, he has worked on various systems development projects.

He participated as a developer in the launch of forex services in 2019. Since then, he has also been involved in the development of MetaTrader plugins and APIs. He is certified by MetaQuotes as a MetaTrader5 Administrator and active in consulting and advisory as well.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy