Created

: 2022.09.09

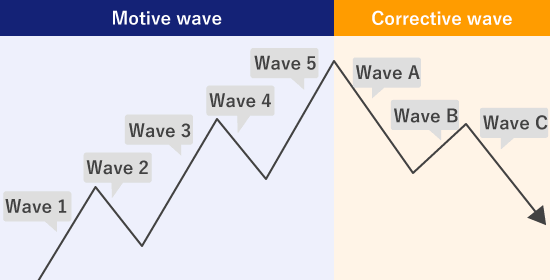

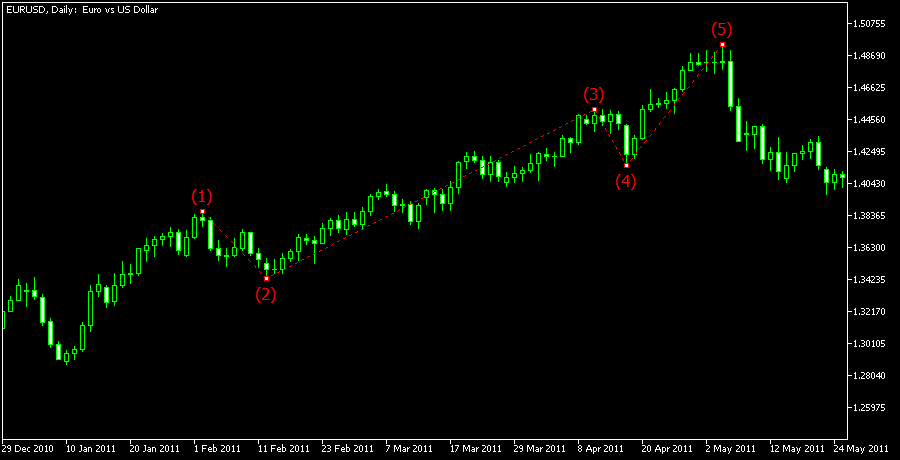

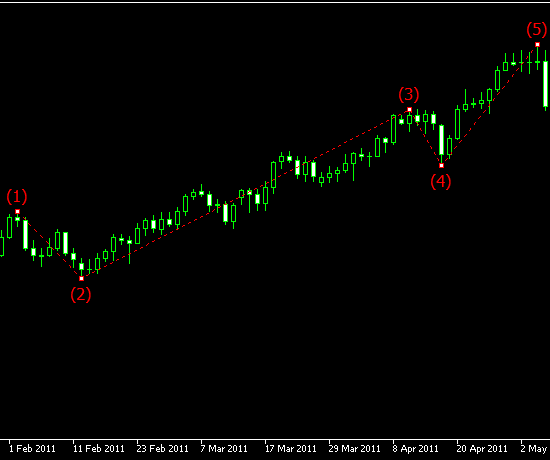

In MetaTrader5 (MT5), the object called the Elliott Wave is available. It is an analysis method heavily influenced by the Dow Theory, based on the idea that markets have a cycle. In MT5, the 5 upward trends are shown as the "motive wave" and the 3 downward waves are referred to as the "corrective wave".(*1)

Here, we'll take a look at how to display and adjust the Elliott Wave.

(*1)Elliott Wave is not available on MetaTrader4 (MT4).

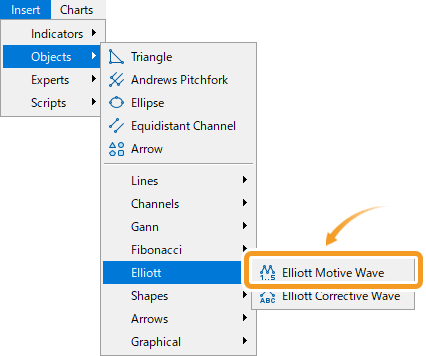

Click "Insert" in the menu. Hover the pointer over "Objects" > "Elliott" and select "Elliott Motive Wave".

The Elliott Wave is made up of 8 waves. Waves 1~5 drive the trend and are called the "Elliott motive wave". Waves A~C which adjust the trend is called the "Elliott corrective wave". The motive waves are made up of waves that drive the trend (wave 1, 3, 5) and those that go against it (wave 2, 4). The theory states that the 3rd wave will never be the shortest. The correction waves are made up of waves that correct the trend (wave A, C) and those that go against it (wave B). The rule states that wave C will always have the biggest price gap in the Elliott Wave.

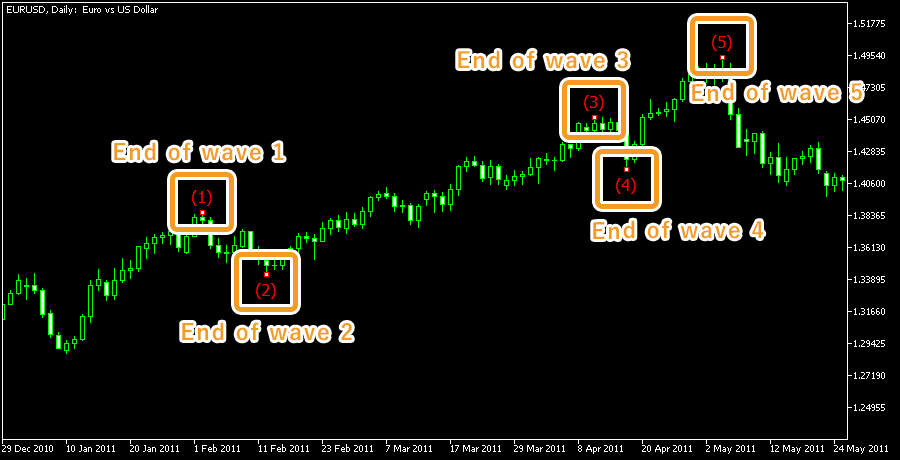

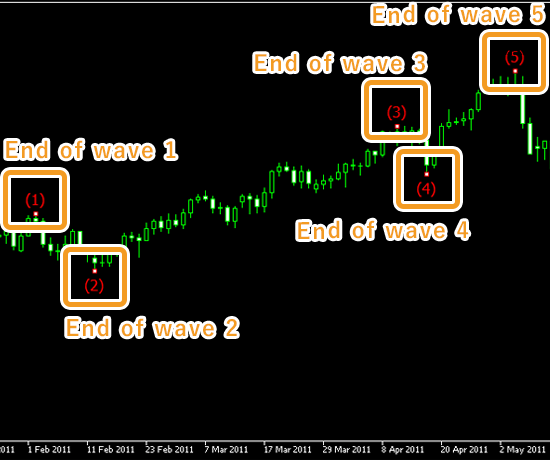

Click on the end point of wave 1 of the Elliott motive waves, followed by the end point of wave 2, 3, 4, and 5. If you want to adjust the position of the Elliott motive waves, make sure the white dots are being displayed on the end points and move each dot as necessary.

If you cannot see the white dots, double-click near the Elliott motive waves to display the white dots.

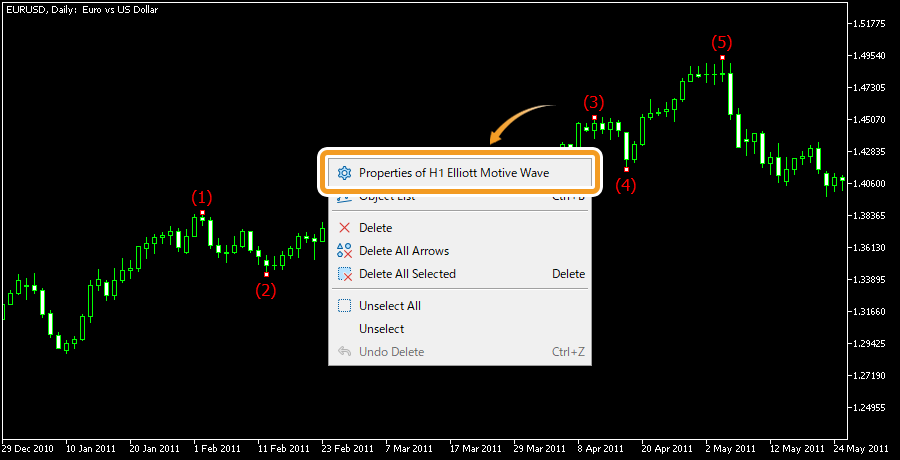

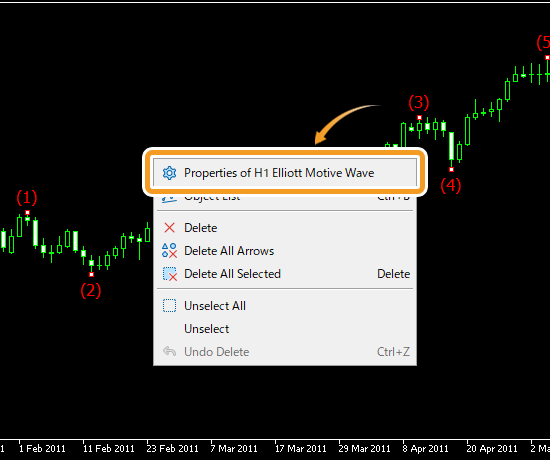

To modify the Elliott motive wave settings, right-click near the Elliott motive waves and select "Properties of (Elliott Wave name)".

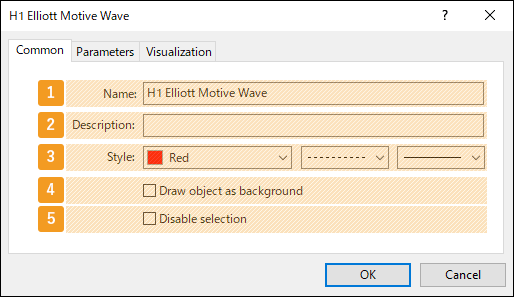

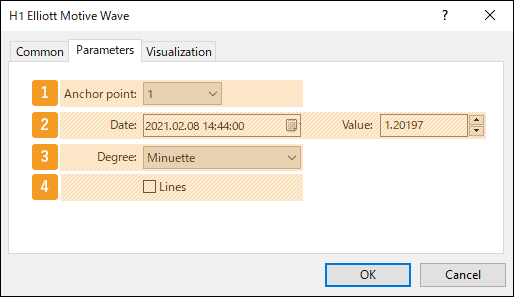

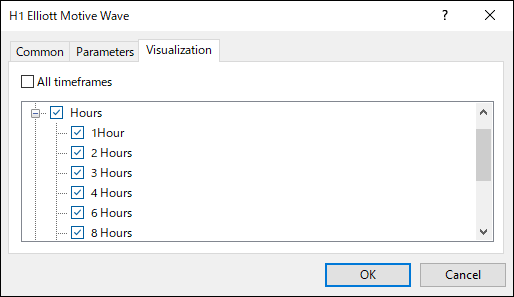

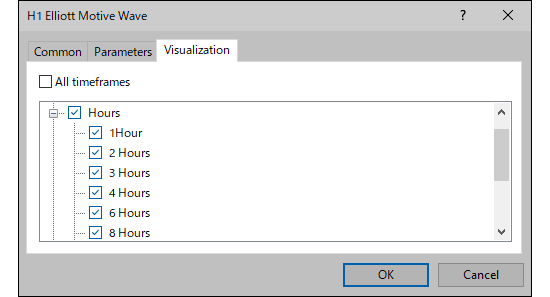

On the "Properties" window, edit the parameters in the "Common", "Parameters", and "Visualization" tabs and click "OK".

|

Number |

Item name |

Descriptions |

|---|---|---|

|

1 |

Name |

Name the Elliott Wave. |

|

2 |

Description |

The description of the Elliott Wave can be displayed on the chart. Related article: Show or hide items on chart |

|

3 |

Style |

Set the color, line type, and line thickness for the Elliott Wave. |

|

4 |

Draw object |

Check this box if you want to place the Elliott Wave behind the chart. |

|

5 |

Disable selection |

Check this box if you want to disable the editing of the Elliott Wave. |

|

Number |

Item name |

Descriptions |

|---|---|---|

|

1 |

Anchor point |

Specify the end point of the wave to move. |

|

2 |

End point position |

Specify the end point position by date and price. |

|

3 |

Degree |

Specify the cycle for the Elliott Wave. |

|

4 |

Lines |

Check this box when you want to connect the end points of the Elliott Wave with lines. |

On the "Visualization" tab, you can specify the timeframes to use the Elliott Wave with.

Elliott states in one of his books that "The wave principle, inspired by the Dow Theory, is an indispensable tool for market analysis". In other words, the Elliott Wave is a more sophisticated version of the Dow Theory. Interestingly enough, they both use "waves" as an analogy to describe the market. Elliott often used phrases such as "low tide" and "flow" to explain market behavior, hence the name, "Wave Theory".

![]()

Created

: 2022.09.09

![]()

Last updated

: 2025.03.18

Nakamaru is a manual production consultant at FINTECS, a company that specializes in creating manuals for their clients.

With a wide range of experience from fintech to entertainment, he presents what user-friendly manuals should be like.

He works with numerous large corporations as an external manual production project manager.

【Business information】

http://www.fintecs.co.jp/profile/

Akira Takagi

Systems engineer, MetaTrader administrator

After graduating from Computer Science at the Uninove, Brazil, in 2014, he has worked on various systems development projects.

He participated as a developer in the launch of forex services in 2019. Since then, he has also been involved in the development of MetaTrader plugins and APIs. He is certified by MetaQuotes as a MetaTrader5 Administrator and active in consulting and advisory as well.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy