- What's Myforex

- Share

- Use tools

- Get information

- What's New

- Help center

- About us

- Customer support

- Terms and policies

-

-

PortfolioShare your portfolio and performance in real time

PortfolioShare your portfolio and performance in real time -

Events & contestsEvents and contests held by retail brokers around the world

Events & contestsEvents and contests held by retail brokers around the world

-

-

Real-time spread comparisonCompare spreads of major retail brokers in real time

Real-time spread comparisonCompare spreads of major retail brokers in real time -

Volatility analysisVisualize volatility as a measure of daily market activity

Volatility analysisVisualize volatility as a measure of daily market activity -

Swap point comparisonCompare buy and sell swap values for each broker by symbol

Swap point comparisonCompare buy and sell swap values for each broker by symbol -

Market rates & chartsCheck prices for all instruments offered by each broker

Market rates & chartsCheck prices for all instruments offered by each broker -

IndicatorsProviding in-house developed indicators for MT4/MT5

IndicatorsProviding in-house developed indicators for MT4/MT5 -

Trading calculatorsCalculation tools for each broker to help you trade

Trading calculatorsCalculation tools for each broker to help you trade

-

-

World FX newsLatest news on forex and cryptocurrencies from around the world

World FX newsLatest news on forex and cryptocurrencies from around the world -

Broker informationTrading information of retail brokers worldwide

Broker informationTrading information of retail brokers worldwide -

MetaTrader4/5 user guideUser guide collection for the latest MetaTrader4/5

MetaTrader4/5 user guideUser guide collection for the latest MetaTrader4/5 -

Economic calendarRelease calendar for indicators from official sources of major economies

Economic calendarRelease calendar for indicators from official sources of major economies

Search results | World FX news

Search results

Show:

-

New

- Breaking news

EUR/GBP rebounds near 0.8450 as investors raise bets on BoE rate cuts

- Breaking news

The EUR/GBP cross recovers to 0.8440 during the early European session on Friday.

Created : 2024.07.26 15:19

Created : 2024.07.26 15:19

Last updated : 2024.07.26

Last updated : 2024.07.26

-

New

- Breaking news

US core PCE annual inflation seen lower in June, reinforcing the case of a Federal Reserve's cut

- Breaking news

The United States will release June Personal Consumption Expenditures (PCE) Price Index figures on Friday.

Created : 2024.07.26 15:00

Created : 2024.07.26 15:00

Last updated : 2024.07.26

Last updated : 2024.07.26

-

New

- Breaking news

USD/CAD holds losses around 1.3800 after retreating from eight-month highs

- Breaking news

USD/CAD breaks its winning streak that began on July 17, trading around 1.3810 during the Asian session on Friday.

Created : 2024.07.26 14:51

Created : 2024.07.26 14:51

Last updated : 2024.07.26

Last updated : 2024.07.26

-

New

- Breaking news

FX option expiries for July 26 NY cut

- Breaking news

FX option expiries for July 26 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

Created : 2024.07.26 14:16

Created : 2024.07.26 14:16

Last updated : 2024.07.26

Last updated : 2024.07.26

-

New

- Breaking news

USD/CHF extends its decline near 0.8800, US June PCE data looms

- Breaking news

The USD/CHF pair remains under selling pressure around 0.8810 during the early European session on Friday.

Created : 2024.07.26 14:00

Created : 2024.07.26 14:00

Last updated : 2024.07.26

Last updated : 2024.07.26

-

New

- Breaking news

NZD/USD struggles to attract any meaningful buyers, remains below 0.5900 ahead of US PCE

- Breaking news

The NZD/USD pair edges higher during the Asian session on Friday and for now, seems to have snapped a six-day losing streak to its lowest level since early May, around the 0.5880 region touched the previous day.

Created : 2024.07.26 13:59

Created : 2024.07.26 13:59

Last updated : 2024.07.26

Last updated : 2024.07.26

-

New

- Breaking news

EUR/JPY holds ground around 167.00 after Tokyo CPI inflation

- Breaking news

EUR/JPY hovers around 167.00 with a positive bias during the Asian session on Friday.

Created : 2024.07.26 13:34

Created : 2024.07.26 13:34

Last updated : 2024.07.26

Last updated : 2024.07.26

-

New

- Breaking news

AUD/JPY edges higher to 100.75-80 area, upside potential seems limited

- Breaking news

The AUD/JPY pair attracts some buyers during the Asian session on Friday and looks to build on the previous day's goodish rebound from the 99.20 area, or its lowest level since April 22.

Created : 2024.07.26 13:11

Created : 2024.07.26 13:11

Last updated : 2024.07.26

Last updated : 2024.07.26

-

New

- Breaking news

EUR/USD appreciates to near 1.0850 ahead of US PCE inflation

- Breaking news

EUR/USD trades around 1.0860 during the Asian session on Friday, extending its gains after rebounding from a two-week low of 1.0825 recorded on Wednesday.

Created : 2024.07.26 12:32

Created : 2024.07.26 12:32

Last updated : 2024.07.26

Last updated : 2024.07.26

-

- Breaking news

GBP/USD rebounds above 1.2850 ahead of US PCE data

- Breaking news

The GBP/USD pair gains traction near 1.2860 amid the weaker Greenback, snapping the three-day losing streak during the Asian trading hours on Friday.

Created : 2024.07.26 11:49

Created : 2024.07.26 11:49

Last updated : 2024.07.26

Last updated : 2024.07.26

-

- Breaking news

Australian Dollar halts losing streak due to commodities prices rebound

- Breaking news

The Australian Dollar (AUD) halts its nine-day losing streak against the US Dollar (USD) on Friday, following unexpected cuts to key lending rates by the People's Bank of China (PBoC).

Created : 2024.07.26 11:42

Created : 2024.07.26 11:42

Last updated : 2024.07.26

Last updated : 2024.07.26

-

- Breaking news

WTI holds steady above $78.00 mark as traders keenly await US PCE data

- Breaking news

West Texas Intermediate (WTI) US crude Oil prices edge higher during the Asian session on Friday and look to build on the overnight bounce from the $75.75 area, or the lowest level since June 10.

Created : 2024.07.26 11:37

Created : 2024.07.26 11:37

Last updated : 2024.07.26

Last updated : 2024.07.26

-

- Breaking news

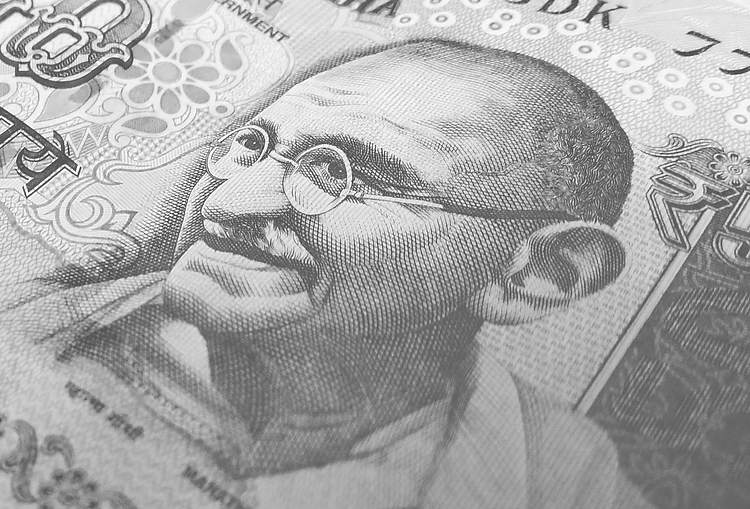

Indian Rupee edges higher ahead of US PCE data

- Breaking news

The Indian Rupee (INR) posts modest gains on Friday on the weaker Greenback.

Created : 2024.07.26 10:56

Created : 2024.07.26 10:56

Last updated : 2024.07.26

Last updated : 2024.07.26

-

- Breaking news

Japanese Yen comes under pressure following Tokyo CPI

- Breaking news

The Japanese Yen (JPY) extends its losses against the US Dollar (USD) on Friday after the Statistics Bureau of Japan released the Tokyo Consumer Price Index (CPI) data.

Created : 2024.07.26 10:23

Created : 2024.07.26 10:23

Last updated : 2024.07.26

Last updated : 2024.07.26

-

- Breaking news

PBOC sets USD/CNY reference rate at 7.1270 vs. 7.1321 previous

- Breaking news

On Friday, the People's Bank of China (PBOC) set the USD/CNY central rate for the trading session ahead at 7.1270, as against the previous day's fix of 7.1321 and 7.2229 Reuters estimates.

Created : 2024.07.26 10:18

Created : 2024.07.26 10:18

Last updated : 2024.07.26

Last updated : 2024.07.26

-

- Breaking news

AUD/USD trades with modest gains above multi-month low, focus remains on US PCE data

- Breaking news

The AUD/USD pair ticks higher during the Asian session on Friday and moves further away from its lowest level since early May, around the 0.6515 region touched the previous day.

Created : 2024.07.26 09:33

Created : 2024.07.26 09:33

Last updated : 2024.07.26

Last updated : 2024.07.26

-

- Breaking news

USD/CAD trades with mild bearish bias near 1.3800, eyes on US PCE data

- Breaking news

The USD/CAD pair trades with mild losses near 1.3815, snapping the seven-day winning streak during the early Asian session on Friday.

Created : 2024.07.26 09:20

Created : 2024.07.26 09:20

Last updated : 2024.07.26

Last updated : 2024.07.26

-

- Breaking news

Japan's Kanda: Excessive FX volatility has negative impact on economy

- Breaking news

Japan's top currency diplomat, Masato Kanda, who will instruct the BoJ to intervene, when he judges it necessary, said on Friday that foreign exchange (FX) volatility has negative effects on the Japanese economy.

Created : 2024.07.26 08:56

Created : 2024.07.26 08:56

Last updated : 2024.07.26

Last updated : 2024.07.26

-

- Breaking news

Japan Inflation: Tokyo Consumer Price Index rises 2.2% YoY in July vs. 2.3% prior

- Breaking news

The headline Tokyo Consumer Price Index (CPI) for July rose 2.2% YoY, compared to a 2.3% rise in the previous reading, the Statistics Bureau of Japan showed on Friday.

Created : 2024.07.26 08:33

Created : 2024.07.26 08:33

Last updated : 2024.07.26

Last updated : 2024.07.26

-

- Breaking news

NZD/USD remains weak below 0.5900, all eyes on US PCE data

- Breaking news

The NZD/USD pair remains under some selling pressure around 0.5890 during the early Asian session on Friday.

Created : 2024.07.26 08:12

Created : 2024.07.26 08:12

Last updated : 2024.07.26

Last updated : 2024.07.26

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy