Created

: 2022.08.24

On MetaTrader4 (MT4) / MetaTrader5 (MT5), you can quickly place orders on the Depth of Market window. Also, some brokers are providing the depth of market data on MT5.(*1)

Here we will look at how to place limit/stop orders on the Depth of Market window on MT4/MT5. Please note that if you wish to place an order from the Depth of Market window, you must have one-click order enabled.

Related article: Enable one-click trading

Switch between MT4/MT5 tabs to check the steps for each.

(*1)On MT4, the depth of market data is not available. The Depth of Market window only serves as a scalping tool.

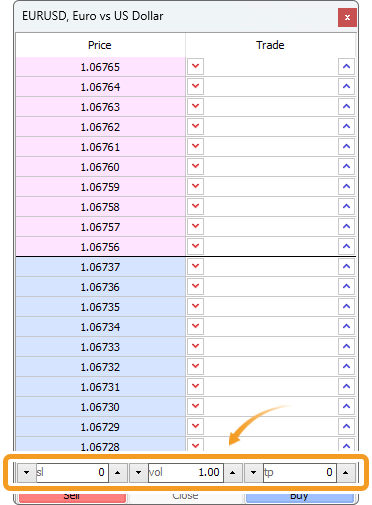

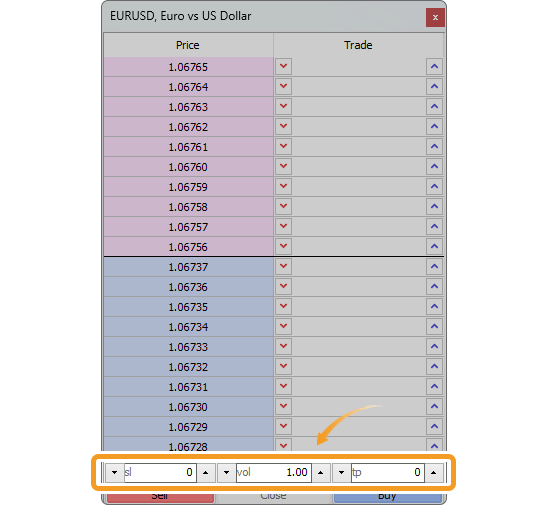

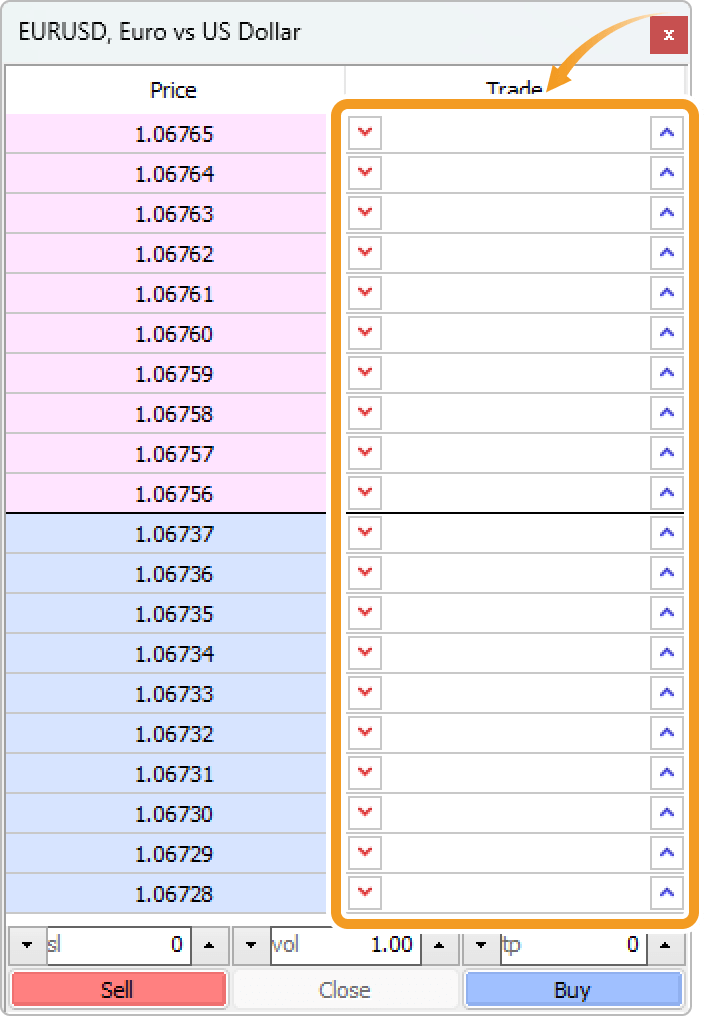

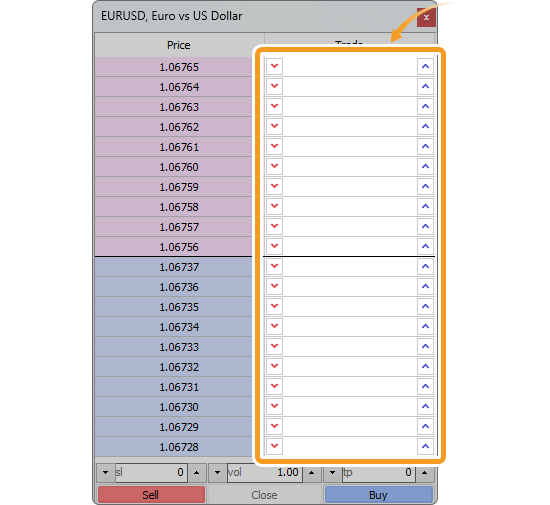

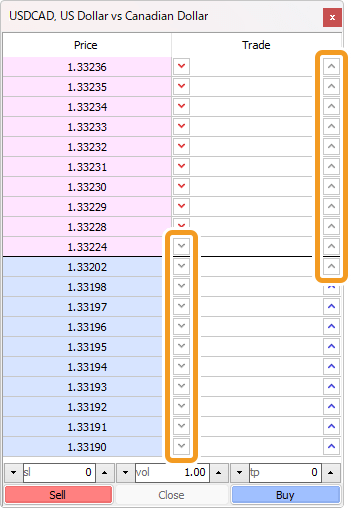

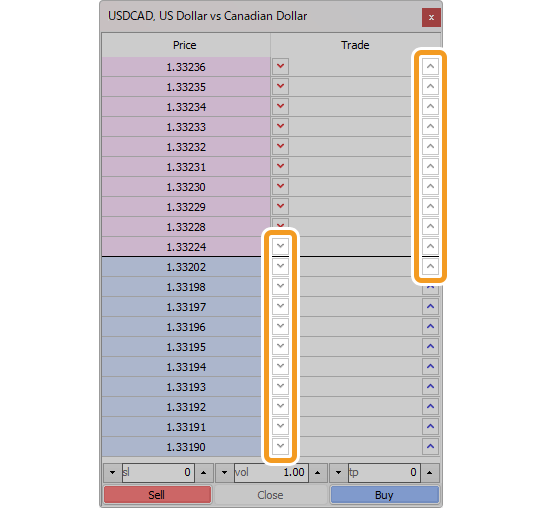

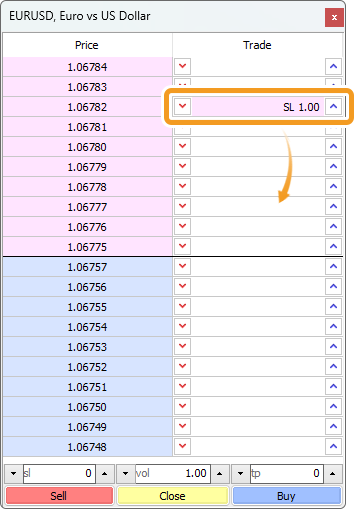

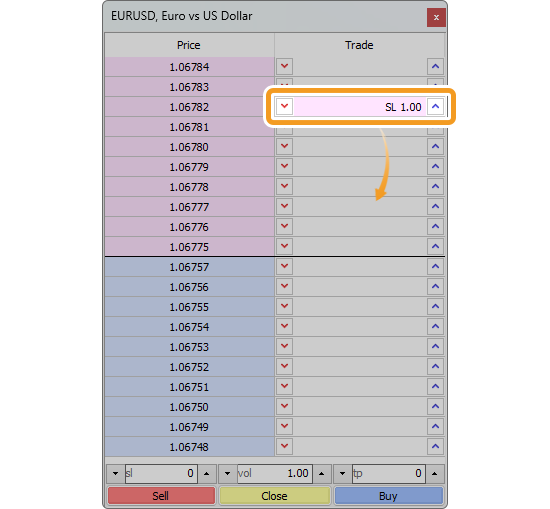

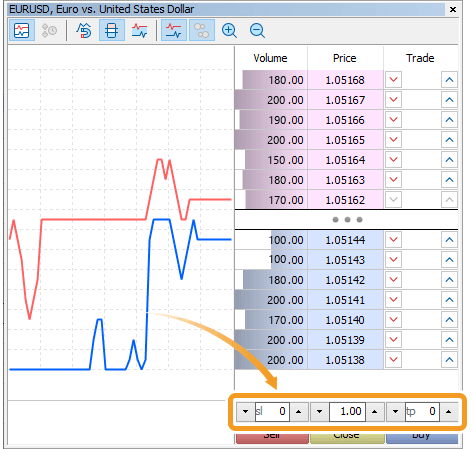

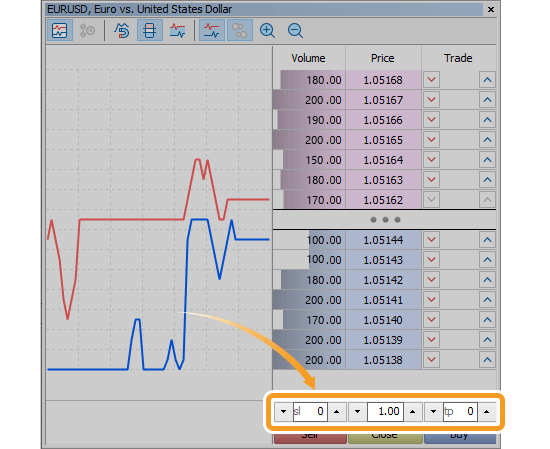

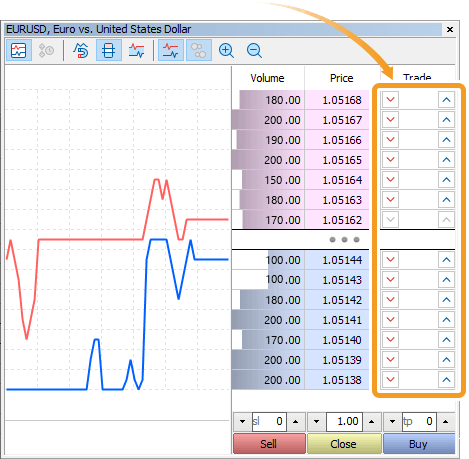

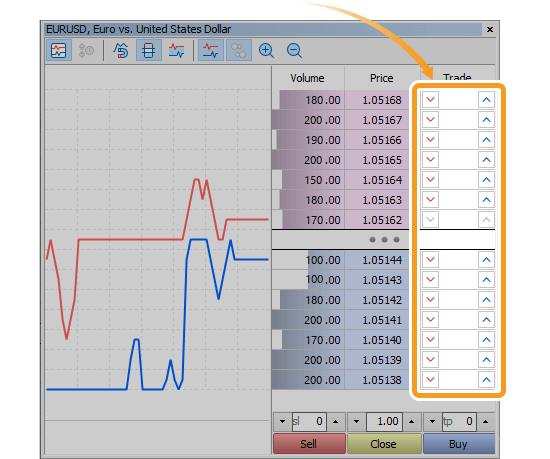

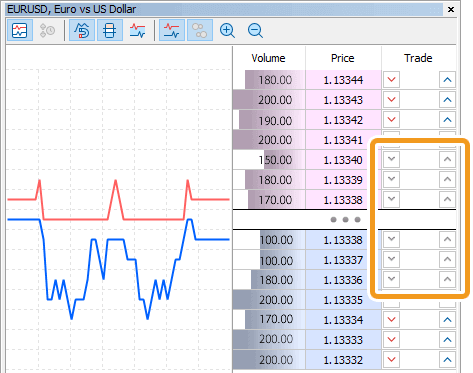

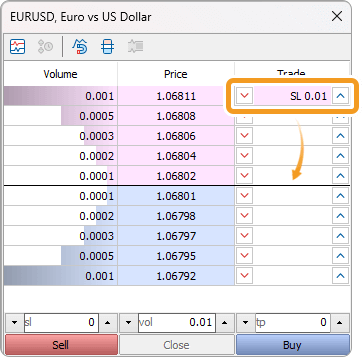

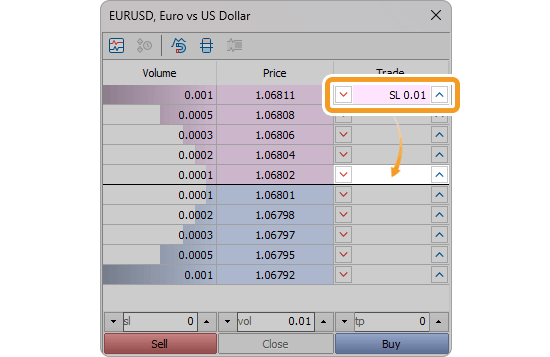

Set the trade volume in lots on the Depth of Market window. Type the volume or use the ▼▲ marks on both sides. You can also set stop-loss (S/L) and take-profit (T/P) values by specifying the deviation from the current price in points.

Related article: Open Depth of Market

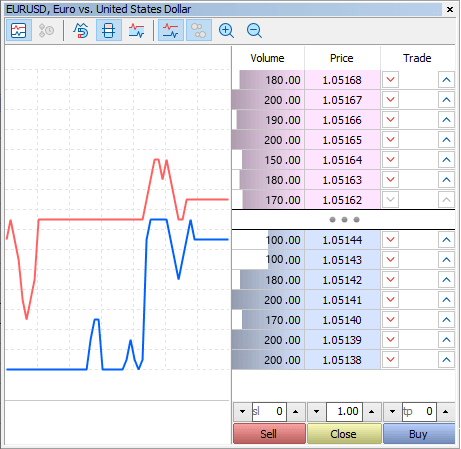

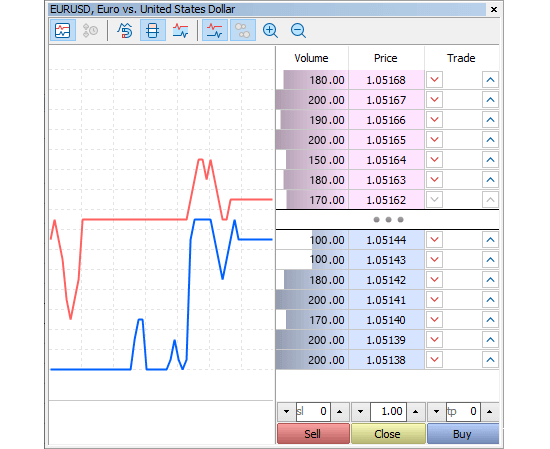

On MT5, some brokers provide the depth of market data, or the real-time numbers of orders placed by other traders. On MT4, on the other hand, this feature is not available. The Depth of Market window still can be used as a scalping tool.

There are two ways to place an order, by clicking on an arrow on the Depth of Market window or from the context menu.

To place a buy limit/stop order, click a blue arrow on the right side. To place a sell limit/stop order, click a red arrow on the left side.

Right-click on the Depth of Market window and choose "Buy/Sell Limit" or "Sell/Buy Stop" from the context menu. These options vary depending on whether you right-click above the current rate or below it.

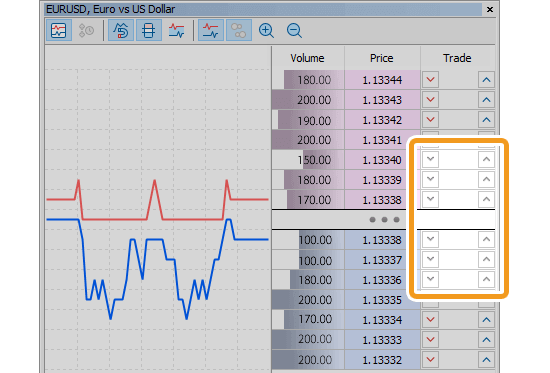

When placing limit/stop orders, you have to specify a price that's certain points away from the current price. The difference between the two is called the stop level and it varies by the forex broker, account type, and symbol. When there is a stop level, the Buy button will be grayed out from the current price up to the price higher by the stop level, and the Sell button will be grayed out from the current price to the price lower by the stop level.

Related article: Check trading conditions

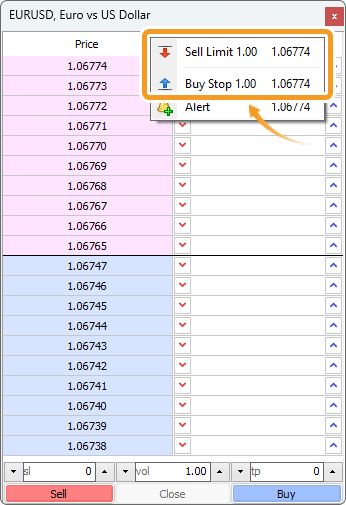

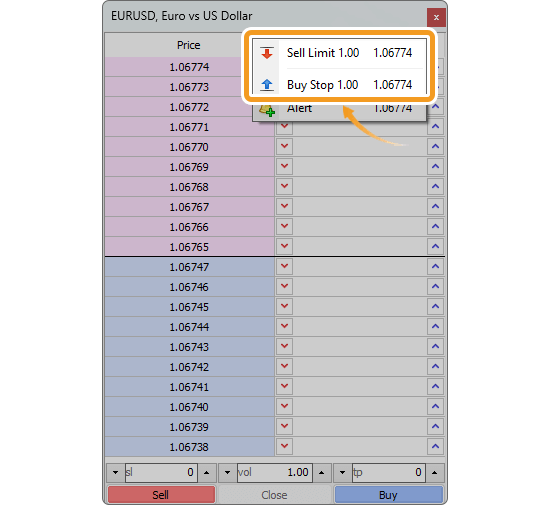

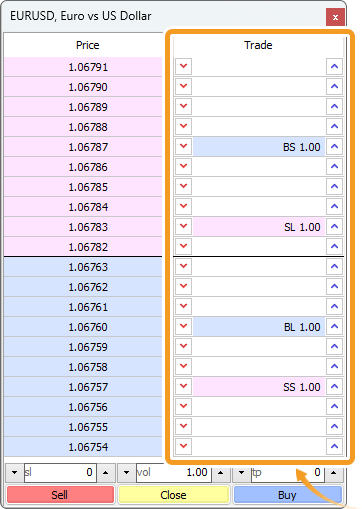

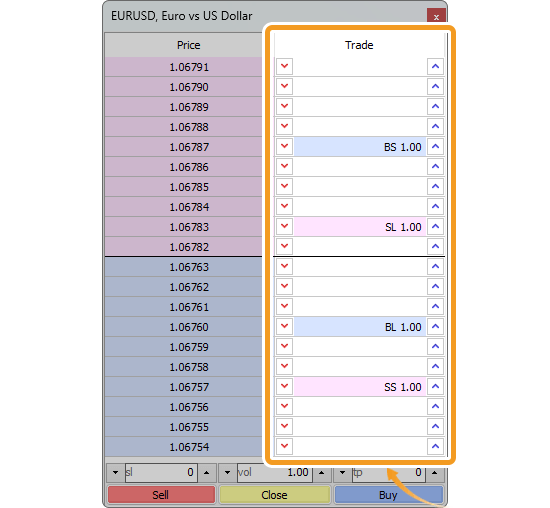

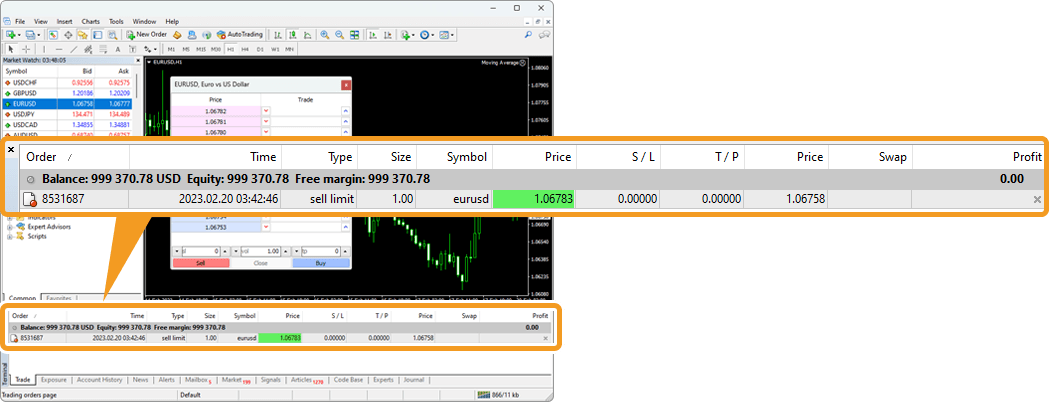

Once the order is placed, the pending order details will be added to the Depth of Market window. Alphabets displayed together indicate the type of each order.

| Order type | Alphabets |

|---|---|

| Sell stop order | SS(Sell Stop) |

| Buy stop order | B(Buy Stop) |

| Sell limit order | SL(Sell Limit) |

| Buy limit order | BL(Buy Limit) |

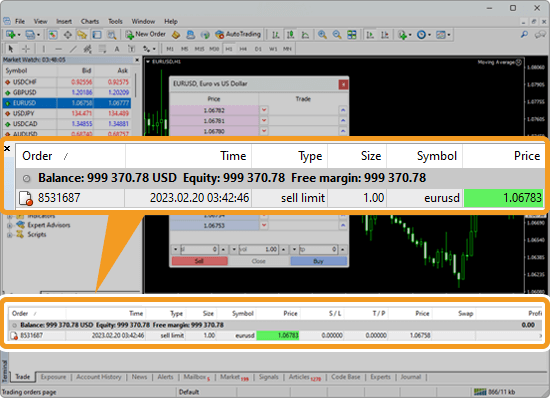

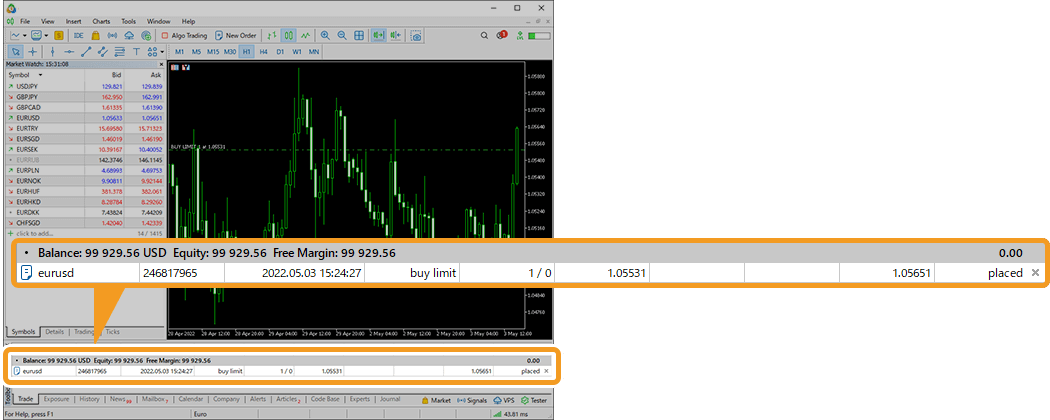

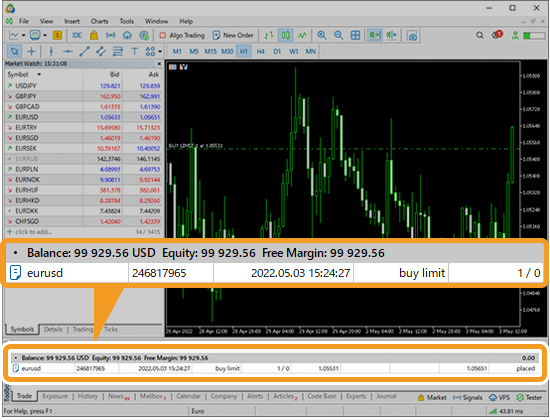

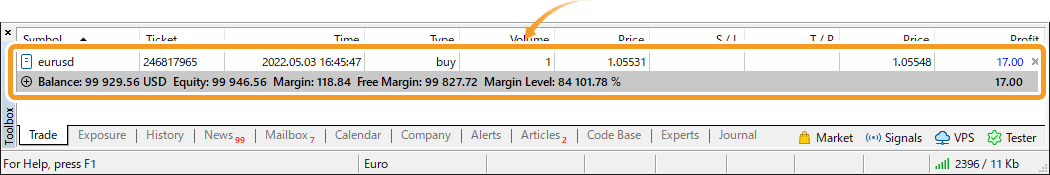

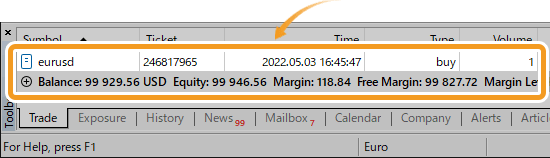

If rates change and the order is no longer within the rate range displayed on the Depth of Market window, the order will be hidden. In this case, go to the "Trade" tab of the Terminal where you can find the order shown as a pending order under the balance line.

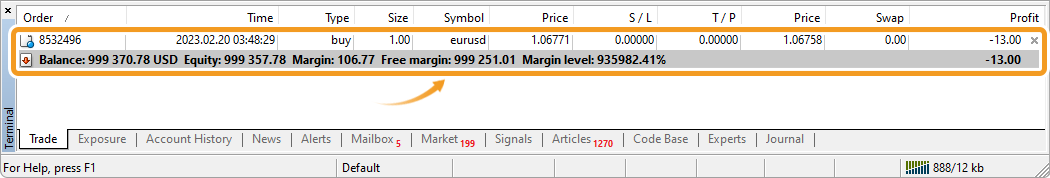

The order will be executed once the specified price is reached. The order details will be updated as an open position and moved above the balance line.

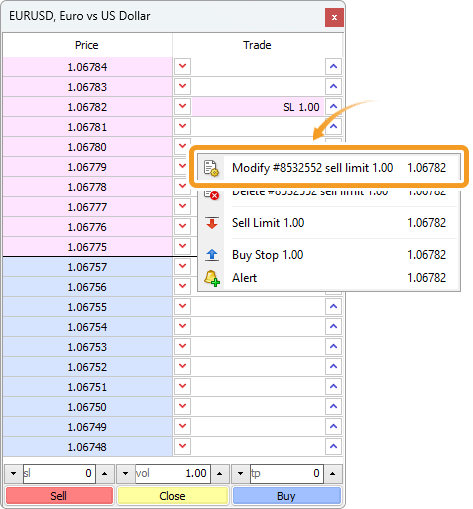

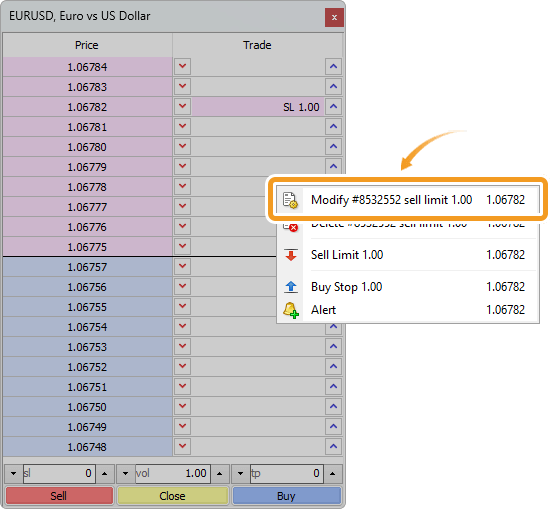

You can also modify or delete limit/stop orders on the Depth of Market window.

On the Depth of Market, drag and drop an existing order onto your preferred level.

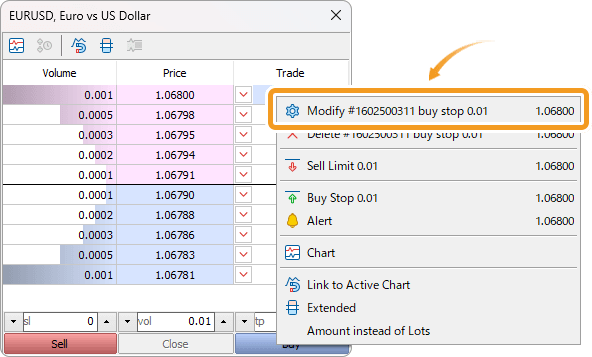

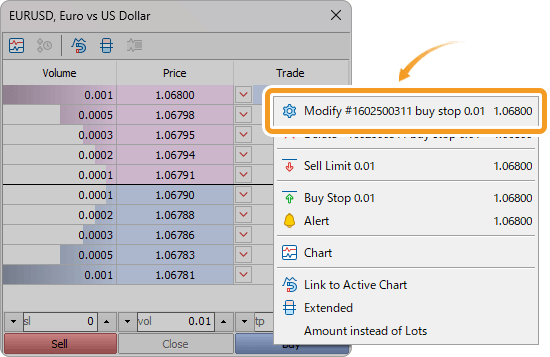

Or right-click on an order and select "Modify" from the context menu.

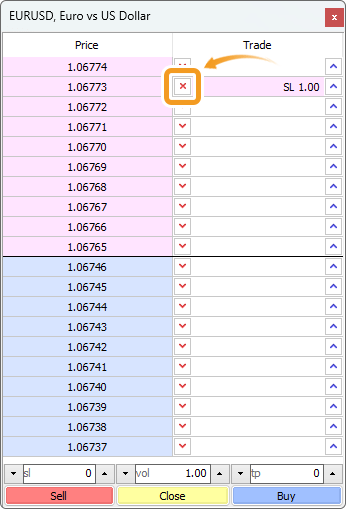

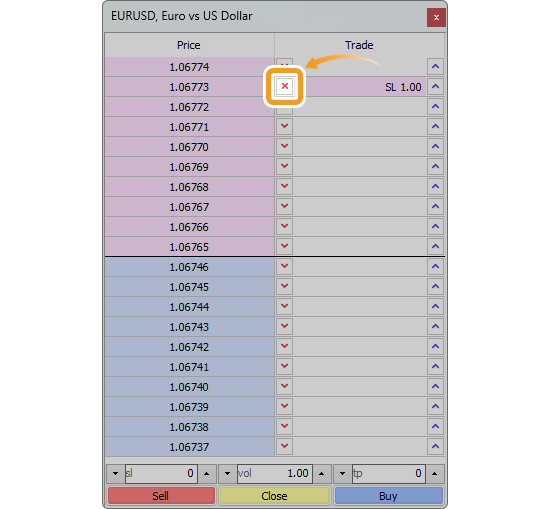

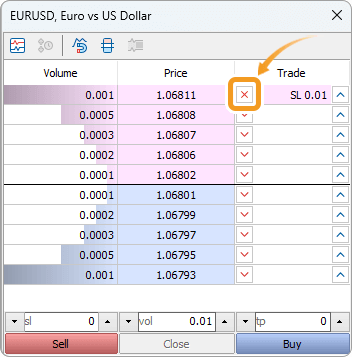

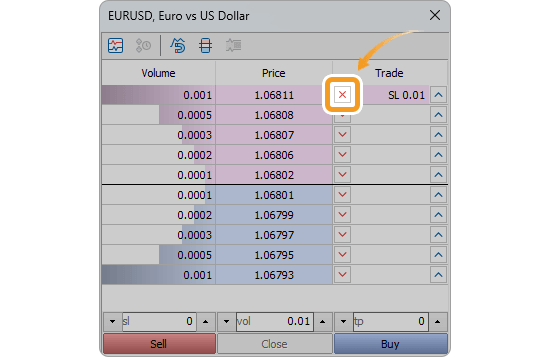

Press "Shift" on the keyboard and then an arrow on the right/left side of an existing buy/sell order will turn into "×". Delete the order by clicking the "×".

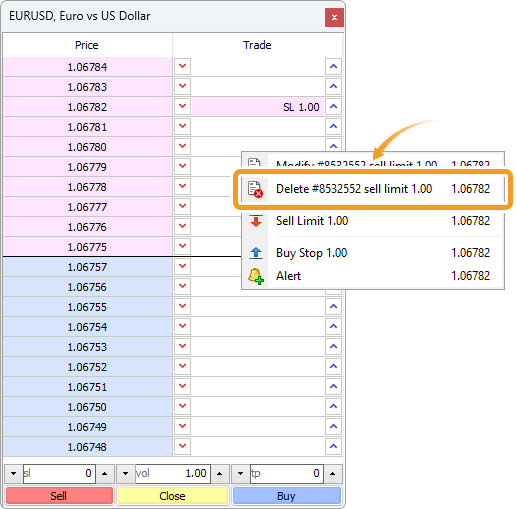

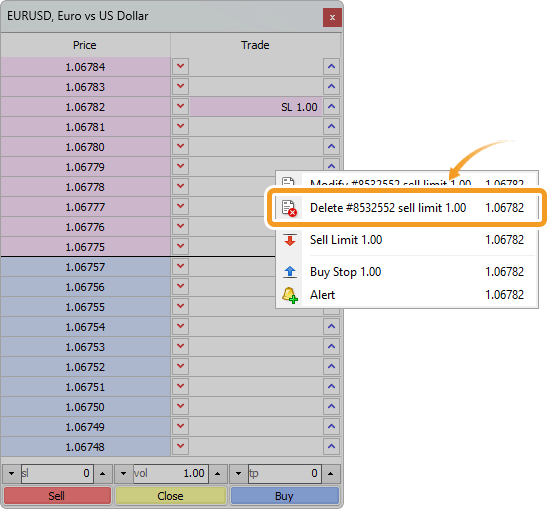

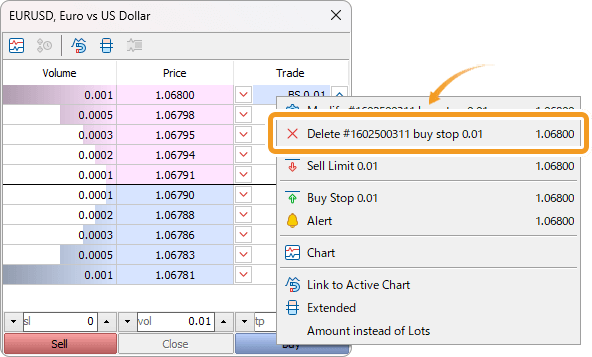

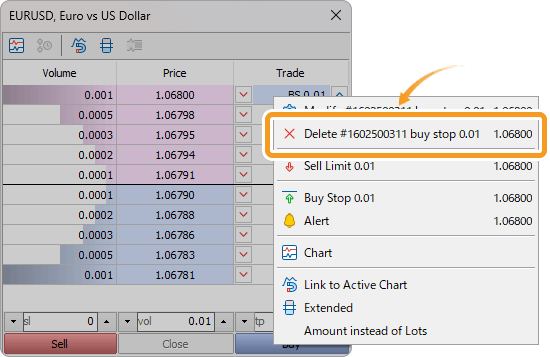

Or right-click on an order and select "Delete" from the context menu.

Set the trade volume in lots on the Depth of Market window. Type the volume or use the ▼▲ marks on both sides. You can also set stop-loss (S/L) and take-profit (T/P) values by specifying the deviation from the current price in points.

Related article: Open Depth of Market

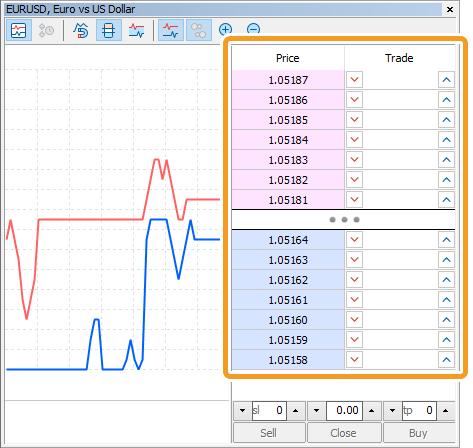

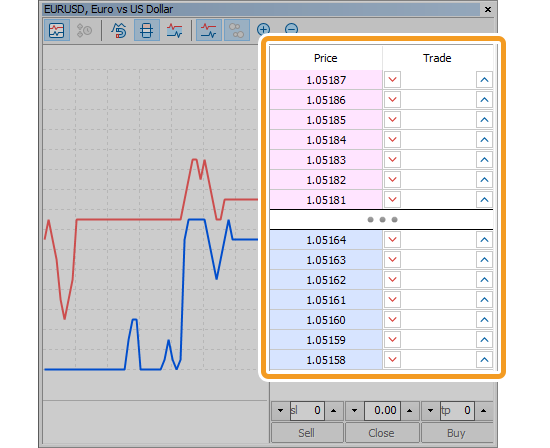

If your broker does not provide the depth of market data, it will not be displayed in the Depth of Market window. Placing orders is still available on the window with the same steps.

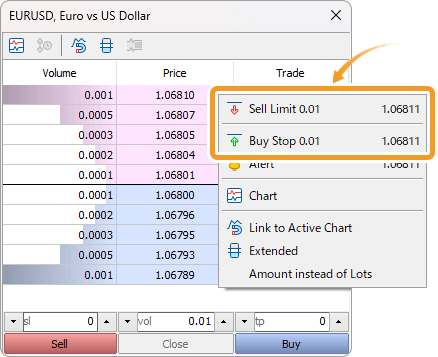

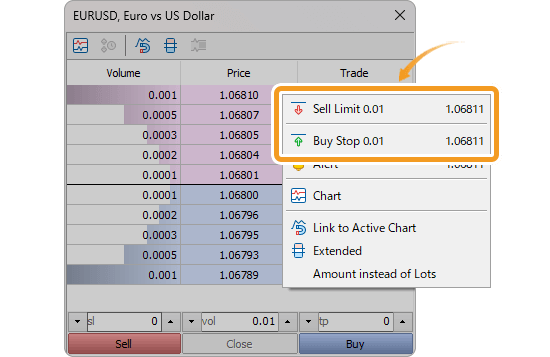

There are two ways to place an order, by clicking on an arrow on the Depth of Market window or from the context menu.

To place a buy limit/stop order, click a blue arrow on the right side. To place a sell limit/stop order, click a red arrow on the left side.

Right-click on the Depth of Market window and choose "Buy/Sell Limit" or "Sell/Buy Stop" from the context menu. These options vary depending on whether you right-click above the current rate or below it.

When placing limit/stop orders, you have to specify a price that's certain points away from the current price. The difference between the two is called the stop level and it varies by the forex broker, account type, and symbol. When there is a stop level, the order buttons on the Depth of Market window will be grayed out.

Related article: Check trading conditions

Once the order is placed, the order details will be added below the balance line in the "Trade" tab of the Toolbox as a pending order.

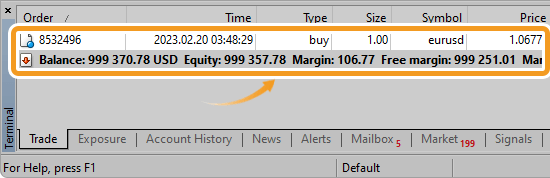

The order will be executed once the specified price is reached. The order details will be updated as an open position and moved above the balance line.

You can also modify or delete limit/stop orders on the Depth of Market window.

On the Depth of Market, drag and drop an existing order onto your preferred level.

Or right-click on an order and select "Modify" from the context menu.

Press "Shift" on the keyboard and then an arrow on the right/left side of an existing buy/sell order will turn into "×". Delete the order by clicking the "×".

Or right-click on an order and select "Delete" from the context menu.

![]()

Created

: 2022.08.24

![]()

Last updated

: 2025.10.12

Nakamaru is a manual production consultant at FINTECS, a company that specializes in creating manuals for their clients.

With a wide range of experience from fintech to entertainment, he presents what user-friendly manuals should be like.

He works with numerous large corporations as an external manual production project manager.

【Business information】

http://www.fintecs.co.jp/profile/

Akira Takagi

Systems engineer, MetaTrader administrator

After graduating from Computer Science at the Uninove, Brazil, in 2014, he has worked on various systems development projects.

He participated as a developer in the launch of forex services in 2019. Since then, he has also been involved in the development of MetaTrader plugins and APIs. He is certified by MetaQuotes as a MetaTrader5 Administrator and active in consulting and advisory as well.

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

please contact us at [email protected].

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.

Myforex uses cookies to improve the convenience and functionality of this website. This website may include cookies not only by us but also by third parties (advertisers, log analysts, etc.) for the purpose of tracking the activities of users. Cookie policy